As time passes HBD gets better. It has been working as designed in all of its exitance without any failures. Its has been improved in the age of Hive and has kept its peg ever since.

The HBD interest rate was set to 20% by the top Hive witnesses back in April 2022. A full year has passed how its paying out 20% interest on the HBD in savings.

The withdrawal from the savings account is three days. A reasonable period. It’s like staking with three days unlocking period.

When the interest on HBD was first set by the witnesses somewhere in March 2021 it was only 3%, then they push it to 10%, 12% and now a 20%! You can see what the interest rate is set by the witnesses here https://peakd.com/me/witnesses.

With the latest Hardfork the debt limit for HBD was pushed to 30%, allowing more HBD to be printed before the haircut rule is applied and HBD is devaluated.

Now let’s take a look at the data and see how much HBD has been transferred to savings and who is taking advantage of the HBD interest rate.

The period that we will be looking at is starting from 2021 to 2023 .

We will be looking at the following:

- HBD balance in savings

- HBD savings VS liquid balance

- Daily and monthly interest rewarded

- Cumulative interest

- Top accounts that hold HBD in savings

- Top accounts earning interest

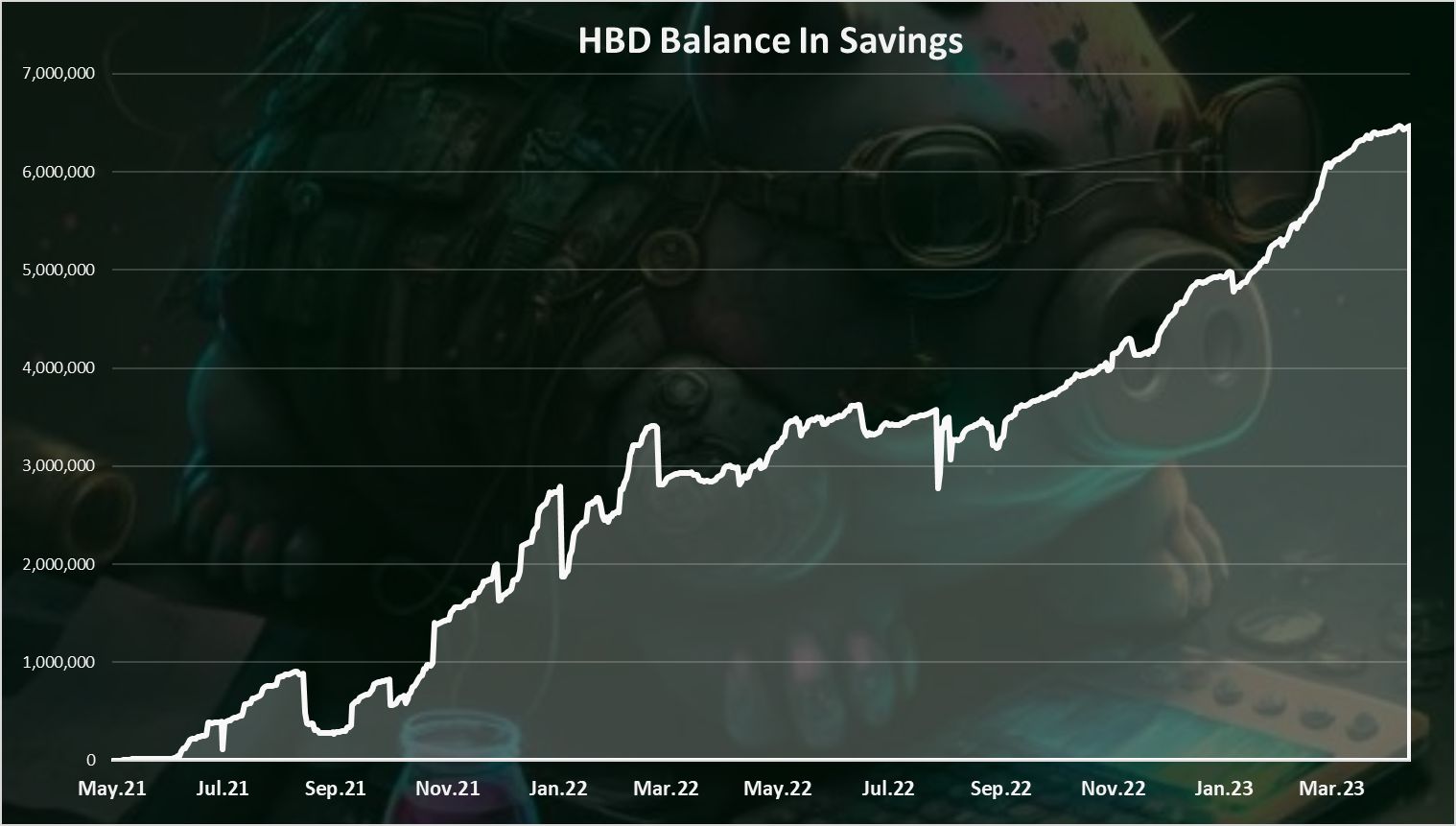

HBD Balance In Savings

Here is the chart for the HBD balance in savings in time.

A clear uptrend here with continues growth!

The HBD balance in savings stated growing in July 2021 and continue an aggressive expansion up until March 2022, with some bumps in the way. In March 2022 the ATH for HBD in savings was at 3.5M. In the period of April – October 2022, the HBD balance in the savings has stabilized around this number.

Then, from the end of the 2022 up until now, April 2023, again a more aggressive growth and we are now at 6.5M HBD in savings.

