It's that time again and we're talking all things LEO, Cub, PolyCub and more on the WenSoon Show.

What about Cub?

So we led the show talking about CUB and the PolyCub features that will be implemented on cubdefi. The V2 Vaults are on the board which will create the buy and burn scenario for cub. On the flipside, protocol owned liquidity is currently not planned for Cub.

Buy back and burn does have its definitive purposes as it permanently removes supply from the equation as opposed to a protocol that purchases and redistributes.

And we discussed how each of these impact whether it makes sense to cut inflation rates. For the buy back and burn model, cutting inflation may not really be a net positive, for instance.

Cash Flow Life

This has become a term in crypto, especially in the curve community. That is a motto I try to live in life generally, but if I can do some from just crypto let's have it.

Essentially, this is the environment is the leofinance team is looking to build between all of the platforms.

Neal also pitched an interesting idea where we have cross platform buying to keep all the different defi coins in the same value range. So instead of an imbalance in POL going to purchase that specific platforms coin, it goes and purchases one of the sister coins.

Also, I make no promises I correctly recapped Neal's idea. I may have butchered it.

Collateralization and more....

Collateralization is in the works still, not idea on the Khalendar but exciting nonetheless.

Also, there was chat about an option to lock xPoly for two years that gives the holder additional governance power.

LeoFinance Community Pages

"Hold up, Heeeeeeey" there needed to be a lightning update, so communities have been rolled back to the Alpha page and pulled from production. There is tons of beta testing going on and if you want to use the alpha page to be a "tester" use this leofinace link: https://alpha.leofinance.io/thorchain

More about it in this post: https://leofinance.io/@leofinance/leofinance-community-pages-or-become-an-alpha-tester

Rumor has it we are a few days away from redeploying to production as the current bug list gets widdled down.

Spread the LEO word!

The area I live in is a very crypto active area, so there is one or two crypto related meetup or gathering each week.

Not only are these opportunities to get AFK and socialize IRL, but it is a great chance to spread the word of LeoFinance and introduce people to the coolest finance related Web3 platform.

So my call to action for all the leo lions is to get out there and be social. If you are in the U.S. you can find local meetups using meetup.com.

LeoGrowth Update

The @leogrowth account is desired for exactly what the name says. The most recent initiative is LEO Power Up day. This is the first month of it and there are three winners each month.

Each winner gets a 20K delegation for three weeks.

All the info is in this post: https://leofinance.io/@leogrowth/leo-power-up-day-is-now-a-thing-join-and-win-a-dolphin-size-delegation

Elsewhere, there is an ambassador program coming where people are focused on brining people into leo and spreading the word. The focus will be on bringing in other communities to build up the community pages.

Delegations to ambassadors I believe is what was mentioned, but you can find all the details here: https://leofinance.io/@leogrowth/leo-finance-ambassador-program-are-you-ready

And other remind stuff...

At this point we stumbled into general economic chatter.

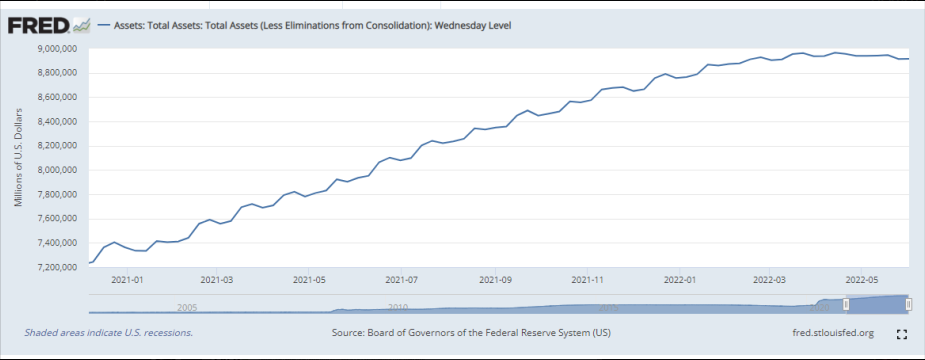

The Fed's balance sheet really hasn't shrunk despite all the chatter that this is what they are doing. Thus far it really hasn't been a factor, though the initiative is still out there.

