I have been watching with interest the progress of WHIVE and opening up the new possibilities this offers HIVE. Today, I decided to dive down the rabbit hole and get involved. Having no idea how, and having never used Uniswap before, I read a few posts and tried to get my head around it.

First step - get some WHIVE.

- I reinstalled my dusty old metamask account that I haven't used for ages. (in crypto land I think ages means over a year...)

- I had some HIVE in my account I had planned other things for, but have used for this instead.

- I visited the WHIVE website

- I turned my HIVE into WHIVE (a bit over 400)

- To learn more about this process see this post from @fbslo

Step two - visit Uniswap

- I stumbled around for a bit before I managed to link my metamask to uniswap. Can't remember how I did it in the end, so can't show how to here.

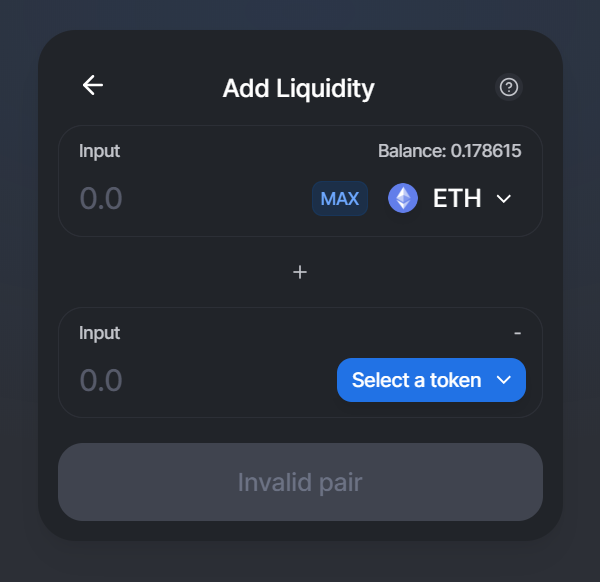

- I then stumbled around trying to add liquidity, but the dumb interface kept asking me to use a list. Couldn't find WHIVE. Lost...

- Come back to Peakd and search for more WHIVE posts.

- Find this post from @lordbutterfly and read in the comments about https://uniswap.info/account/ - thank you @brianoflondon

- Stumbled around for a bit more and then figured out how to add liquidity. There is a helpful little "Add Liquidity" tab on the info page for the WHIVE-ETH pair

Need a matching amount of ETH.

- I realise that at this point, to become a proud Liquidity Provider I need to have a matching amount of ETH - to the value of my new WHIVE.

- I scrounge around and gather some ETH up.

- I buy a little more from Coinbase (ugg - It's still my easiest and quickest fiat onramp)

- I gather it all together in my Metamask.

Ready.

Liquidity is provided.

- It worked - 0.15 ETH and 230 WHIVE, added by me to the Liquidity Pool.

- I had more WHIVE, so figured i'd swap some to ETH so I could add it also.

- Worked out how to do it, and swapped some WHIVE for ETH (which uniswap did via DAI for reasons unknown to me???)

- Made a second deposit into the LP of 0.04 ETH and 63 WHIVE

So, I have no idea how much (if any) fees I will receive for contributing to the WHIVE-ETH LP. My share at the moment is currently 0.19 ETH and 300ish WHIVE.

My new life as an Liquidity Provider has begun.

Cheers,

JK.

Posted Using LeoFinance

I shared this post to twitter

#posh

Posted Using LeoFinance

So how do you theoretically get paid for adding liquidity to the market?

Posted Using LeoFinance

I think those that add funds into the pool receive their proportional share of the fees. Not miner fees, but transaction fees received by the pool.

I'm learning by doing here, @khaleelkazi knows Uniswap better than me. This was my first try today.

It's exactly like you think.

I am salivating...while I withdraw all my liquid HIVE to meet expenses, you got some 400 HIVE to play around in DEFI as a liquidity provider... good you ave that kind of money to be able to afford to do that...

and chills man... how much were the fees for the swap...was it 20$ - 50$ what, how insane was it...the fee amount only is something I withdraw from peakD to meet my expenses, every 2 weeks...dash it!!

Hey sorry mate I didn't mean to upset anyone with the amounts. It's strange because while most people's 2020 sucks, I'm personally having a great year (money wise anyway). Spent the last 13 years living week to week with a mountain of debt. A lot has changed in the last 6 months.

Most of the ETH gas fees were around 3 or 4 dollars. The crazy big ones have only been on certain types of transactions as far as I know. I have not seen any. None of what I'm doing here is urgent, so if I see a fee I don't like I just cancel the transaction and try again later.

All the best mate, I'm sure that the wheel will turn for the better for you soon.