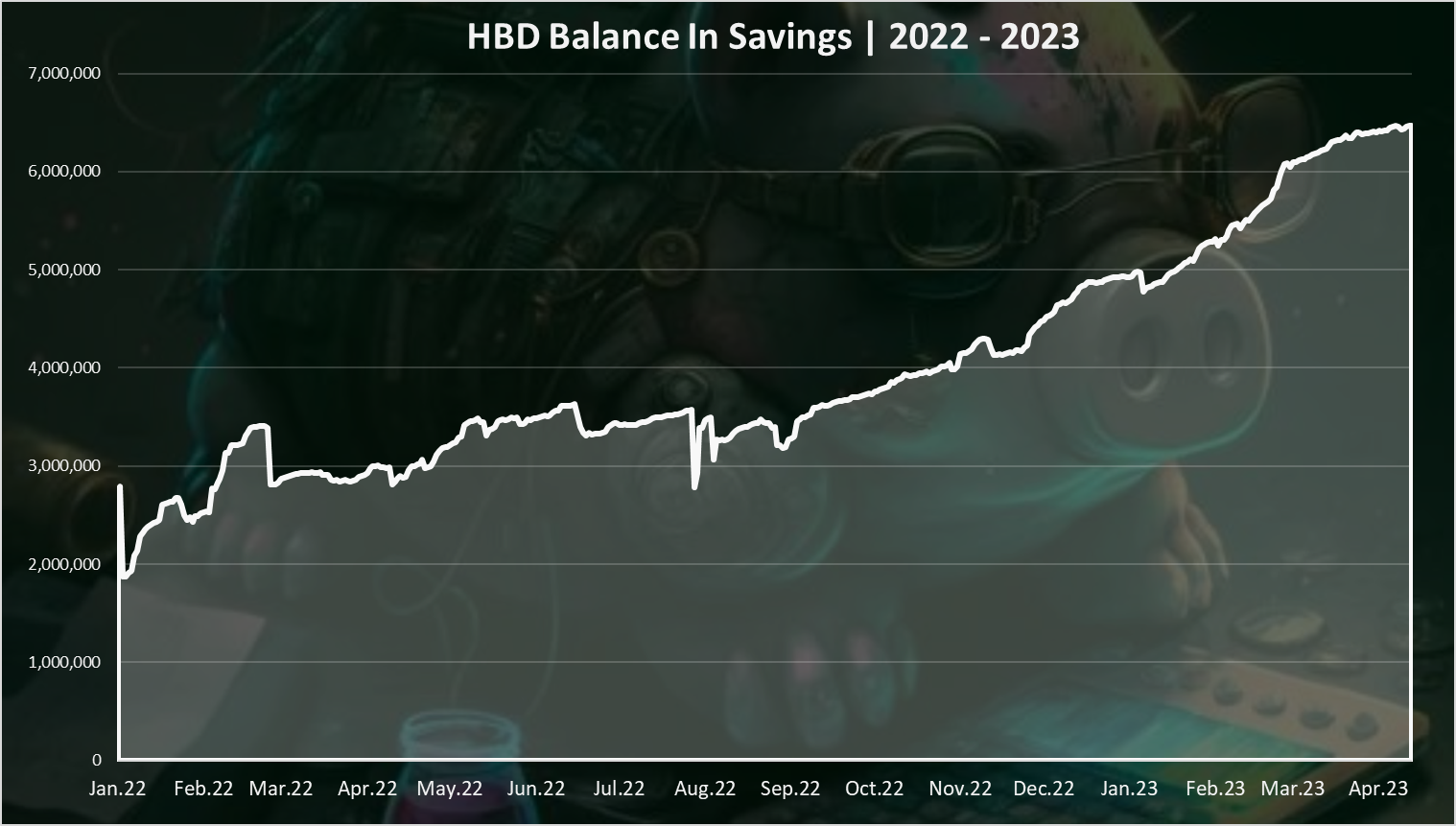

If we zoom in we get this.

A steady growth with some bumps usually when the price of HBD increases.

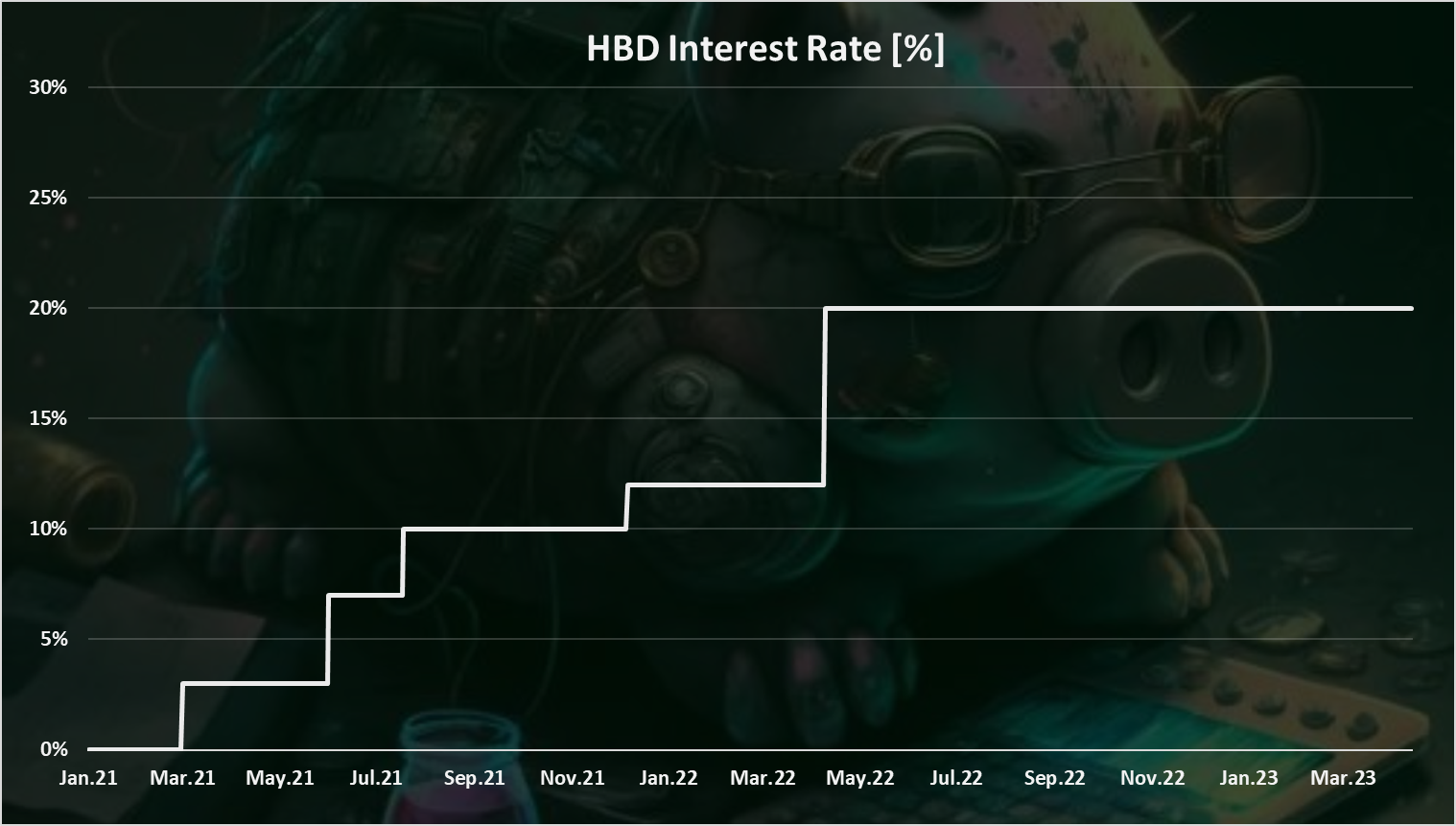

HBD Interest Rate [%]

Historically the interest rate for HBD has been as follows:

- Mar 2021 - 3%

- Jun 2021 - 7%

- Jul 2021 - 10%

- Dec 2021 - 12%

- Apr 2022 - now – 20%

We are now a full year with the 20% interest rate and it is the longest period in the Hive history to hold this percent.

