Hey Jessinvestors

Like many of you, I've been learning more about investing as it becomes a more important part of our lives; working for a living and saving only gets you so far, and if you're not investing, you're left behind. Investing is a complicated task even for the most seasoned of investors; no one can predict markets, and this is why many of us offload our capital to money managers instead.

Since we don't have the capital to have a money manager, some of us are speculating on our own in different markets. Some it's real estate, some it's equities, some it's corporate or government bonds, some its index funds, some its crypto or derivates.

Depending on the amount of capital you have, your risk tolerance and your time preference, you'll choose one or a few of these strategies. Ideally, we want to protect the purchasing power as goal 1 and goal 2 would be to increase that relative purchasing power over time.

Now, as you can see from the investment classes I've mentioned above, there are plenty of options. Within those asset classes are individual companies, coins, stocks, tranches, funds and contracts you can purchase to speculate in these markets.

Diversification

One of the strongest narratives in investing is not to keep all your eggs in one basket, to diversify, to hedge, and overall this is a good strategy. While many of us are used to the adage of stocks versus bonds as diversifying, others are saying this is an anomaly based on monetary and fiscal policy, and you should actually diversify across different asset classes.

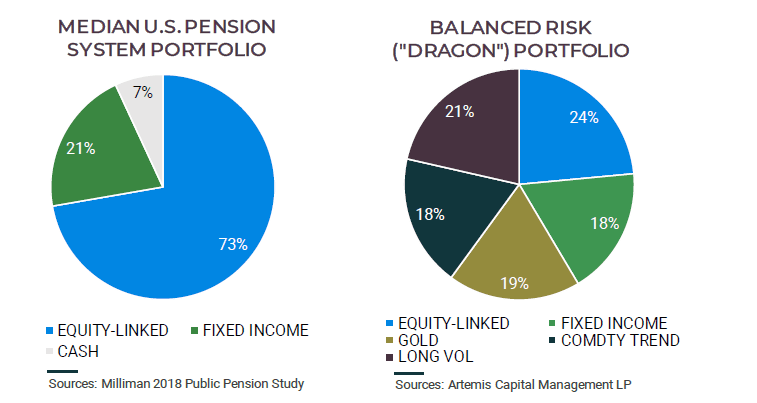

Such as the dragon portfolio, which is a 5 way split of

- Fixed income - bonds

- Gold

- Long volilitliy - index funds

- Equity - stocks

- A strong commodity trend

Image source: seekingalpha.com

Each asset class will give you some protection should the other capitulate, as money can only go into one of these classes. The goal with diversification is to have exposure to where money is reallocated.

Diversify in an asset class

This is where people tend to make mistakes; they hear about diversification and think then apply it to one asset class. So let's say you're in cryptocurrency; instead of only owning Bitcoin as your exposure, investors will buy a bunch of other coins under the guise of diversification.

When this is, in fact, a poor strategy when you opt for the market leader in an asset class, more often than not, you're getting enough exposure at a risk-adjusted rate.

For example, in the smartphone wars, would it be prudent to put all my money in Apple or buy some apple, some Nokia, some Motorolla, some blackberry?

The answer would be all-in on Apple, the same with eCommerce with Amazon, to social media with Facebook. Diversifying in a specific market only saw you sell more of your winner to buy the losers.

A false sense of diversification

Diversification within a specific asset class also tends to provide you with too many correlated bets, which in turn has you overleveraged to market trends. If Bitcoin goes down, more often than not, your other bets will break down too.

I see many friends getting into crypto and misunderstanding diversification and not looking at risk tolerance and risk-adjusted returns, never mind the tax implications involved.

I guess it's all part of our financial education, and it's also how I've learned to rebalance my investments over time. I might not shoot the lights out with my trades, but as long as I don't lose purchasing power, I count that as a win.

Since I am still young enough to acquire more resources, protecting my purchasing power over time and growing it slowly is where I like to play.

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, "I am a Jessie."

Let's connect

fanbaseIf you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my

Posted Using LeoFinance Beta

I am a Jessie

Posted Using LeoFinance Beta

Lol welcome, the network keeps growing, we're bigger then some shitcoins :P

Your knowledge is one thing I wish for.

Thank you for sharing this post.

I am still learning about a lot of things. I don't fully understand bond but I guess everyone has to invest in the five things you mentioned and add crypto as the sixth.

Posted Using LeoFinance Beta

Lol nothing you can't learn, I am just an avid reader and listen to audio books and podcasts when i drive or work out. Don't feel pressured to learn it all at once, I am no bond expert either I am learning, but I think bonds will make a come back in the future as a more popular retail trade.

Right now they a bit of a shit show and well overbought

I'd been thinking that in relation to Hive based tokens, i.e. I need to sell some and get into some other crypto, but not in relation to cryptocurrency overall. Makes sense though. It's just that I don't have the motivation to learn about other classes.

We are already invested to a lesser amount in a couple of the others you mention but I'm not interested enough to put in the time and energy to do it well.

