Here's something you've probably never heard before: The best time to start investing is when you're close to broke. No, I’m not suggesting that you gamble money you can’t afford to lose. What I am suggesting is that you take the $10 you would have lost anyway by going to the movies or getting take out tonight, stay home, and use that money as the initial deposit in a free trading account. Your future self will thank you.

Playing around with a few bucks that you would have spent on something frivolous means that you can’t lose much, but you can start to learn the fundamentals of the market and get your finger on the pulse of its fluctuations. That way, when you do have some disposable income, you won’t end up flushing it all down the toilet navigating a steep learning curve as you learn the hard way how susceptible you are to the Dunning-Kruger effect. If I had started investing when I had a ton of disposable income, I probably would have lost it all by falling victim to my own impulsive nature.

Spare Change - Source

But first, the obligatory disclaimer! I am not an expert in investing, and I am not a financial advisor. I am simply a formerly broke person who started investing when I had basically no money to my name. As always, do your own research, and take anything you read on the internet with a grain of salt. (Referral links are included for some of the apps below; all have incentives attached for you and for me, but don’t use them if you don’t feel like it.)

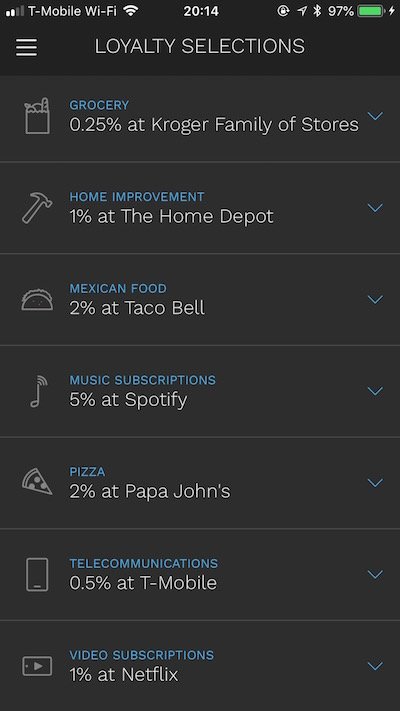

1. If you have $0 - Sign up for the Bumped waiting list

Get started here: https://bumped.com/

Bumped is like a traditional cash back rewards program, but instead of receiving cash from your purchases, you receive shares of stock. If you already have a Netflix or Spotify subscription, Bumped will reward you with Netflix and Spotify stock every month. I receive free stock every time I buy gas, go grocery shopping, go to Starbucks, indulge in fast food, or pay my phone bill. It’s only a small fraction of a share each time, but the stocks you receive are all in large companies that aren’t likely to plummet in value anytime soon--and they’re free, assuming you don’t take it as license to buy a bunch of stuff you wouldn’t have bought otherwise.

Bumped is currently in beta, and you have to get invited through the waitlist. You’ll get an invitation faster if you refer others to sign up. I sent my link to a couple of friends and got an invitation within a week of signing up.

2. If you have $5 - Open an Acorns account

Receive an extra $5 when you use this link: https://acorns.com/invite/WCLSGV

Acorns is a robo-advisor with a very low account minimum--only $5, and they’ll give you a free $5 just by signing up using a referral link. You can invest money manually, with automatic contributions, or by instructing it to “round up” your purchases from your debit card (like Bank of America’s Keep the Change program).

I started my Acorns account with $25 in 2016, and have kept my round ups on ever since. I have fluctuated between automatically investing anywhere from $5 to $50 per week depending on my income at the time (and generally, it was on the low side). As of this morning, I have over $6,000 in my Acorns account, entirely funded by money that I wouldn’t have otherwise noticed was gone. Even Acorns’ most aggressive portfolios are relatively conservative, so you’re unlikely to lose much by investing with them, even if the market goes into a nosedive.

Acorns is free for the first four years for students using an email address ending in .edu, and $1 a month for everyone else. If you’re going to use Acorns, I would make sure you have at least $200 in your account after the first five months (when your referral bonus runs out) to safely offset the cost of the service with the dividends you’ll earn.

Acorns is an automatic advisor which doesn’t give you much control over individual investments, so it’s not a way to learn how to trade stocks. However, it’s a great way to start benefiting from the market with the relative safety given by expert investors, and it’s a much better move than keeping all of your money in a low-yield savings account. I can’t recommend it highly enough.

3. If you have $10 - Open a Robinhood account

Get a free stock worth $3 to $150 when you use this link: https://share.robinhood.com/mallord55

Robinhood is the account to open if you want to trade individual stocks for free, but be careful. You’re more likely to lose money on individual stocks than you are to win, since you’ll be betting against people who probably know much more than you do. That being said, if you have a strong hunch about an up-and-coming company which you happen to know is developing some potentially world-changing tech, do your research and pick up a share if the fundamentals are sound. Look up some expert analysis first, though. VectorVest’s phone app has a free two week trial, and you can read up on what they have to say.

Still, it’s a risky move to go head first into Robinhood if you don’t know what you’re doing. The main reason that I put Robinhood on this list is the free stock promotion. If you use a referral link, Robinhood will give you a free share of stock worth anywhere between $3 and $150. Assuming that you don’t dump all of your cash into the app and start going crazy with investing in things that you don’t know anything about, a free stock that you didn’t pay anything for should offset a small loss.

Robinhood’s biggest weakness is that you can’t invest in fractional shares. If you only have a little bit of money to play with, that means that you can only buy low-market cap, risky stocks, and you can’t diversify at all. It’s a great way for a novice trader to lose their shirt. I would recommend opening an account, taking the free stock, and coming back to it once you get the basics down.