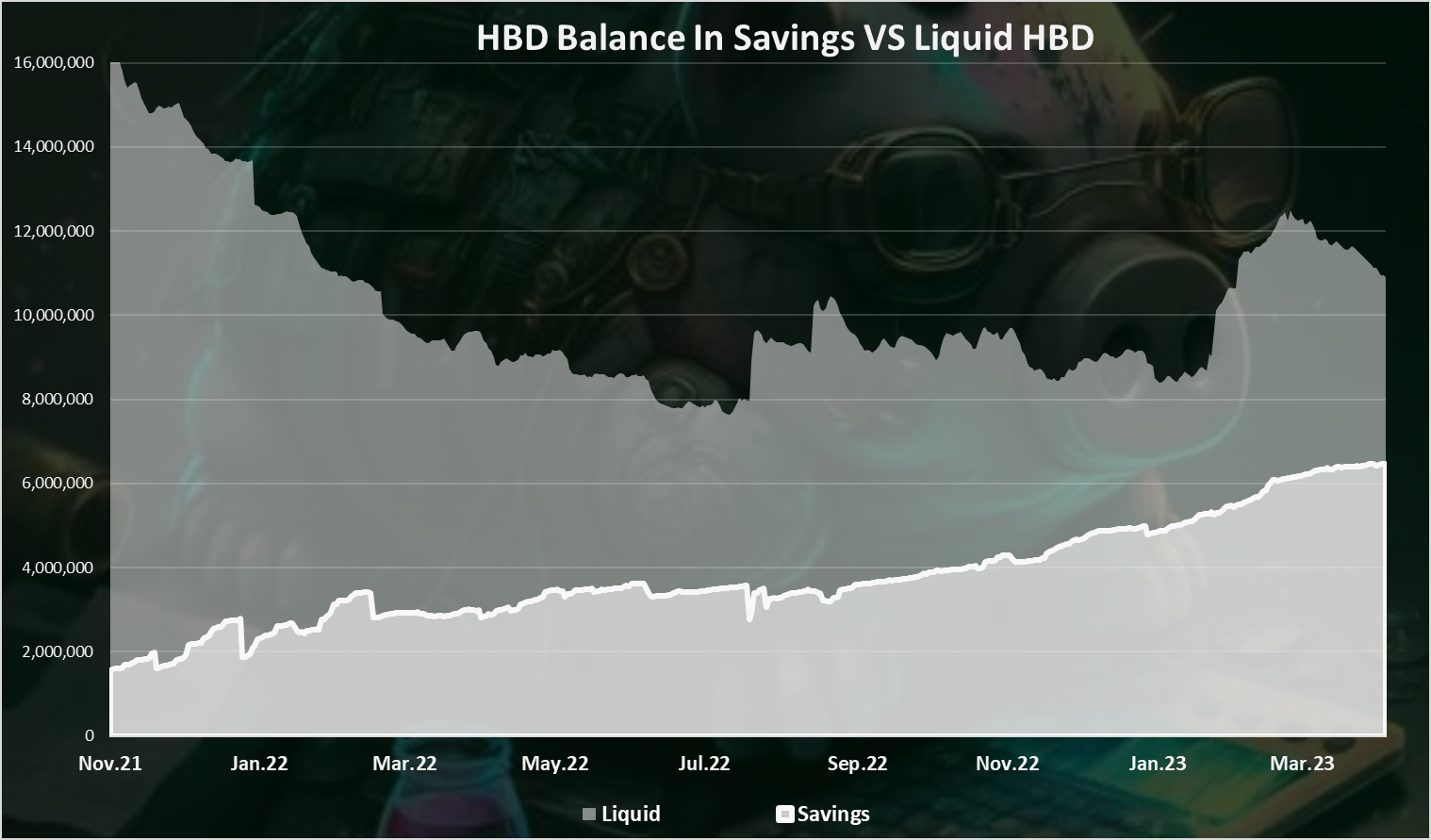

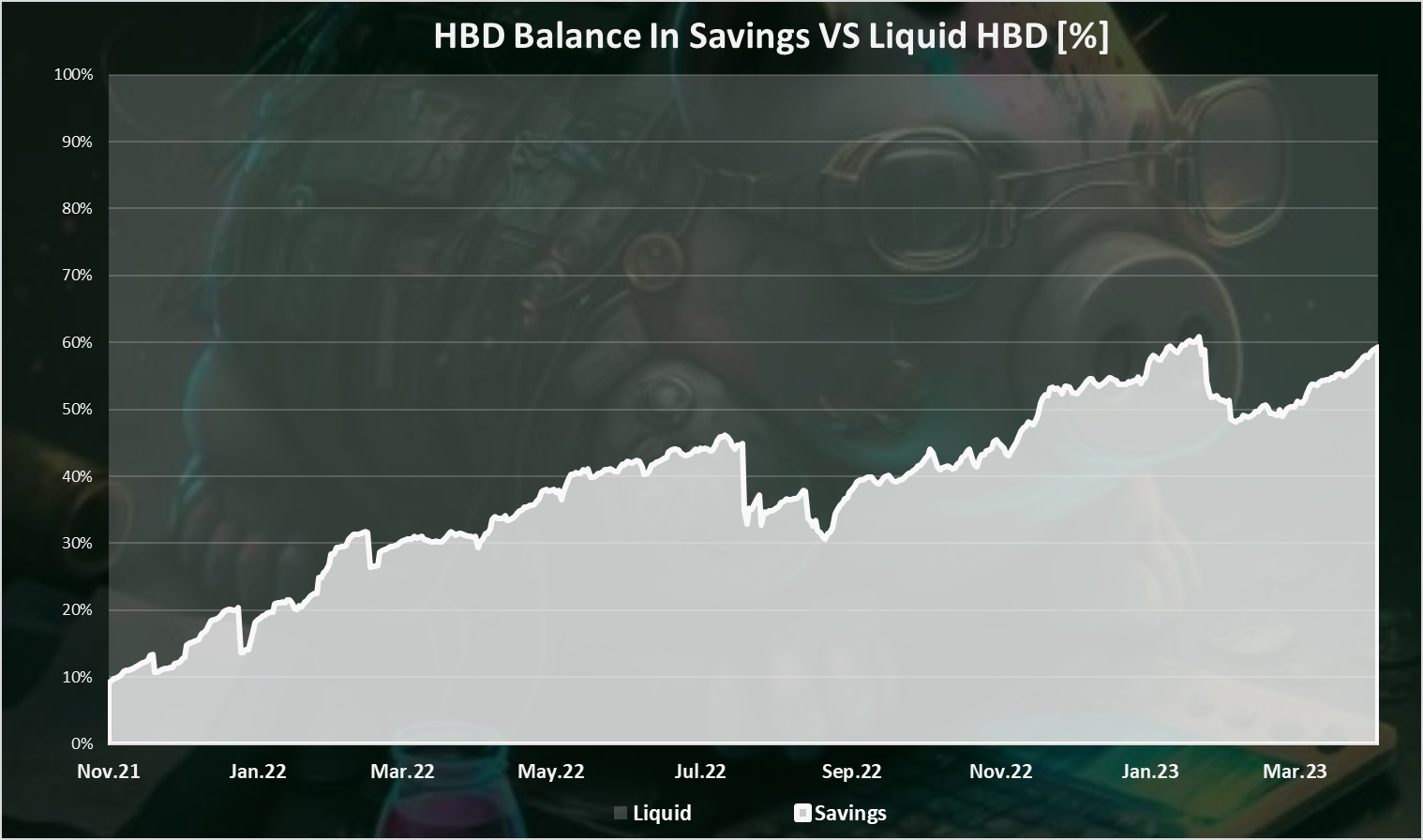

HBD Balance In Savings VS Liquid HBD

Here is the chart.

As we can notice the HBD balance in savings has kept growing, while the overall HBD balance has been going up and down. In 2022 the overall HBD balance has went down, while the HBD balance up, basically eating away most of the liquid HBD supply.