With this said, total liquidity isn't being reduced which means prices of things cannot go down, which Neal alluded to in his chatter about this.

He dropped this chart showing liquidity isn't growing but it also isn't going down...

Inflation, inflation, inflation....oh my. We chatted about inflation and the impact and factors of it.

Stagflation is when the economy is stagnate and inflation is high, which is different than inflation where you have both.

Also, we touched on debt and the point where revenue doesn't cover debt payments everything is F'd. The U.S. is not there yet and honestly has some ways to go before getting there, but it doesn't mean the debt situation is pretty.

That's a wrap!

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the people sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Thanks for the recap @scaredycatguide!

Here's my tiny contribution to spreading the word on Leo Finance and doing what I can to generate discussion and learning:

https://mobile.twitter.com/AGNochez/status/1533856159710470146

Posted Using LeoFinance Beta

Awesome! The power of word of mouth

Posted Using LeoFinance Beta

I couldn't be myself if I didn't ask wen blank... :)

Posted using LeoFinance Mobile

Pretty much figured we where in stagflation which is the worst of the worst. All I know is CUB, PolyCUB and LEO all looking like great options at these prices ;)

There is a liquidity crisis in the USD. This is evident by the fact that IR swap spreads are expanding, the USD on the exchanges is increasing and the demand for safe assets.

Here is the point missed:

Fed Liabilities are not legal tender

To pose otherwise is misleading the Fed does not print USD, that is the responsibility of the commercial banks.

But if we are going to talk about the reserves, what the Fed really does print, they are down about $500 billion in 2022.

Then we have the reverse repo hitting an all time high.

None of this screams a liquidity. In fact, it is the exact opposite, the financial system is suffering from a lack of collateral. This means everything, including bank lending tightens up.

Posted Using LeoFinance Beta

Congratulations @scaredycatguide! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 280000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Nice recap! When we spend more than we make... it's a simple recipe for disaster!

Ray Dalio makes a good argument to the patterns pires go through as they rise and fall. Here's one I wrote about last week: https://leofinance.io/@senorcoconut/making-sense-of-the-next-world-order-are-we-already-in-world-war-iii-and-haven-t-noticed

It's anout placing ourselves in the right spot for that part of the story!

Hey so what does testing out the communities rake?

Posted using LeoFinance Mobile

Not sure what comes from testing communities, I don't think anything outside of people that just want to create a better user experience for themselves. The ambassador program I believe has benefits.

Posted Using LeoFinance Beta

Ok thanks, I'll have to look into the ambassador program... but like I said I have so much on my plate, I don't think I have time to take something on like that. Maybe during the winter

Posted Using LeoFinance Beta

Does that mean that each protocol will have only one general POL? (Talking about Neals idea)

Also,....I really desire to be in a location where crypto is more adopted and there are opportunities of meetups like in your area. I could of so much use than I am now.

That would be pretty cool, but I don't think its gonna be a thing. Seemed more just like a random thought or idea.

Yeah I'm spoiled in FL with meetups

Posted Using LeoFinance Beta

So.... sit on my cub and just.......... wait.

And glad to know the fed can still cover its debt payments.

Posted Using LeoFinance Beta

I love these short summaries. They are very helpful for the times I miss out on those long AMAs. Please continue to make these recaps if you can.

What I'm most waiting for is 2 year xPOLYCUB lockup and collateralized lending.

!PIZZA

!LUV

Posted Using LeoFinance Beta

@scaredycatguide, @vimukthi(1/1) sent you LUV. wallet | market | tools | discord | community | daily

wallet | market | tools | discord | community | daily

PIZZA Holders sent $PIZZA tips in this post's comments:

@vimukthi(1/5) tipped @scaredycatguide (x1)

Please vote for pizza.witness!

Thanks for the recap @scaredycateguide

Posted Using LeoFinance Beta

Love this category cat:

Posted Using LeoFinance Beta

Not in the U.S. they are not. I'm about to raise rents on a couple renewals (and need to with costs soaring)

Posted Using LeoFinance Beta