There is an old saying if you think of it and believe in it then it will come true. Vice President Pence praised President's Trump great work in getting 3 million people jobs, yet he neglected to mention over 30 million lost their jobs in the same period. Then there is Larry Kudlow say the US economy is in a V shape recovery that is very similar to the stock market. The tragedy though is main street is damage beyond repair. Thousands of small businesses gone and millions waiting in line at food banks. The grim reality is not what those politicians are saying.

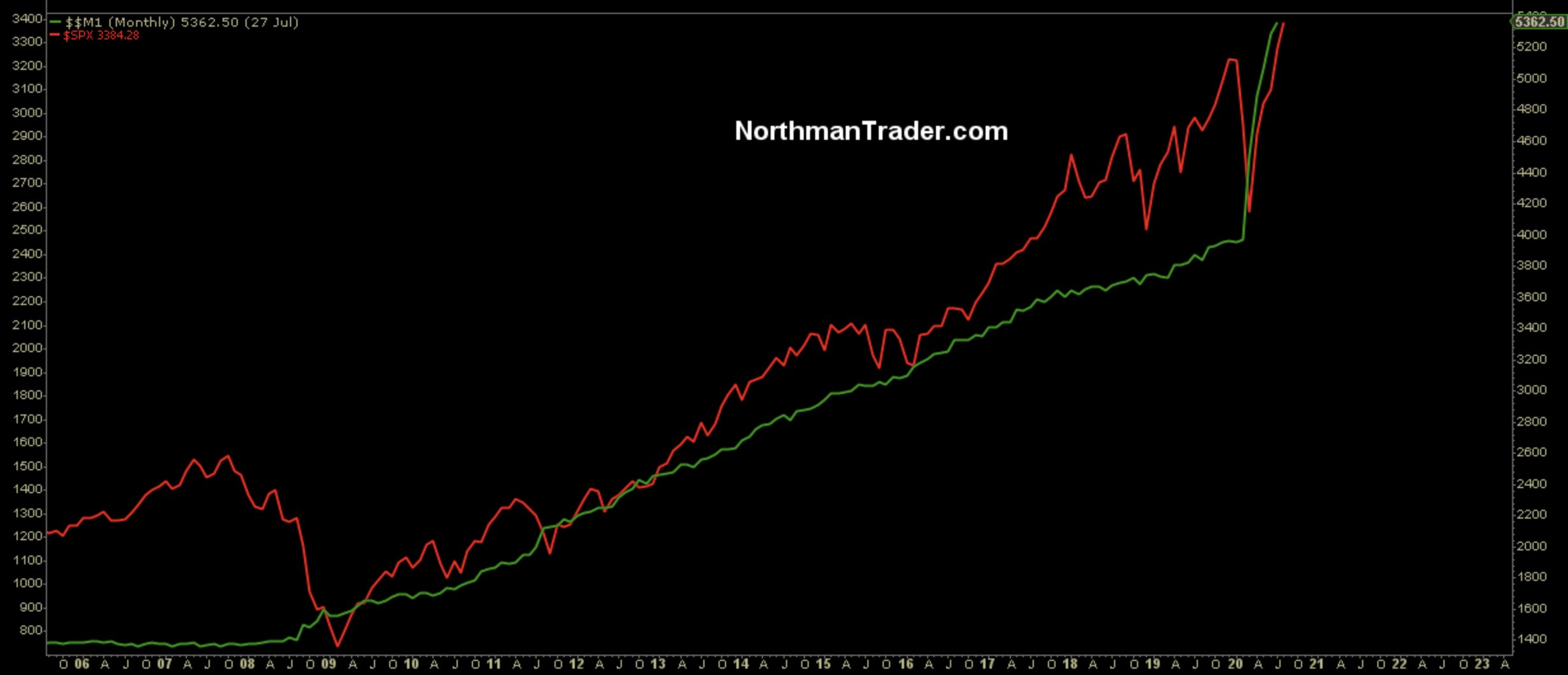

So what is really behind this stock market optimism. Here is a good example, the QE and Repo on to of the government stimulus has done this much to the markets. Obvious it can not be a coincidence the money M1 is running in parallel with stock index SPY.

Then there is the truth behind the higher spy number. On the ratio of equity versus worth of the dollar the market is currently equivalent to 2015/2016 value. That is the green curve in the chart below. Basically SPY is at all time high numerically but the actual money value is worth that of 2015/2016.

So all time highs in the markets do not represent higher real returns. Think about that for a moment. In other words the actual equity price increase over the past decade is not enough to offset the dollar weakness.

Oh well maybe if I believe in what the government is saying things will come true?

Posted Using LeoFinance