At the moment of writing this, there is 6.5M HBD in savings and 4.4M liquid HBD, or cumulative 10.9M HBD. More than 50% is in the savings. Note that this balance doesn’t include the HBD in the DHF fund, that are not freely circulating.

When we plot the chart above in percent we get this:

We can clearly see the trend here where more and more HBD share is locked in savings.

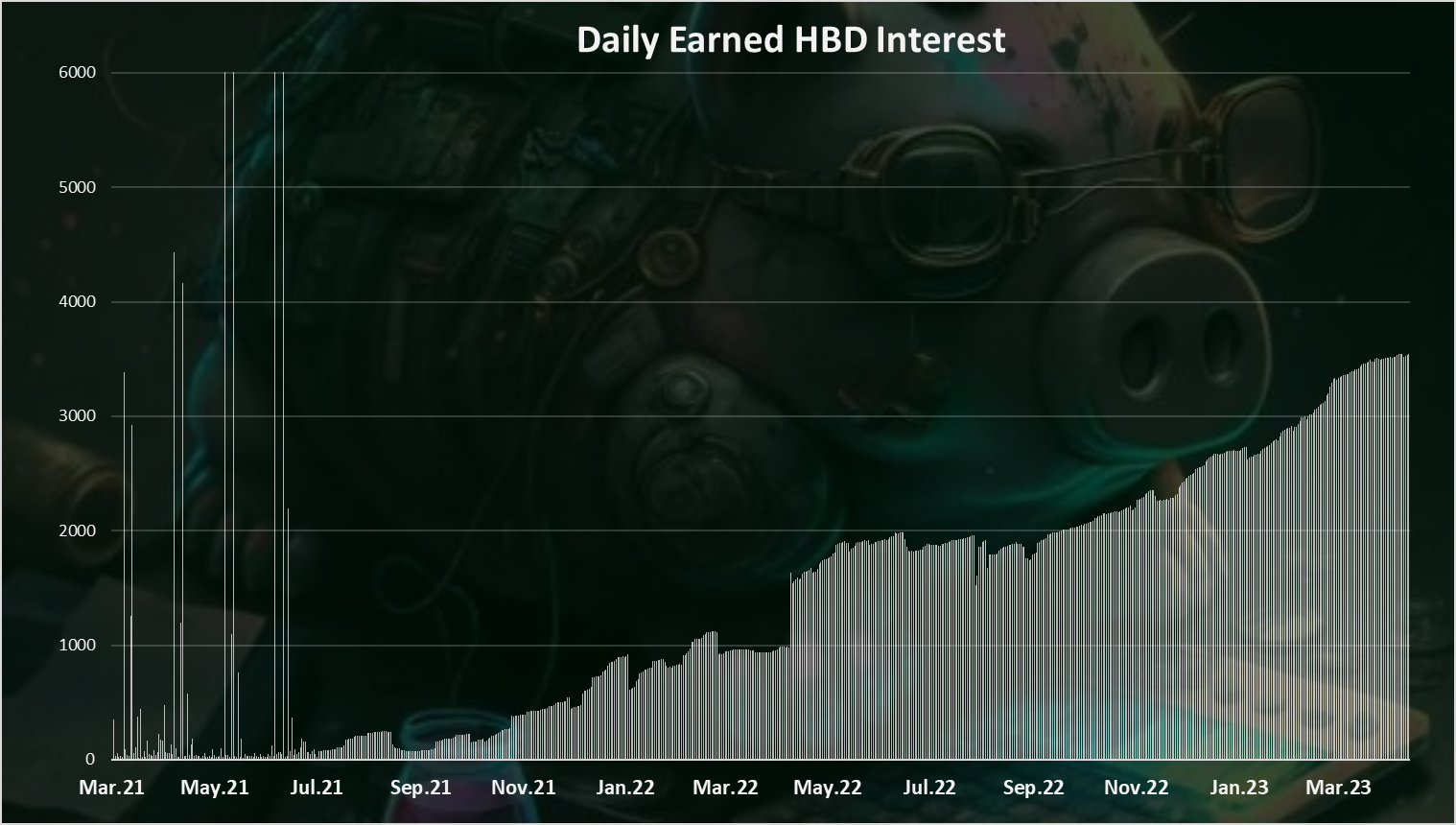

Daily Interest Rewarded

How much interest is paid to the HBD in savings? Here is the chart.