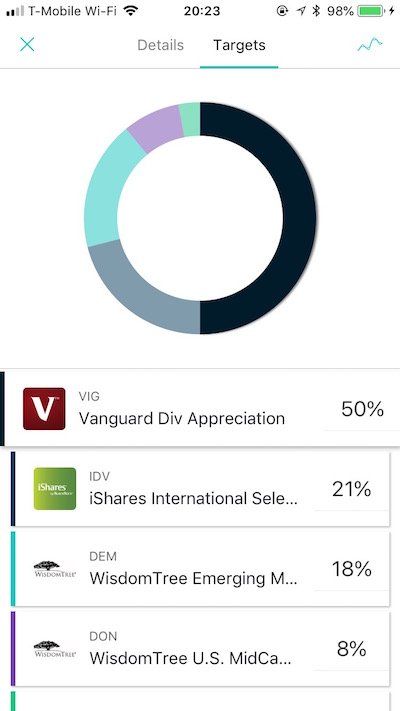

4. If you have $100 - Open an M1 account

Get $10 free when you use this link: https://mbsy.co/sWCVq

I started using M1 recently for all of my manual investing, and it’s my favorite app by far. M1 combines robo-investing features (like Acorns) with the ability to manually manage your investments, but it lets you do it all for free. You can also purchase fractional shares. It does not let you day trade, which is how M1 manages to keep its services free. It only conducts trades during one daily trading window. That makes it ideal for someone who wants to keep medium to long-term investments.

My M1 account is admittedly recklessly aggressive, which I only permit myself to do because I keep the majority of my money in Acorns or in savings accounts. My M1 portfolio includes shares in up-and-coming industries like green energy, cybersecurity, marijuana, and e-commerce. I also have shares of index funds and super high dividend REITs (real estate funds) and ETFs (stocks that are made up of a bunch of other stocks). That means that the stocks award holders high percentages of the share price just by holding onto them--up to 15% for some of the ones I hold--but they all come with their own risks.

M1 automatically rebalances your account whenever you auto deposit by adding in more money to “underweighted” assets. For example, let’s say you have instructed M1 to keep 50% of your money in Stock A and 50% of your money in Stock B. Stock A rises in value, and Stock B falls in value, so that now 51% of your money is in Stock A and 49% is in Stock B. When you deposit money next time, M1 will buy more of Stock B than of Stock A to preserve the 50/50 balance. In theory, you’re more likely to win more in the long run, because M1 is buying stocks more when they are down than when they are up.

The market is down today. What if we go into another recession? Should I wait to invest?

If I had to guess, I’d say that we probably are about to go into another recession in the next couple of years. That being said, I’m not a macroeconomics expert, and I don’t have a crystal ball that can predict the future. Either way, you should still get started investing sooner rather than later. One of Wall Street’s most famous aphorisms is that “time in the market beats timing the market.” The market goes through ups and downs, but in the long run, a diversified investment account will appreciate in value, barring any long-term catastrophic collapse of the world economy.

Don’t fool yourself into thinking that you can jump right in and beat the market on day one by knowing exactly when to put your money in and exactly when to take it out; even professional investors have a hard time doing that. The smartest thing you can do is dollar-cost average your way in--put in a small amount of money consistently and regularly--and do not take all of your money out if things go south for a little while. Market returns vary wildly from year to year, but over the long term, they even out to a significant gain. Don’t panic and stop investing if you see a drop; just keep adding in a little bit at a time on a regular schedule, and it will grow eventually.

Of course, this isn’t everything you need to know in order to get started investing. For a thorough introduction, I highly recommend getting started by reading up on Investopedia. If you liked this, let me know, and I’ll write my own guide to the basics.

Outside of crypto I'm not very familiar with investing, but I think I will grab the free share from Robing Hood at least. Though I got interested when you mentioned having shares on green energy and cannabis – I can see those industries doing well in the future, so maybe I will diversify on those, too, when it becomes timely (ie. when I get my first paycheck form my job).

Nice to see you posting again :)

Let me know if you have any questions about it! I can make some recommendations for stocks in those sectors. You'll probably need an M1 account for that since you're going to be picking individual stocks and you probably don't want to dump your money in whole shares. Just don't go in with more than the account minimum at first until you really know what you're doing.

I actually got interested in crypto because I had been playing around with stocks for a while and it was super exciting seeing this whole new asset class bouncing around. It's similar to day trading penny stocks in a way. If you know the basics of how those markets work, then you probably already have a basic vocabulary of how the regular stock market works.

Thanks! Yeah, I fell out of the habit of writing when I started my business last summer, and that took up much of my creative energy.

Yeah, I will definitely just go with the minimum and see how it works out.

I see. What type of business, if I may ask?

Posted using Partiko Android

Time in the market >>>>>> Timing the market

Anyone getting into stocks should be able too see that throughout all the booms and busts in history, the market always ends up going up. With that fact in mind, why take on the additional risk of timing the market?

The same goes for crypto. Don't be like those guys who panic sold bitcoin when it was $30. Investing means you are in it for the long haul.

Congratulations @malloryblythe! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Thank you for bringing our attention to things I had never heard of. Especially valuable to have these money matters reviewed in a balanced and cautionary manner.

I doubt you'll be picking up this reply any time soon, or will find time to write a little more about your life now that you are working towards building a comfortable nest egg. I can just about anticipate what you might have to say on how investing enriches one's creative side, possibly one's social life, and definitely one's confidence in life, should all go relatively well (remain steady, I suppose is the initial aim). But I have yet to hear how it has broadened one's range of freedom. I shall be writing on this lack of freedom most of us experience (without even knowing it) and would have loved to have exchanged ideas with you.

Thinking hard of you to summon you .....Auuummmmmm.