Late last week my accountant called me...I avoided it letting it go to message bank. I knew what it was about and wasn't in the mood to have the discussion but it was inevitable and, as expected, the call came in again several hours later and was about exactly what I thought it would be.

I've used the same accounting firm for almost twenty years and am happy with them including the owner, my personal accountant. But here's the thing, he's completely clueless when it comes to cryptocurrency. He's trying though, I'll give him points for that. He has three clients with crypto and told me he's using us all as guinea pigs which is why he sent me an invite link to CryptoTax Calculator with instructions to import all my transactions so he could take a look at how the site works, what benefit it may have.

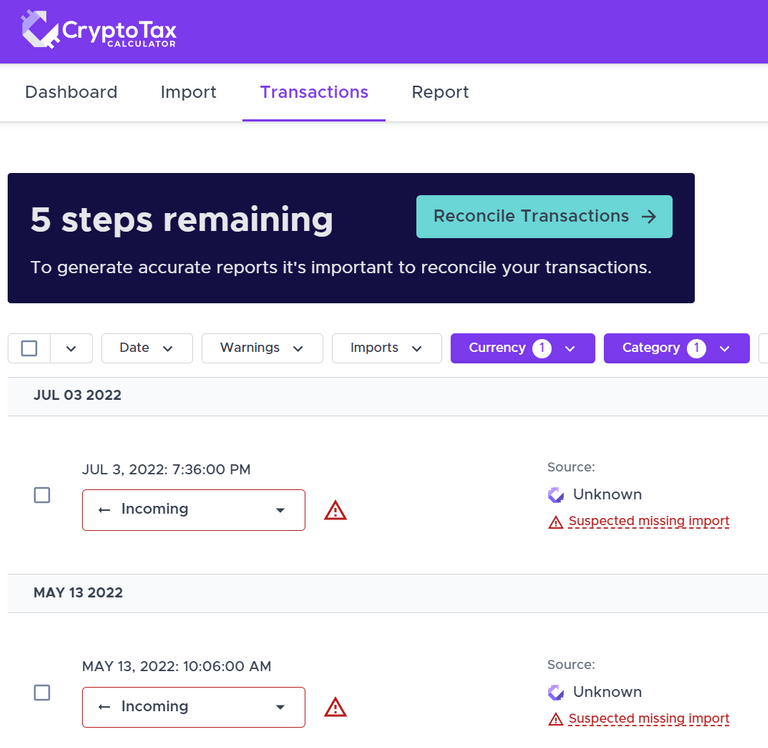

I went ahead and imported some from a few of the exchanges and wallets I use and it came up with many thousands of transactions. I expected that, the volume of transaction, but didn't expect I'd have to go through and reconcile transactions manually, for various reasons. It's what nightmares are made of to be honest, however if it's not done there's no way to generate accurate reports.

Here in Australia the tax office (ATO) haven't been very forthcoming with information in respect of how cryptocurrencies will be taxed and what tax laws and mechanisms will apply; they basically said, crypto will be taxed, and when the accountants have asked for more information the ATO basically said, sure, here's some...crypto will be taxed.

It's not been very helpful and I would have thought they'd have it a little more sorted by now.

I've been under the impression that if cryptocurrency isn't exchanged for fiat currency no tax event is triggered but apparently that's not the case at all; there may be a tax liability for crypto holdings held in exchanges and wallets, at least that's what my accountant told me may occur in Australia. That's not good news.

No one really knows what's going on to be honest, however after a few discussions with my accountant it's very clear that the ATO are working towards stitching it up tight and taxing people in ways that generates as much tax as they can gain from those holding cryptocurrency. It's also abundantly clear that the situation is fluid, and incredibly complex and I don't know what that means for me...other than hours of work reconciling transactions, if it's even possible to do completely, and the cost of lost funds to tax. I knew I'd pay some of course, but had thought it might be a little more straightforward.

I asked my accountant if it was likely I could just cut a deal with the ATO, you know, something like relinquishing half of my holdings to then in tax and walking away with the rest, but he was adamant that that won't be an option. I wonder if that means they will seek to tax people at a higher rate than fifty percent?