At first in 2021 the interest was paid to all the accounts that hold HBD, without the need to be put in savings. Then after the HF in June 2021, HBD interest is paid only for HBD in savings. We can notice the sharp drop at that time.

Since then the daily interest payouts depends on the amount of HBD in savings and the interest rate for HBD APR.

The payouts started growing and reached to around 1k HBD daily prior to April 2022. Then the APR increased to 20% and so did the interest increase and reached 2k shortly after. Since then, it has been constantly growing as the HBD balance in the savings increases and now we are around 3.5k HBD daily interest.

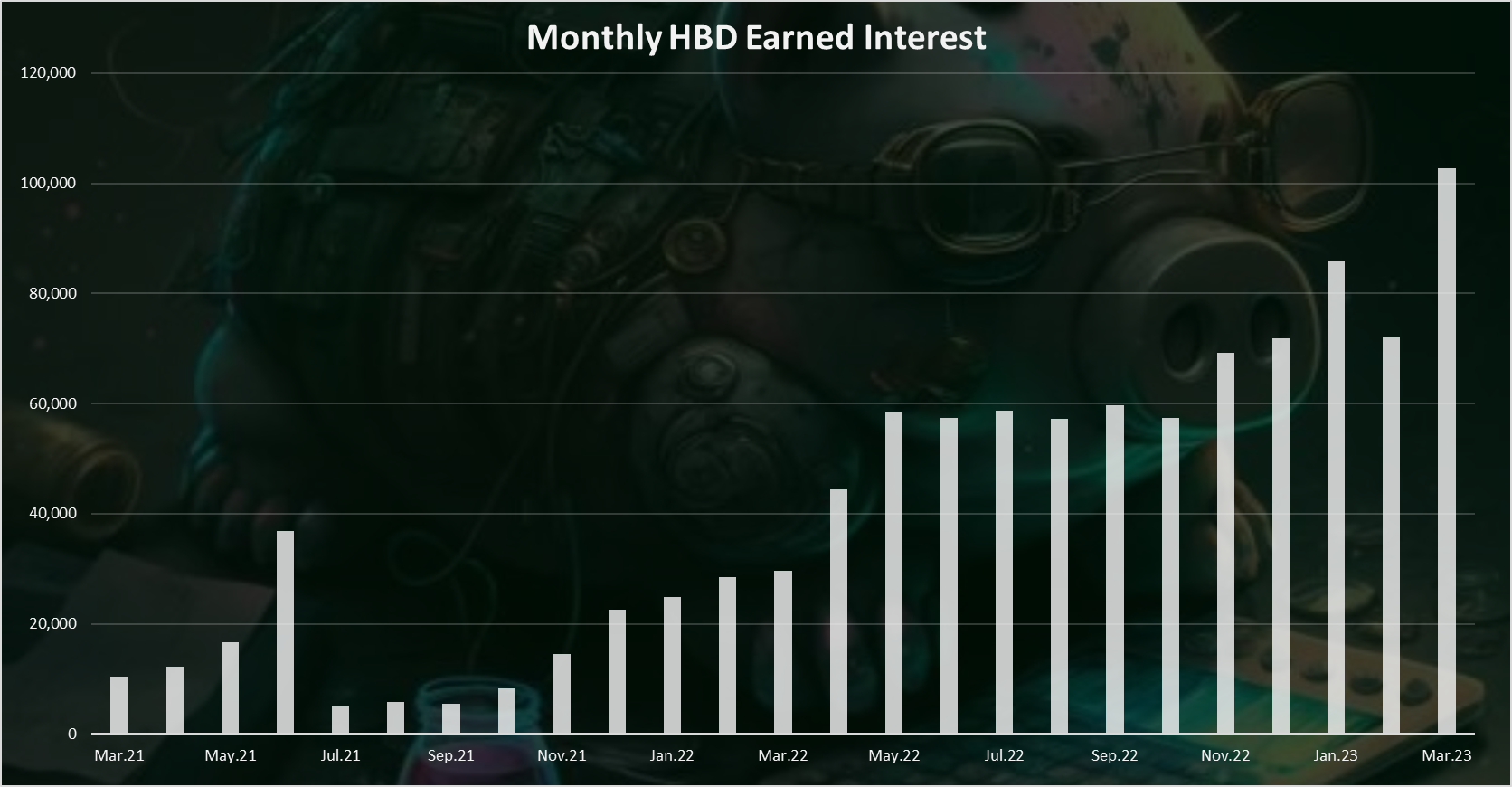

The monthly chart for the HBD interest looks like this:

March 2023 has seen the highest payouts in HBD interest with more than 100k HBD paid as interest in the month. Prior to this there was a period with around 60k HBD paid, then up to 80k and now 100k.

