Dropping some casual bombshells in Spaces.

The LEO AMA was actually pretty crazy today. I've had a lot of reservations regarding the wLEO/CACAO listing on the Maya protocol, but a lot of that skepticism has been laid to rest after this discussion.

The main worry, which was also confirmed during the AMA, is that fees on Ethereum are quite simply too high and create so much friction that it is only worth using for huge batch operations that are at least four figures large to offset the liquidity provider fees, slippage between assets, and on-chain fees. In this case the on-chain fees being absurdly high on the L1 ETH blockchain.

The reason for these high fees is two fold. First, even the process of turning LEO into wLEO costs an ETH fee. Then trading it away costs another ETH fee. This puts the network between a rock an a hard place especially when looking at a bridge into Hive. The only way to make fees worth it is to do a large transaction, but liquidity between LEO/HIVE is so thin that a large transaction will almost certainly create exponential slip which results in the same problem. Classic case of needing liquidity to get more liquidity. Flywheel and all that.

But all that's behind us now.

In the AMA Khal explains how Maya is going to be implementing Arbitrum protocol, which is an EVM layer 2 that I've heard of before but have never actually used yet. At first glance it looks a bit more legitimate than other lazier EVM clones that use the "second layer" moniker as a marketing tactic. In fact it even uses ETH as gas instead of the ARB token, which is nice to see. I guess I'll have to do some more research on this later in another post.

Point being that during the previous Spaces talks the Maya community asked if we would be integrating with Arbitrum... which sure would be nice because the fees are even cheaper than both BSC & Polygon. Pennies even. Khal took that advice and ran with it, and after a 12-hour overnight sprint the LEO team was able to integrate their old ETH EVM code directly into Arbitrum. Impressive.

So yeah the obvious first question I asked in the Threadcast was addressing any potential security vulnerabilities that might arise from porting the code over from Ethereum so quickly. There doesn't seem to be any concern here whatsoever which honestly makes sense because all the contracts are EVM compatible and very much should be plug & play across layer two... which is why they only needed a 12 hour sprint to get it done in the first place.

wLEO/CACAO on hold indefinitely.

It is of the utmost importance to not needlessly spread out our liquidity with a market cap so small (less than $2M). Khal has confirmed that indeed the wLEO listing is no longer happening, which again is a very good thing in my opinion. This pool would just serve to vampire attack the other pool and syphon liquidity away from it for no good reason. The fees on ETH are simply too high; we need a cheaper option, and Arbitrum is looking pretty damn good so far. A wLEO listing could be an option later but might be pretty counterproductive considering how easy it would to bridge into ETH without one.

Another added bonus of these cheaper fees will be the ability to provide liquidity to the LEO/CACAO pairing in smaller chunks. Before I was certain I was going to need to commit something like at least $5000 to make the whole ordeal worth it. Now with L2 fees on Arbitrum even providing $1000 or less will be easy. It looks like even $100 would be viable from a fees/slip standpoint.

Diesel pool incentives?

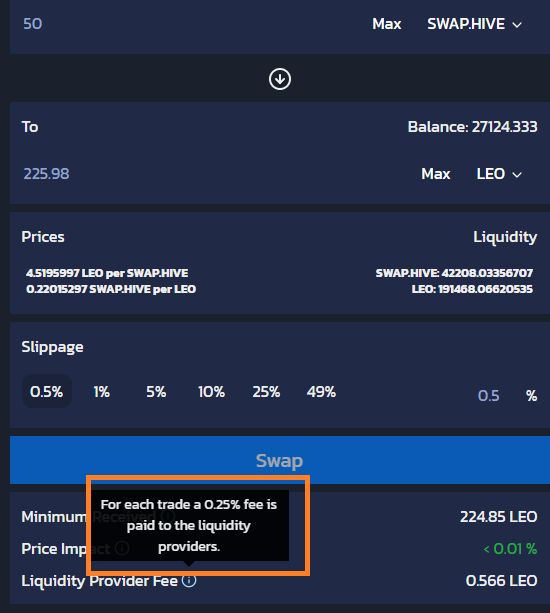

I asked Khal about allocating emissions to the SWAP.HIVE/LEO LP on HiveEgine, and he was considering it... but then he made a comment about wishing that HE took a trading fee and distributed it to the liquidity providers... which if I recalled correctly was added some time ago.