I'll admit that I ended the day feeling somewhat dismayed over the situation and, with no answers forthcoming yet, more a little confused as well. That didn't stop me heading over to one of my exchanges and trading some Hive whilst the price was up into the $0.90USD range but the excitement over the gain I'll make by rebuying down lower won't be as enjoyable because of this complex and unreconciled ATO situation that has now raised its ugly head.

I've not been all that keen to import anything at all into CryptoTax Calculator and have held some of my exchanges back so far but I'm still left with thousands of transactions and at least a couple thousand uncategorised transactions to deal with and, to make matters worse, some of the places I have cryptocurrency don't have a sync-mechanism to assist with the import, such as Wirex. Fuckers.

I don't know how this is all going to play out for me and the other Australians that hold crypto but I'm sure the ATO will get what they want. I wonder how much will be left for those of us who have done the hard work and I think I'm going to be incredibly pissed off if it's weighted the governments way. I'd love to simply hightail it to some other country that doesn't tax crypto but that's not a viable option at this stage, and I think I'm going to have to endure the pain of what's to come from the ATO. Time will tell.

Do you know the situation in your country? What tax liabilities might you face and what processes are in place in respect of cryptocurrency and taxation? As I say above, it's a complex thing here and I assume it is elsewhere also. Tell me about it in the comments below if you know the situation, or just have a rant about the tax office...And now I better go back to reconciling transactions, I should be done in several years at this rate.

Design and create your ideal life, don't live it by default - Tomorrow isn't promised so be humble and kind

Any images in this post are my own, the CryptoTax Calculator image is a screen capture from my computer.

The accountant we used a few years ago was clueless about crypto. We’ve used TurboTax since but FWIW we’ve just checked the YES box that asks if we done any crypto transactions in the last year. But what then? There’s no option for entering anything manually, but it’s not as if I could do that anyway. Between Hive and Hive-Engine, there are dozens or hundreds of micro transactions every day. I’ve got no clue how I’d begin to comply.

If I ever get audited, the tax demons can figure it out and bill me.

I agree, there's no real way to make it work by tracking every transaction.

I was thinking...Imagine someone knitting a sweater to on-sell. At the point of sale revenue is collected and tax is payable on the income. Does the tax department ask to see every stitch reported on or just the materials, cost of manufacture and revenue? I think they're juts trying to grab as much as they get when paying tax on crypto to fiat exchange is the simpler way to go I guess. I'm no accountant, so am more clueless than accountants when it comes to this stuff but there's got to be a simpler way.

I like your idea though, let them sport it out. I'd be happy to pay 50% on every dollar converted to fiat and not have to report.

I agree and asked people in Hive that I know there. Their answer is they have no clue or they just do not report it. So cant say that I am to happy with Hive and anything regarding in how to file taxes for crypto. My tax person is still trying to figure my taxes out for me. If it ends up that I have to pay into federal and state taxes I will jump dump everything I own in crypto. Just my thoughts on this matter.

Well, the blockchain is decentralized and people in hundreds of different jurisdictions with wildly different tax codes can earn from it. And the core developers have no real incentive to help us figure out how to do our taxes.

Just one of the many ways they are coming for us bro.

Until they control every aspect of our lives.

I expect an audit due to the fact that I disclosed my crypto info this last April. I payed a penalty of just over $500 usd.

I know the gov sanctioned robber barons will not be satisfied with that.

I will fight back by claiming every piece of computer and or electronics, also the electricity they use. They want to tax crypto. Then the couple laptop mining farm just expanded into a major business write off. Every tablet, phone, monitor, and peripheral device. Printers, mice, keyboards, etc.

I agree. The control mechanisms in place, and to come, are dehumanising the masses, taking away freedom of thought and action. So many play along though, and so it'll keep happening.

It is crazy that there should be any taxes on crypto. I mean its like money.. don't they have their fiat for that?!

Governments are always going to try and grab what they can and as great a quantities as they can. I'm no expert, but I also think governments fear the rise of crypto and the decline of fiat currency, the devaluing of it, and that's probably got a lot to do with it also. I'm not very switched-on with all this tax and crypto stuff but I know those who are in positions of power have always tried to take advantage.

Sadly you are right. I guess we need to try and keep as much of our crypto in the defi space as we can.