Also, I no longer have this luxury:

The game I'm playing is trying to get regular, as reliable as possible, returns from what we've already got and increasing our BTC stake.

Much of the time it feels less like play and more like a chore to me though. At least I feel I'm making progress, all be it very slowly.

Posted Using LeoFinance Beta

I get you, I think it's often the case of how much you're willing to learn, you could learn different investment stuff or learn a new skill that is profitable, it's all about your motivation and capacity for learning and how you apply your time.

I mentioned in one of my other comments that another hedge would be to get equity in top crypto exchanges that way you have exposure to all the shitcoining and trading without owning all that rubbish but you still profit from it

Sorry. Most of this stuff goes in one ear and out the other. Does this mean buying their coin. So BNB for Binance, CRO for crypto.com etc.

If it doesn't, no need to explain again I'll find your original comment. 😁

!ENGAGE 20

Posted Using LeoFinance Beta

No I mean shares in companies you can buy listed companies like coinbase shares or private equity via places like bnktothefuture who raise funds for popular service like Kraken and abit pay

Ah. I see. A whole 'nother asset to investigate then. I may look at that once I feel I have my crypto sorted. 😊

!ENGAGE 20

Posted Using LeoFinance Beta

Take your time, its all about the journey for me, I am focusing on Bitcion and once I feel overextended and I see other asset classes starting to show adjusted returns that consistently beat Bitcoin ill spin off into those asset classes

!ENGAGE 10

Posted Using LeoFinance Beta

ENGAGEtokens.ENGAGEtokens.ENGAGEtokens.Agreed, this is sometimes not usefull. Especially if you thoroughly invest in something you know to diversify in a lot of things "you do not know much about".

As an example in my stock investing, I do much better when I invest in a sector I know will thrive well in the future, and pick my favorite stocks inside that sector / themes.

Lately I have been doing these for e-commerce / new retail stocks (such as Zalando, Hellofresh, delivery hero) and video games (Ubisoft, EA, Activision and smaller publishers). I made 3-4x the return compared to if I had diversified in many sectors I do not believe in (banks, oil and gas, auto, etc...)

That's also another thing I didn't touch on, if you diversify you also move out of your focus area or expertise area and you send up making bad calls. Like for you in equities, you pick companies that you know well and how they compete in that market

But at the same time you could also spin those profits off into another asset class like gold for example, so if the WHOLE equity market takes a hit you have some protection

I agree with you choosing the strongest competitors for the specific space but if someone said he put 100% of everything into only BTC or just one investment, then I would say he needs to make some considerations. There is nothing wrong with conviction but it shouldn't completely destroy your portfolio.

Posted Using LeoFinance Beta

I agree with you on the beginner's luck and also a misunderstanding of money, retail gets access to pretty shocking financial products, so crypto looks like a good bet for them but when you run the math like on these staking platforms you are still losing money over time, short of your timing being perfect, most will lose money

In crypto, I would say Bitcoin would be my primary holding and I'd much rather own equity in an exchange than own any of these coins. Exchanges are going to make money in bull or bear markets so if you want to have exposure all the shitcoining I think that's a better option.

It's a hail mary and I don't blame people for feeling they need a moon shot and buying into the hopium but this will end in tears as has many a frenzy

I checked out this video I doubt it will age well, this guy's arguments aren't based on anything, he says the supply can be changed, short of 100 000 plus people willing to all dilute their own stake, that's not going to happen.

He says it can be hacked, it's literally the most powerful computing network in the world with zero downtime in existence

Just another YouTube salesmen shitting on Bitcoin so you can buy his product/service

Personally, I think stable coins are a joke, what's the point of having tokens "backed" by something that is tied to something that is being debased in record numbers. I see no point in using it short of getting around SWIFT and regulations and being able to get hold of forex and I have no need for that, others might but not me.

Believe me I get where you coming from seeing Bitcoin and crypto as the same thing, and I'm not here to argue with you about it, I see it differently, I've spent time looking into all of these things and Bitcoin isn't for everyone and that's fine. There's a lot of shady shit in crypto, in fact I am waiting for USDT to implode and bring down the entire market, but I still believe in Bitcoin, it's the only one worth holding in my opinion.

Everyone is going to make their bets somewhere, be it cash, stocks, real estate and no ones going to come out unscathered

I understand where you coming from but what you’re talking about is a financial system thay onto 13% of the world get to enjoy.

For someone like me in south Africa BTC as “volitile” as it is now is still a better form of currency than my national currency and I am not the expection! G7 countries financial systems are NOT the norm for everyone

BTC for me works great in storing value that cannot be seized, it scales perfect well on lightning, charge backs can’t be done on ANY blockchain because charge backs are only available for assets where final settlement isn’t available

Sure handling your own money comes with it’s downsides but I feel it’s a worthwhile trade off not to be tethered to various local institutions

If tomorrow s&p downgrade my countries debt I’m fucked through no fault of mu own so having this asset offers me a lot of benefits