Wrapped Leo is special

You see wrapped Leo has an unfair financial advantage over other ERC20 Tokens world of

I read a post by @pouchon and in between the lines I saw questions about what does this mean for Leo and Hive?

Then I realized that Leo and Hive are not singularly affected. I think wrapped Leo Ethereum pair is unique because for the majority of the swap pairs on Ethereum the investor needs to buy both tokens, then deposit them.

But the wLEO-ETH pair changes that dynamic

Investors don’t have to buy Leo, they can blog for it, send it to www.wleo.io and change it to wrapped Leo. Then deposit it into the wLEO-ETH liqquidity pool to yield farm.

They save the money/capitol they would have invested in Leo and can use it for Gas fees (transaction fees) on Uniswap/Ethereum.

Blogging for Leo to save Ethereum

Investors can blog here and literally turn their words into Ethereum.

Unique thing number two

The wrapped Leo pool is literally a great reason to move your Ethereum out of your Hodl wallet and yield farming because it has great yield farm incentives.

Wow blog for one half of the pair and profit from great incentive yield bonus awards....

I don’t know about you, but I smell something special in the air... it smells like success.

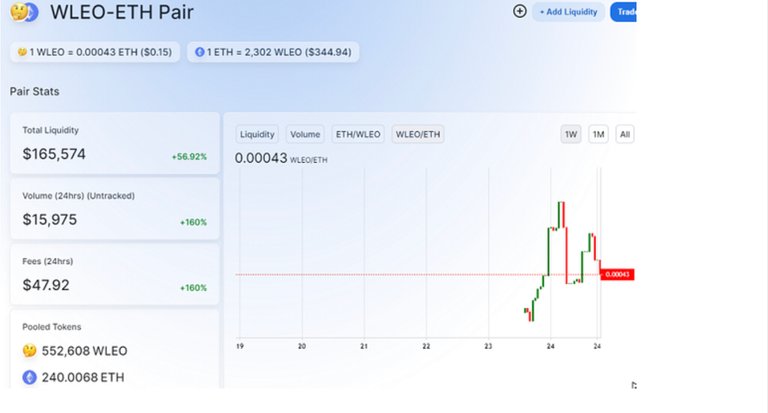

We can see wrapped Leo has passed the magic threshold of 100k in liquidity and is generating decent rate of return, reported at 16-17% by one of the primary investors.

100k

Posted Using LeoFinance Beta

Great point. Ethereum now has access to a yield farming coin that can be harvested in 3 different ways. upvoting (stakeing), blogging & posting, and Uniswap fee-farming.

This is a pretty unique situation, because now Uniswap is our best exchange by a huge margin (say x1000) if one plans to any trade enough volume to justify the $5 gas fees. Smaller purchases can easily be made on HiveEngine.

Sounds like the basis for your next post. 😁

Posted Using LeoFinance Beta

I agree!

An interesting situation would be to create a Uniswap or MakerDao on Hive, with wrapped Ethereum conversion facility somehow connected. Then investors would experience fast free transactions while depositing wrapped Ethereum-hive pairs in that trading pair on “hiveswap”.

Posted Using LeoFinance Beta

Thanks @shortsegments! (:

Yes, having the option to choose whether you want to stake LEO or trade it for Ether is very attractive.

I personally don't have much Ether at all and would like to obtain some.

Posted Using LeoFinance

This may be your, you can create wLEO and then swap it for Ethereum!