I plan to use my crypto in the real world eventually so it is an issue that is going to come up. Plus, with the prospect of the ATO assessing crypto held in exchanges? If that's the case there will be no way to hide it.

Sorry for jumping in here. I don't think within the realms of Australia, the government is not scared of crypto. In fact I think they have been looking on it as another form of income the whole country. Now as for the thinking that why should there be taxes on crypto since it is money after all. I think we should look at it as being if it is money, if you are earning money then there will be tax on it so I would say it would mean it is just natural to be paying your tax. If you want to have a functioning country.

You're right, it is "money" which is why the ATO is taxing it.

Ah, @new.things and I were just having this conversation a couple of nights ago and your name came up as one of the only other Aussies we know on here. Brad's trying to figure it out on his own (which is his M.O.) but I think I'm in the same boat as @preparedwombat when they say:

But I do have a much smaller crypto portfolio than all three of you I'm willing to learn from anyone who knows more than me. I just hope it doesn't turn into mountains ("years") of work for any of us. If it does, maybe we need to have a Zoom crypto reconciliation party to keep each other company while we figure that ridiculousness out.

And I'm curious, how are you approaching this @riverflows? (If you're comfortable talking about it here. If not, please disregard, my love!)

It's a complex scenario, I've had three meetings with my accountant about it and am no closer to a solution, or even a way forward. He is clueless because the ATO aren't giving clear, or viable, directives and are taking what seems to be a scattered approach to it.

I have a reasonably significant crypto portfolio held across multiple wallets including offline, built mainly off blogging on Hive and some trading so my initial buy-in was very small...Now with the prospect of holdings being taxed when in exchanges before realising the profits in fiat currency...well it seems a little like robbery to be honest. I have always factored in losing 50% to tax, but that's likely to be more if they're taking it before I even take it. That's like the ATO taxing my 2024 income today right?

If they can tax the theoretical gains, can you write off the theoretical loses. 🧐

I was just pondering how it would work as far as gains and losses and drew a blank.

Unfortunately my accountant doesn't have an answer to this one either. I've just tried to call him (again) but maybe after all our calls he's avoiding me. Probably cursing my name and the fact I have crypto. 🙂

Totally. Not simple. I can only imagine how frustrating it must be with such a significant amount in hodlings. If you magically find a very clear explanation now or in the future, I look forward to seeing a post about it!

!LOL

lolztoken.com

It was a case of age-related macaroni degeneration.

Credit: reddit

@galenkp, I sent you an $LOLZ on behalf of @consciouscat

Are You Ready for some $FUN? Learn about LOLZ's new FUN tribe!

(1/6)

I'll write a book and become a gazillionaire. 😜

!LOL 😂😆😁

lolztoken.com

I said oh god not that as well!

Credit: reddit

@galenkp, I sent you an $LOLZ on behalf of @consciouscat

Are You Ready for some $FUN? Learn about LOLZ's new FUN tribe!

(2/6)

If you are familiar with capital gains tax then it should not be hard to work out how tax is calculated for the transactions and if you have been trading consistently and looking like you are professionally then it can technically be argued as revenue instead of capital which would be in my opinion what makes it start to be within the complex situation category.

I think this is useful.

https://www.ato.gov.au/General/Gen/Video-Transcripts/Crypto-myth-busting-with-Tim-Loh---interactive-video-transcript/

If you are familiar with capital gains tax then it should not be hard to work out how tax is calculated for the transactions

I am very familiar with this and it applies, but that's not the only tax law that applies and here in Australia one can't pick and choose what tax laws to apply, the ATO does that.

It's not simple, not even close to simple, and each person's tax situation is different depending on many factors. With crypto...Well, I was on the phone with my accountant for an hour (he charges me for this) and we were no closer to determining a way forward other than the fact he needs to do what he can to keep me from being investigated by the ATO.

There is no way to simplify this situation, here in Australia, despite that being what we'd all like. I know people like to over simplify it, but in reality just about every tax accountant in the country is scratching his/her head. The las is the law and the ATO will enforce it, despiite what we, as tax payers, want.

That is true. The law is the law. Because I am not privy to the details of transactions your accountant is trying to apply tax law is would be hard to give a detailed opinion on how it will apply to your selling, swapping or anything else along that line.