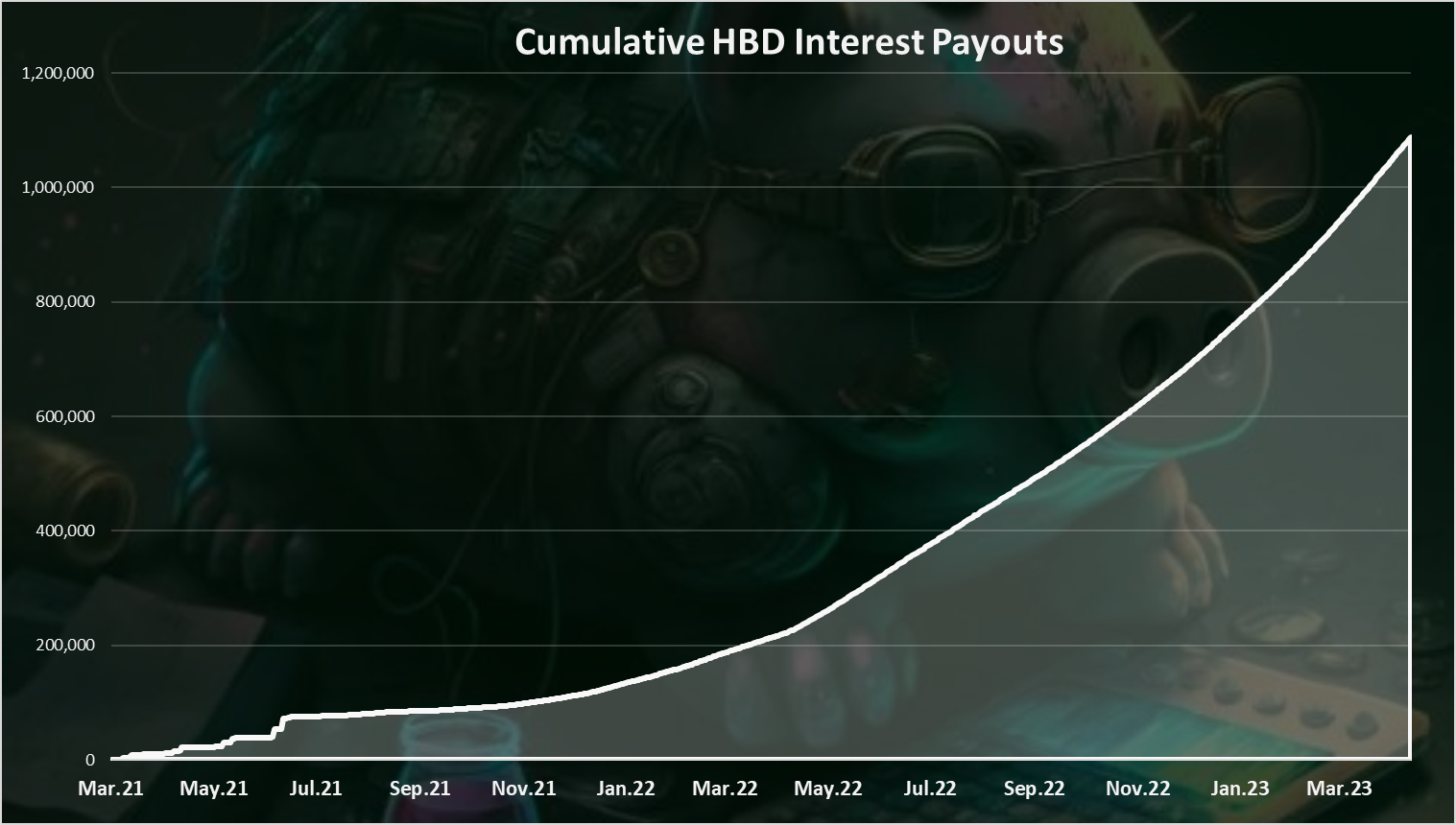

Cumulative HBD Interest Payouts

The chart for the all time cumulative HBD interest earned looks like this.

More than 1M HBD is paid in interest now from the Hive blockchain. This is in a period of two years’ time, with more heavy payouts in the last months.

Top Accounts That Hold HBD In Savings

Who has the most HBD put in savings? Here is the chart.

The @lazy-panda account has been staking a lot of HBD in the last period, especially in January 2023 and it is now dominant on the chart with just above 1M HBD in savings. @newsflash is on the second spot with 433k, followed by @muenchen.

@alpha is now on the top with almost 200k HBD in savings, followed by @muenchen. @mika is on the third spot now, after a long period of time when it was dominating the chart.

More than 7.3k accounts have at least 1HBD put in savings.

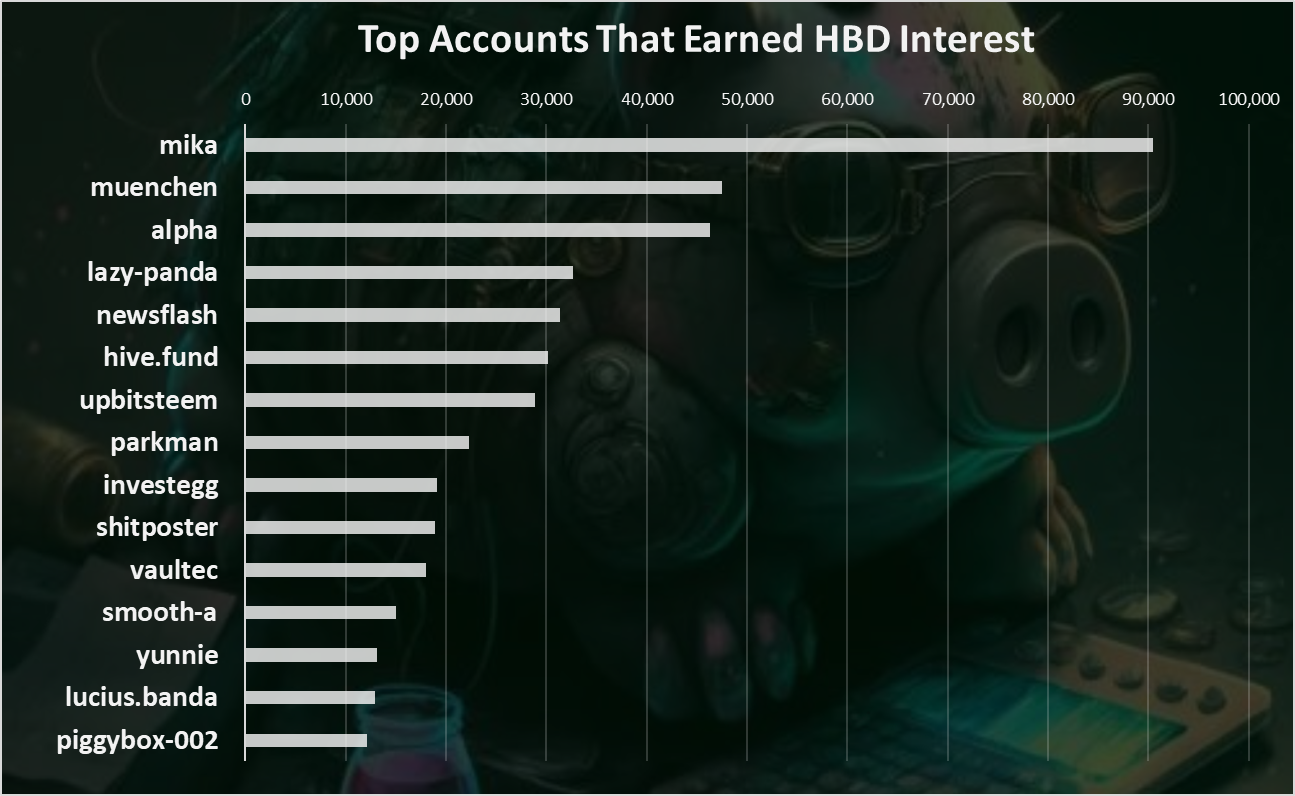

Top Accounts That Earned HBD Interest

The above was the current situation for accounts that hold HBD in savings. Some might have added and others removed. Who has earned the most in the past?

