Can't decide if you should stake your ONEUP or provide liquidity to a pool? This post got you covered. In this post, we will be comparing the APR of these two options, and look at the advantages and disadvantages of each.

Let us start with Liquidity pool!

Liquidity pool (LP)

If you are not yet familiar with ONEUP liquidity pools, you can easily check these out here.

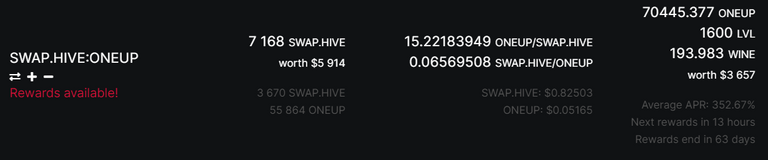

ONEUP Pools APR

As of writing, both ONEUP liquidity pools offer a triple-digit annual percentage rate (APR). The current Average APR for the pools are a whopping 349% and 353% for ONEUP:SPT and SWAP.HIVE:ONEUP, respectively. What an awesome potential return just by providing liquidity to this pool.

Before jumping in, it is important to understand first the advantages and disadvantages of adding in LPs.

EDIT: For more information and clarity regarding the ONEUP liquidity pool rewards, I highly recommend reading flauwy's comment below.

Advantages of LPs

- You can remove your tokens anytime you want.

- Unlike in staking where you have to wait for the unstaking process to finish, you can easily remove your provided liquidity anytime that you want and get your corresponding tokens.

- Little to no time commitment

- With liquidity pools, your share of rewards are automatically distributed to you on a daily basis. The only time that you need to spend time in LPs is at the initial stage. Other than that, no time investment is needed on a regular basis. This is great for those who don't have much time to spare for curating contents.

Disadvantages of LPs

- Currently has a lower APR compared to staking

- What? There is a higher APR than 349? and 352%? Well yes, staking APR is higher if you curate contents consistently. You can see this computation in the next section.

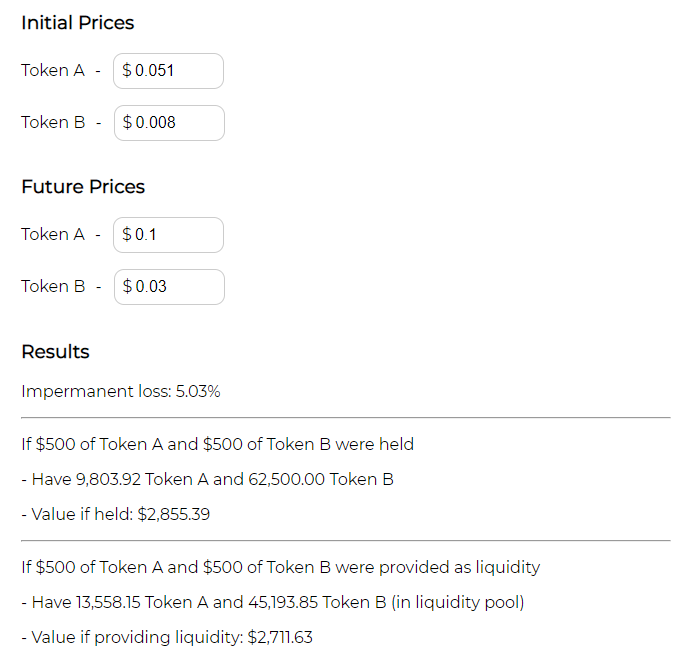

- Risk of impermanent loss

- Providing liquidity to LPs will expose you to the risk of impermanent loss, which is caused by larger changes in the token price compared to when you added them to the liquidity pool.

For better illustration, here is an example of an Impernanent Loss calculation with the current price of 1UP (Token A) and SPT (Token B) as the basis:

Source: Impermanent loss calculator by Daily Defi

Of course the future prices in the calculation are arbitrary. Feel free to play with the figures in the link attached above.

- Your share of pool rewards fluctuate based on the amount of liquidity in the pool.

- Since the rewards are split among the liquidity providers, if the pool gets more liquidity, we can expect our own share of rewards to gradually decrease. This is assuming that we just maintain the initial share that we have.

Staking ONEUP

For our next part, we have Staking ONEUP and curating ONEUP contents consistently.

Curation rewards

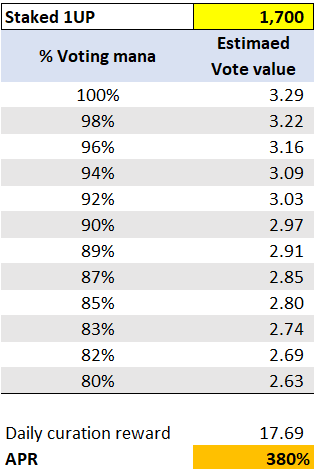

For this illustration, we used a Staked ONEUP of 1,700 as our basis:

Note: The Daily curation reward indicated in the table pertains to the corresponding curation rewards for your upvotes that day. Note that you will not be able to get these rewards right away. The timing depends on the post payout.