It was confirmed that HE does indeed take take a quarter percent fee from swaps and gives them to the LPs for their troubles. With this incentive in play Khal believes it is enough to seed a deeper liquidity pool as long as that pool starts getting a whole lot more volume (which it should given this new infrastructure).

I'm not personally sure if I agree with this strategy, but also getting a liquidity pool for free rather than paying for it with emissions is worth exploring. I may even allocate some HIVE/LEO to this pool just to test it out going forward to see if it's worth the risk of those dreaded "impermanent losses". With high enough volume over long periods of time I assume it would be viable.

It was also noted that the HE/TribalDEX frontends do a poor job of displaying how much APY one can actually earn from these fees, as they are displayed linearly with raw values and not percentages over time.

LEO/CACAO pair

The wrapped token on ARB won't be labeled as such. It won't be aLEO/bLEO/wLEO/pLEO. It will just be LEO, which is refreshing given that this is what every centralized exchange does even though all their assets are wrapped pinky-promises. Identifying the wrapper only creates confusion in my opinion. Only more advanced users know what it means and those same users are likely to figure it out anyway without the hint.

50M token hardcap

The way this new contract will work is that all 50M possible LEO tokens will be minted all at once on Arbitrum and then the contract will lock and not allow any more. Apparently this 50M LEO cap is somewhat present on HE as well and inflation goes to zero at 50M tokens (currently sitting around 18M).

There are a couple of different reasons to do it this way, the first of which ironically is security. At first glace it would seem not so great to premine 50M wrapped tokens on a new chain, but leaving the contract open-ended to print more tokens is even worse. This way there is only one pain point of vulnerability instead of two. Completely removing the ability to mint tokens is certainly the way to go.

Data Aggregators.

Another advantage of doing it all this way means that sites like Coinmarketcap.com and coingecko.com are going to show a much more accurate representation of the token itself.

Take bLEO for example.

First of all, the ticker is bLEO... which already confuses the issue... and then on top of that only 10M tokens were minted on BSC... which is obviously plenty for BSC but it makes it look like the token has a fully diluted market cap of less than $1M. By printing out the full 50M hardcap at once on ARB we may be able to juke the numbers a little bit and swing it in the other direction.

It's also quite useful to use such hardcaps as a marketing ploy. I've been around long enough to remember when LEO had no caps. Even though the amount of coins in circulation is very small, people want to be told there is such and such hardcap on the token's upside. In this case that number is 50M. I don't really respect this trend, but Bitcoin and a mountain of failed DEFI products have trained the population to be this way. Beggars can't be choosers.

Maya v109

Delay delay delay!

The LEO token already exists on Arbitrum at this point, it actually launched during the AMA. Now it's a waiting game we play. Maya has to update their protocol to allow Arbitrum in the first place. These things happen.

The really nice thing about this situation is that LEO is going to be the very first token from Arbitrum to be listed on Maya... and it will happen immediately on ARB integration. I can imagine LEO getting a lot more attention just because of that. Also the exponentially lower fees will be quite nice.

LEO DEX

As a final thought this delay allows the LEO team to bust out the rails for Hive on day one of the launch. Hive will have access to a new route into a layer one dex. From Hive into SWAP.HIVE into LEO into ARB LEO into CACAO. From here the CACAO can go into any asset listed on Maya, and because Maya is connected to Thorchain via the CACAO/RUNE pairing that means we have access to Thorchain as well through this backchannel.

Of course this is a lot of jumps and might be a bit pricy... but I do very much like knowing that this pathway exists in the face of so many other centralized liquidity pools being cut off to me (namely Binance). What would happen if MEXC just decided to boot me off their network? That would be quite bad for me personally. Bridges like this will certainly help soften the blow should financial regulators continue their assault on financial freedom.

Conclusion

This LEO listing on Maya just got a whole lot juicier. If I'm being honest I was quite dreading the prospect of paying fees on the Ethereum blockchain. I have refused to use their service since $1000 was the ATH back in the day. Now all that's left to do is a bit of research on Arbitrum to see what they've got going over there. Thus far it looks promising.