Here is the chart for interest earned.

Here is the chart for the all time interest earned from HBD in savings.

@mika comes on top here, followed by @muenchen and @alpha.

An overall uptrend for the HBD in savings, with more aggressive increase in 2023!

This is most probably because of the new 30% debt limit after the recent Hardfork. I expect for the HBD in savings to continue to grow as long as the 20% APR stands. This said it is worth debating what is the proper long term interest policy for HBD.

This steady growth for the HBD in savings is happening in a bear market. Meanwhile the overall HBD supply has decreased and the debt is now just around 6%.

HBD has proved to be resilient even under the bear market conditions of 2022.. As time progresses and the concept proves itself more, we will see more and more HBD put in savings, that will on the other hand put pressure on the HIVE price as well.

Not to forget that HBD savings are on L1 blockchain, not a defi app with third party risk. Payouts are in the native HBD token, not a secondary yield token. Much better security and stability. Other daps can build on top of this.

All the best

@dalz

Posted Using LeoFinance Beta

~~~ embed:1646600452442583047 twitter metadata:MTIzNTUwMTI2fHxodHRwczovL3R3aXR0ZXIuY29tLzEyMzU1MDEyNi9zdGF0dXMvMTY0NjYwMDQ1MjQ0MjU4MzA0N3w= ~~~

~~~ embed:1646625966008020992 twitter metadata:Mjc3MDY0MzZ8fGh0dHBzOi8vdHdpdHRlci5jb20vMjc3MDY0MzYvc3RhdHVzLzE2NDY2MjU5NjYwMDgwMjA5OTJ8 ~~~

~~~ embed:1646772114391977984 twitter metadata:MTExNzI5NTYwMDg2Nzc2NjI3NHx8aHR0cHM6Ly90d2l0dGVyLmNvbS8xMTE3Mjk1NjAwODY3NzY2Mjc0L3N0YXR1cy8xNjQ2NzcyMTE0MzkxOTc3OTg0fA== ~~~

~~~ embed:1647212645618171904 twitter metadata:MTQxNTE1NTY2MzEzMTQwMjI0MHx8aHR0cHM6Ly90d2l0dGVyLmNvbS8xNDE1MTU1NjYzMTMxNDAyMjQwL3N0YXR1cy8xNjQ3MjEyNjQ1NjE4MTcxOTA0fA== ~~~

The rewards earned on this comment will go directly to the people( @dalz, @hiro-hive, @seckorama, @uakulinar, @reeta0119, @muneeb487, @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I cannot understand people storing so much HBD even for the 20% APR, when you can have it all exchanged in HIVE and benefit from the market spikes, 10% APR from curation and more gains from price improvement. And as the bull market might be warming up, we could see serious growth of Hive value.

Posted Using LeoFinance Beta

Most are not speculators. That is why there are so many who invest in fixed income like bonds.

Posted Using LeoFinance Beta

I get your point. I'm a terrible trader so I love it. If I was more confident in my ability to play the swings I'd probably have more hive. Right now I'm about 50/50

Posted Using LeoFinance Beta

At the moment, with the current supply of HBD, it's totally fine with 20% APR, feasible.

But my question is, let's say 5/6 years down the line, if the HBD supply becomes 100 million or more, don't you think 20% APR will be too much inflationary, considering the fact that the debt limit is now capped at 30%?

Anyway, as always quite informative and insightful stats. Thank you for that.

HBD can be a max of 30% supply of hive market cap. For hypotetucal scenario lets say all the 30% is in savings yielding 20%. That is a max of additional 6% inflation on top of the exsiting one.

The haircut rule is what protects hive and hbd, not low apr for hbd. If we approach the debt limit, I expect the amount of hbd in the savings to drop no matter what is the apr.

Clearly, the community is taking advantage of the HBD interest and its stability. It is great to see HBD holding the peg impressively. Hive is creating its own digital nation where we all build wealth.

Very interesting stats.

Posted Using LeoFinance Beta

Interesting stats, these numbers will only increase because the 20% APR is just mind-blowing.

Yea 20% is quite the deal

Some (me) would argue it is too high! 😅

well, when it would appear it has skewed the distribution too much, the witnesses will dial it back ... it's a bit like central banking ...

Good to know! I surely hope they will act a bit before then though 😅

It's about personal responsibility. People around here often come from Bitcoin backgrounds and imagine Hive is "about as decentralized as Bitcoin". Nothing could be further from the truth. The Top 20 witnesses assume personal responsibility for the success of this community and this system. It is a political hierarchy in which the participants have vested power through the witness votes. Unlike the other, classical politicians though, the Hive witnesses do not have to maintain an extravagant lie that they are in it "for the good of the Nation / people / whatever" when in reality they are in it for the power and the money.

The blockchain miracle is that it aligns the interests of the powerful and the meek: our Hive politicians get more power and more money when they act for the good of the community. No need to pretend.

I'm not sure if I love more HBD interest or your stats! 😉

Thank you ser ;)

This is an interesting post highlighting the growth of HBD in savings and its performance in the past years. It's impressive to see how the interest rates and debt limits have evolved, making HBD more attractive for investors.

My question in mind is: Given the steady growth of HBD in savings, do you think there is a possibility of the interest rate being reduced in the future to maintain stability, or will the current 20% APR be sustainable in the long run?

More power to you @dalz

After one year of 20%, the debt level is now only at 5.5%. Far from the 30% limit. I'm personaly against making frekfent changes to the APR, and would leave it at this level for a long time. The haircut rule is the ultimate protection for hive and hbd

Thank you for your response, @dalz.

It's reassuring to know that the debt level is currently at a comfortable 5.5%, well below the 30% limit. I agree with your standpoint on maintaining a stable APR, as frequent changes may impact investor confidence and market stability. The 20% APR seems to be working well for HBD in savings, and as long as the debt level remains under control, there might not be any immediate need to alter it.