For a 1,700 Staked ONEUP, you will be able to get a curation reward of ~17.69. This is assuming that you will maximize your Voting Mana everyday. If we get to do it consistently, this now gives us a whopping APR of 380%.

That's huge! But what are the advantages and disadvantages of Staking ONEUP?

Advantages of Staking

- Opportunity to reward great 1UP content with your own votes.

- I have always been a fan of rewarding quality posts in Hive. So this advantage is a huge plus for me. My vote might be a small incentive for the author, but it will still add up and hopefully motivate them to continue making great content that can help the 1UP community.

- Higher APR if you maximize your daily voting mana.

- Maximizing your daily voting mana means curating posts on a daily basis. In the illustration above, we opted to stop voting at 80% to have a full 100% voting mana after a day.

- No risk of ending up with less 1UP tokens unlike in liquidity pools.

- If you are extremely bullish on ONEUP and you don't need it liquid, it might be a better to idea to stake instead of adding to the LP. This way, you won't be exposed to the risk of ending up with less ONEUP once you remove your provided liquidity.

Disadvantages of Staking

- You would not be able to convert your staked ONEUP immediately should the need arise.

The entire unstaking process is done in a span of 1 month, with 25% of your processed tokens becoming liquid each week. This means that if you plan to unstake a 1,000 ONEUP, you will get 250 liquid ONEUP each week in a span of 4 weeks.

This is a major disadvantage if you plan to use your ONEUP tokens in the near future.

- Varied payout timing compared to LPs.

- Unlike liquidity pools that give a regular daily payout, curation rewards varies in timing. This might be an issue if you prefer to have an expected liquid ONEUP on a daily basis.

Final Thoughts

My game plan is to maintain my current exposure in the liquidity pool, and only add when my share in the pool is going below 1%. Other than that, all of the liquid tokens that I will get are Staked and used to vote for awesome ONEUP contents. Since I love reading posts about NFT games, I don't have a problem with curating contents on a regular basis.

I would adjust this strategy if I suddenly find out that the time commitment is quite difficult to maintain for me or the liquidity pool suddenly becomes much more attractive. Who knows, maybe we will eventually get a Daily Bonus reward in the ONEUP:SPT LP or another token that I love is added to the rewards pool? Until that time comes, I will continue to focus on increasing my Staked ONEUP.

There you have it! Thank you for reading this far. I hope you all enjoyed this post. Let me know in the comments section if there is anything that you'd like to add or discuss about staking and liquidity pools.

CREDITS

Screenshots from certain websites are noted within the post.

Cover photo made in Canva.

Awesome APR comparison. The LP will change in 60 days. We will add more pools and include time bonus. Theoritically APR should be higher for the pools but the way rewards are paid is somehow unintuitive. We have 6500 ONEUP inflation for pools each day - where are they? Look at any pool with rewards, they are not paid out entirely but stack up in the reward pool. I read that it takes 180 days until rewards are paid as intended but might have been gossip. Will there be a massive payout at the end to empty the pool?

Thank you for the additional information Flauwy. It seems like I would have to closely monitor the respective APRs adjust my strategy accordingly. I was not able to factor in the 6500 ONEUP inflation and the time bonus after 60 days.

Quick question for clarification regarding the pool:

I'll have to research more on the stacking of the reward pool and potential massive payout at the end.

Will edit my post to link them in your comment. I do not want the readers to rely solely on the APR computation shown above, without factoring in the information that you've mentioned. Thank you again Flauwy!

I'm basically doing it the other way around. I'm just adding daily to the pool (ONEUP/SPT) and then staking whatever is left over. I'm getting a lot more ONEUP than SPT so I cover the full amount of the SPT and add it to the pool and then stake the leftover ONEUP. My pool amount doesn't go up very quickly this way, but it keeps rising every day. Kind of fun to watch. Like anything else, I feel that if I do this consistently, the rewards at the end will turn out to be pretty substantial. Nice writeup!!

I agree that it is so fun to watch! I remember the bliss when I am stacking up on my ONEUP:SPT pool, it's quite fulfilling to see that % share go up :)

Btw, you might want to double check if you get the rewards from the pool the day that you added more liquidity to the pool. @failingforwards mentioned in the 1UP discord that you won't get the payout for the day that you added to the pool. So it's worth checking out if you're still getting the respective rewards especially that you add to the pool daily. You'd not want to miss out on those sweet sweet ONEUP rewards!

I can't check from my end since Hive Engine don't provide the historical payout for pool rewards, it's annoying..

Awesome post! I too realised that the curation rewards from 1UP add up quickly! So it's consistent with your calculations. 👍

Congratulations @mozzie5! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 7000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Great work! I didn't even know that if Ill use my vote power properly ill can get more rewards. But also I have to spend my time on curation. I think that pools are really interesting but many ppl can lose money if spt will drop