When you say there are other tax law that applies, can you give me that particular transaction? i.e. staking implications? sale of tokens? transfer of tokens to an exchange? or as you outlined briefly the implied gains to having tokens in an exchange?

I am very much interested in how it applies to you since I live in Oz too.

All of the above, including investment tax and others as outlined on the ATO website.

Based on my understanding of crypto and tax implicaitons.

If you are earning tokens because you are staking. On the day you are rewarded, the market value of the token when it hits your wallets will be ordinary income (this is not capital gains), in turn this will be the cost base of the token. The thinking is for you to get that token to begin with you would have to had spent an amount of money to gain it.

That same token once you sell it later, you will need to work out how much you got it for (which is the cost base - market value when you got it) versus what end up selling it for, either a gain or a loss. This is then a capital gain.

As for having it in an exchange. If you never transfer it to anyone else but yourself I do not see any tax implications since you are not getting anything in return. It's all about transfer of ownership. I can basically have 10 wallets and transfer my tokens to any of them as much as I want and not have to pay tax on transferring between my wallets since it is still me that owns them but the moment I transfer it to someone else then there is an ownership change, triggering CGT.

These are my understanding of what we all face when we own crypto.

I think it's best you find an accountant, or you can go it alone I guess, we'll each approach it in our own way, as will the ATO.

Thanks for your commenting, I like the engagement.

Hey no problem man. Tax is one of my hobbies so if you ever want some more nonsense re its application. Don't hesitate to bug me. Am sure the blind leading the blind will eventually find that burning bush.

https://www.ato.gov.au/Individuals/Investments-and-assets/Crypto-asset-investments/Transactions---acquiring-and-disposing-of-crypto-assets/Staking-rewards-and-airdrops/

People working on government excusing and justifying why they are entitled to everything for nothing never ceases to amuse me (I have to be amused as fury is the other option and that's only useful sometimes).

Did you manage to get through all the million bazillion transactions? x_x

Fury works for me also Ry.

Nope, I stopped reconciling as it's pointless as I don't know enough about what the categories mean. There's a spam category which at first seemed strange, but considering what my imports have actually imported (valueless coins I don't even have), it makes sense. Click it though and up pop the warnings about that category as far as hiding transactions. It's the same with some of the others.

I've sent hive, a significant amount, as gifts over the years and they're easy to reconcile, the rest? Nightmare.

Rage is only good when you can action with it, otherwise it's just a headache XD

Is there an "enough" point that will keep the accountant happy? :S

His goal is to keep the ATO off my back, prevent an audit, as that will be invasive and unpleasant.

It's interesting, all these crypto people with their ways of interpreting the tax laws and boasting about how they are going to get around it...After several hours of discussion with my accountant I realise how futile and naive that really is.

There's no enough point. I hope there's a point that the ATO decide is sufficient though. It's up to them, not my accountant, he's just the intermediary.

That point the ATO finds sufficient is what I meant. I know there is no amount that is ever "enough".

Oh my, you're hitting a spot with this rant. Taxes are then one thing that keeps me from really enjoying my time here on Hive and playing SPL. Well, not quite true, not the tax itself but the scarce information of how you are supposed to file them. We are good law-abiding tax people so in April we started our taxes, deadline = 4/15, I researched and googled and read and - gave up. I filed for an extension so now I have to file in October - sigh. And I am dreading going back to researching this. Like - supposedly NFTs are taxed like income so, does that mean that I add a couple of thousand USD that I hold in SPL cards on top of my income? F*uck if I know. Come October I'll probably ask a CPA or company for their input. It really shouldn't be this hard though, right?

Okay, rant over. I hope you got your transactions sorted out 😁

It's a complex issue and whilst many like to make light of it, flippantly commenting that they'll move to a country that has no crypto tax, we all know that that's, most often than not, a pipe dream rather than reality. In first world countries the governments will lick this all up pretty tightly, as the ATO are doing, and if people think they'll be able to rort the system they're wrong. Boastful talk doesn't bring the situation to a resolution, it just helps a person feel in control.

The ATO have crypto people working on this, not just accountants, so they know what's up and will know about every situation, wallet, exchange and so on, probably more than most crypto people who will only focus on the elements they know or work with, like SL for instance.