The haircut rule indeed serves as a safety net for both Hive and HBD, ensuring that the system doesn't spiral out of control. As we continue to observe the growth of HBD in savings and its impact on the Hive ecosystem, it will be essential to consider long-term strategies to maintain stability and attract more users to the platform.

My plan is to continue sharing this good news on Twitter and maybe attract some investors. Wish me luck

Keep up the great work analyzing and sharing valuable insights on providing valuable data for Hive. Cheers

It is always fun to stake something that brings a lot of wealth your way.

Typo in the title?

I've been trying to decide whether to support the current rate and noticed that you have set it at 15%

I don't know whether you set it at 20% before, but I'd be interested to hear what the rationale is for 15 instead of 20.

I set it at 20% and advocated for others to do the same when UST was paying 20%. I felt it was important to be competitive in the DeFi space at least on a temporary promotional basis even though everyone should recognize that 20% is not sustainable indefinitely if there is too much demand (we're able to afford it on a small total saving balance as long as uptake remains low due to hardly anyone knowing about it).

Once UST collapsed, it was no longer necessary to pay 20% to be competitive. IMO 15% is still a very attractive return, better than just about everything if not everything else, and saves us a bit of expense on interest. But the 5% difference is not large, so I haven't really pushed for a reduction. The 15% is just my opinion.

Thank you for your explanation.

I agree, 15% is still a competitive rate, and I have mentioned elsewhere that I think between 12% and 15% is something I would be more comfortable with supporting.

Just some context:

~~~ embed:1647241155107598339 twitter metadata:ZWxtZXJsaW58fGh0dHBzOi8vdHdpdHRlci5jb20vZWxtZXJsaW4vc3RhdHVzLzE2NDcyNDExNTUxMDc1OTgzMzl8 ~~~

As a larger HP holder, these are my personal thoughts.

It hurts.

Pain all over

Paid your dues.

Yea ... corrected... thanks

I don't know much about HBD but through your post i have learned alot about it. I like your post.keep it up.

That is cute

I just began to get my facts about HBD and it seem to be a very good investment

Imma invest in it as soon as I have the money

I think putting HBD in savings is one of the best investments one can make on the Hive blockchain especially during a bear market. The passive income earning potential is quite huge!

Where exactly does the HBD come from that is paid in interest? I'm not sure how this system sustains.

I think you could ask the author of the post. He knows a lot more about it than me. You can browse through this posts, you'll find one about all things HBD.

There are two types of people in this industry, those who like to take risks Those who want to take risk are the ones who buy the hive because they know it has to go up and down. If it goes up, good can be found. And people who don't want to risk their money at all take HBD and stake them, and twenty percent APR is pretty good. And the benefit for those who have stacked is that they can comfortably bear his expensive. The way he has been managed over the last two years has given him a lot of trust.

That's why my retirement plan has a great portion of HBD in it. Stable, yet large yields. It's like a dream.

Very interesting statistics to keep an eye on if you hold a lot of HBDs!

Nice up is the only way we must go!

https://leofinance.io/threads/@seckorama/re-leothreads-2gtqz1cqa

https://leofinance.io/threads/@mazilicious247/re-leothreads-3fnxvu

The rewards earned on this comment will go directly to the people ( seckorama, mazilicious247 ) sharing the post on LeoThreads,LikeTu,dBuzz.

Yes I am totally agree with you, great information, it is very good to invest in HBD because I think 20% APR is more than enough.

If you know next to nothing about what to do with your HBD, you won't find a better option than to push that into 20% savings. That is insane to turn your back on it.

Not sure why I keep coming back to your posts about HBD but I'm starting to see why. Keep em coming.

I value the analysis.

So glad I came across this! Very interesting stats I will definitely be tuning into your posts more often!

This is pure massive. Thank God I have some hbd in my savings. Thanks to hive witnesses. They're working so hard. Thanks for the knowledge. I will save more and more.

!1UP Good work!

!PGM !PIZZA

You have received a 1UP from @underlock!

@leo-curator, @vyb-curator, @pob-curator

And they will bring !PIZZA 🍕.

Learn more about our delegation service to earn daily rewards. Join the Cartel on Discord.

$PIZZA slices delivered:

@curation-cartel(17/20) tipped @dalz

Excellent stats sir. I will be waiting for your next post. Thanks

How exactly does HBD keep its peg at this interest rate? There absolutely isn't 20% more fiat entering into the HIVE ecosystem simply to cover this interest payout. I understand that it is due to the 'haircut' system ie when people start eventually converting HBD to hive it'll tank the conversion rate but I just don't get it.

HBD has been a great tool for hedging against market volatility, and it's encouraging to see it perform well even in challenging market conditions. As more people become aware of the benefits of HBD and its potential for long-term savings, I'm confident that it will continue to grow in popularity and demand.

I enjoyed your presentation.😍 HBD is an interesting entity. It is very good that part of the asset is kept as a hive and part as a stable HBD.😎

HBD is no doubt a good way to keep your saved money without even having to worry about anything. The juicy 20% APR is forcing people to keep their HBD in savings, the other factor is that HBD is not losing its peg, on the other hand, SBD is not coming to its purpose of creation. I love HBD for the same reason.

20% is good - but explosive growth is not needed - 25-30% would be a huge incentive for investors!!!

I love HBD, and am keeping a portion of what I get in savings. My ultimate goal is to have 2000 HBD by 2024, which will supply me with a small diversification fund.

With profits from my other investments, hopefully I can buy more Hive during the next serious bear market.

This post has been manually curated by the VYB curation project

This post is quite educative and very helpful for a newbie like me.

I hope the 20% will stay until I can build my purse to $1 dollar interest a day it's a tough slog but the compounding of interest is beautiful to watch.

Posted Using LeoFinance Beta

This is really a good news. I have never save my hbd before but I see it necessary. Thanks for the Good information

Just in time... thanks!

First off, love the charts and analytics for $HBD, keep it up, I will keep consuming the data - haha.

So, I joined Hive back in August 2020, about ~5 months after the original hardfork, when the interest rate was pretty low and I didn't fully understand how Hive or $HBD worked. I am glad I am in it to win it, now, as the entire altcoin space has showed its true colors. Projects that focus only on price of token are bound to fail in my mind.

Projects that focus on building longterm, sustainable value, like Hive, will continue to persevere and grow. I think the 20% APR will remain for a while, mainly because Hive is still so minuscule in size and public profile compared to most others that dominate the internet media.

Posted Using LeoFinance Beta