The difference between this Maya listing vs something like Cub is completely in a separate league. Maya is a layer 1 chain connected to multiple other layer one chains with an actual community behind it, that also just so happens to be reinforced by the greater Thorchain community. I'm still in shock that they'd even we willing to list something like LEO, but here we are. I guess Khal has connections. Everybody wins. Send it.

Huge news... big win for all Hive users with this integration.

Connections or money? You'd be surprised what you can pay for with these types of DEX platforms lol In any case it's good to see at least options for being able to move around assets and the proposal of something internal for hive would be nice as well. No reason why all of this can't be built right into the InLeo UI.

Khal has been floating around the Thorchain community for years and LEO doesn't have much money to spare. So gonna go with connections.

I'm still skeptical. I got burned bad on Cub. I'm not skirting the blame, but I have still lost a lot of faith due to that. It's going to take a lot for me to get involved in something with Leo again.

Yeah that's not great!

I've written half a dozen blogs about why allocating yield to random LPs is a great way to bleed out all the money of the token being inflated.

But also perhaps you've forgotten how easy it is to make money when these things first launch no matter how unsustainable they are. Initial FOMO lasts about 3 days in my experience. Unless there is a hack or a rugpull within those first three days it's usually free money if you hit the ground running and then sell into the FOMO a couple days later. But that's just gambling and not really an investment based on fundamentals.

Main point being that the feelings you're feeling right now is exactly why people FOMO in at the top and get wrecked every cycle. "Now's a good time to ape in; everyone's doing it and they've had success." "Maybe I'll put a second mortgage on my house!" lol

Haha, yeah. I have definitely learned a lot since then. I would do things much differently. Everything I lost was gains, but it was gains that I should have moved into stables and still had now versus it all basically going to zero. I don't blame anyone but myself, but I hopefully don't plan on being FOMO'd again. At least not on this.

If the 4-year cycle plays out as planned I'll be telling everyone and their mother to rotate hard into HBD & BTC come November 2025.

😀

Full send

I take a day off of Hive and big things happen. Geez.

Yeah, I added it as an option with the ETH chain on my new DEX, but will certainly try to add the Arbitrum chain when I can.

I just added Arbitrum to Metamask today because I wanted to just get it added, but I don’t have any ETH to use so I’ll have to figure that out. Probably send some MATIC or something. So I will be learning it too as I do like it after doing some research.

I assume it may be easy to get some ETH on Arbitrum when Maya lists it.

XDEFI wallet is turning into a full replacement for Metamask.

Right on, I'll have to check it out. I know I can get ETH on Arbitrum using my Cross Chain swap on LogicSWAP, which is just a Simpleswap embed, haha.

Ita not April yet. So I am getting excited.

Ug... I wish we could just skip April lol

Well, this is a surprise.

I already bought wLEO on Uniswap and cacao on Cacaoswap and was holding them in my wallet for the big day.

It's a good thing I love this place, or I might be salty.

Oh well... Change is the only constant in life.

Don't scold me for this... but I already started a transfer of Leo to wLeo, which is "in progress" on Leobridge.

Only the Good Lord knows why I still use Leobridge, but you know you gotta have faith that things will get better if you keep usings Khal and team will fix the bugs and things will get better.

I like to think of my bridge transactions as an investment of time to give feedback to Khal and team on bug fixing the bridge.

I always get my money back, so it's never a risk of losing it, just a matter of how long it will take to get it.

I still see utility as king here and eventually the UI appearance and the utility of the things Khal is building will win over many, many people.

Call me a dreamer, or a blind zealot, but I still think that utility and UI are king, those are the themes which attracted me to Steemleo back in the day, and keep me here. But only if we use the stuff and give feedback.

Any who... time to change from wLeo to aLeo LOL

So I guess I will add Arbitrum to my xDefi wallet, go sell my wLeo, buy some aLeo and stand prepared again.

Anything tips you can share would be appreciated. I

Dam... 8.37 plus 35.06 to swap WLEO for ETH... I will wait until later.

No idea how much I lost playing with Cub etc. Will watch this for a while.

Everyone check Your Hive-Engine Balance for VKBT

https://hive-engine.com/trade/VKBT