I'm a realist and I believe this is going to be a nightmare scenario for most and considering I hold a reasonable amount of crypto value in my portfolio it's definitely going to be an issue for me. I'll have to deal with it though, moving to Portugal, or wherever crypto isn't taxed, isn't an option.

I hear ya. Moving is not an option and where to move to anyhow? Crypto is / will be everywhere and governments everywhere are hungry for money.

The thing is - I am willing to pay that money, my taxes but - please make it easy, clear concise to execute. I really am not in a place where I want to have an issue with IRS. I just don't.

I see people sniff about KYC and stuff and I'm like - okay, that's not me. I'm too old to go rebel - LOL - or in your words I'm a realist

I hope you get yours sorted out (and I hope even more that I get

oursmine sorted out - in time)It's that clarity I think people really need, my accountant included! They keep pivoting with each new crypto-related thing and that's a recipe for disaster. I'm hoping for a solution but I'm going to be very pissed off if I have to pay tax on crypto that's being held in an exchange. Does a person pay tax on shares they own or only on the revenue gained? (Revenue gained, as far as I know). Why is crypto any different?

Time will tell I guess. I'll be happy, or not, the same as everyone else in this position.

Absolutely agreed. Governments need to come up with their rules a.k.a. laws. It would be great if they were to tax only gains when you actually trade and make money but - who knows? This is why I'm so confused about the SL NFTs. Well, at one point i.e. October, 15 or 17 I'll have to make a decision - if the IRS hasn't made one by then.

Seems pretty silly to me.

It's all pretty silly. What's going on here will tax me twice: Once (or possibly more) in exchanges and again when I take it into fiat. I only have one thing to say about that; What the fuck!

Its really very saddening that most countries are looking at the option of taxing crypto but have not come up with viable and simple methods of how they are going to do it. Its not in Australia but countries like Uganda my home country are looking at various ways of how they can tax crypto. Thank you for the deep discussion about crypto and its taxation.

Agreed, but it is currency, an asset, and so is always going to be taxed; certainly here in Australia. You know, if I buy a watch then sell it for a profit the profit is taxed. It's the same for a car, shares, gold and silver...Its all taxed...Unless one wants to break the law and circumvent it. So, crypto is taxed in various ways to ensure the government get their piece of the pie...As always.

Ugh. I still have no idea how it's done in the US, either.

Ugh.

It's a bit of a nightmare for sure, and one that can't be ignored forever.

Bummer. 50%?! Is that your tax rate?

My accountant in the US, two years ago, seemed to feel confident that I would only experience a tax event if I exchanged for fiat. Which I doubt I will ever do. I wonder now though. What if I buy something tangible with it? hm...

No, not at all. It was a comment based on what I would be happy to pay on my crypto holdings I draw down into fiat. The tax situation here, as per this post, is complicated and unclear; that's what this little rant is about.

That's the thought I've always had. It seems that's incorrect though, here at least.

I'm not taking my crypto to the grave and have no children so I'll be using it. I have factored it as part of my income when I don't work any longer.

That's stitched up here too, using crypto to make purchases.

This post has been manually curated by @steemflow from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share 100 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Yes, your Bitcoin, Ethereum, and other cryptocurrencies are taxable. The IRS considers cryptocurrency holdings to be “property” for tax purposes, which means virtual currency is taxed in the same way as any other assets you own, like stocks or gold.

However, to be accurate when you're reporting your taxes, you'll need to be somewhat more organized throughout the year than someone who doesn't have investments. For example, you'll need to ensure that with each cryptocurrency transaction, you have a log of the amount you spent and its market value at the time you used it.

Hmm, yes I sort of know all this. Thanks for your comment though, and good luck with your crypto holdings and tax liabilities.

I found the coinspot exchange crypto and tax info helpful. Bottom of there main web page under learn if your interested. No log in necessary.

My unqualified personal interpretation is any upvote rewards might be considered as gifts from within a loyalty program similar to flybuys or Qantas frequent flyer rewards and all hopefully not taxable. Maybe this wishful thinking but as you say they might have to come up with some clearer rules that hopefully only effect future earnings.

Lol, good luck with your gift paradigm. I think you'll not get away with that although I hope you do.