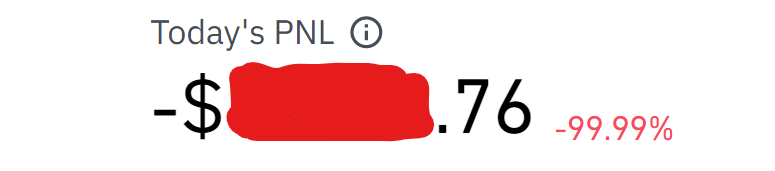

Binance has a handy profit and loss metric, here is mine for the last 24 hours:

That is not a good result and I feel like a fool. For the last few weeks while Bitcoin has been pumping and then the GameStop pump, I have read articles from the mass media and the constant warnings that said "you can lose everything" - I thought it was FUD. I should have listened.

But looking at that loss it is painfully obvious where all of my value went.

To the 0.01 percenters....

Ok, in reality, it is a glitch on Binance and it will be corrected soon enough. I don't care much about this metric overall, as what I focus on is my crypto holdings, not the equivalent in Fiat.

The other day, a friend at work was commenting on how he didn't get why people would put their money into Bitcoin or crypto, as it is nothing at all, just some zeroes and ones. Putting it in the bank is much safer as it is something real.

Fiat money is a currency established as money, often by government regulation, that does not have intrinsic value. Fiat money does not have use value, and has value only because a government maintains its value, or because parties engaging in exchange agree on its value.

wikipedia

Seems safe to me, no room for abuse in there.

It is interesting to listen to how confident some people are about their view on the world, without actually ever having thought much about it at all. Most of what we learn comes culturally and we never really review or question it, because it seems natural, because it is familiar. It is no different to being indoctrinated into a cult of some kinds from birth, where no matter how much of a mess it is, it feels normal. It is only when there is a wakeup call that there is the chance to have a slightly more objective look at what is actually going on.

What I think is slowly happening is that like the reading on my account, the 99.99% are starting to awaken and realize how heavily in the the red they are. Generation after generation is having their value bled out of them, to the benefit to the benefit of the 0.01%.

But it isn't their fault, it is ours.

We have created a system where money buys power and with that power it is possible to change the rules of the game. A company that reduces its tax burden through loopholes isn't doing anything wrong, they are playing the game as it has been designed. A billionaire who donates to political parties to get favors is playing the game too. This is a game that we support, because even though there are options, we stay dormant, so the transfer of value keeps happening.

In a comment I got the other day, someone said that people want to invest into LEO because it is profitable, they are thinking long term.

No, they are thinking mid-term, because they are looking at it from a profit perspective, meaning that they are actually looking to sell what they have and likely move into something else. Long-term thinking isn't selling, it is building conditions where value can be generated as an owner.

This is something that might be culturally learned as well, where people think that someone has "made it" when they are rich, but I think someone has made it when what they have created is able to keep generating value indefinitely. Yet, we are very quick to sellout, given the opportunity.

I wonder how many offers Bezos turned down for ownership of Amazon over the years. What would have been a fair price - A million, a hundred million, a billion? I wonder at what point he would have sold in 2000, or 2008. However, selling is far easier than taking the risks of the markets and facing ruin. Most people take the bird in the hand approach to life - sell now, as tomorrow the opportunity might be gone.

But, for those interested in building over profit, it isn't a good enough deal to take market value while in the build phase, especially if one believes in the product. For most of the real builders, they have taken many risks to get to where they are, sometimes it is close to all or nothing to make it through, to cover debts. Yet, they roll the dice. Why?

It is hard to say for each individual, but I think it comes down to personal hierarchy of what is considered important. Yes, I am sure they enjoy making the money, but that tends to be a buy product or tool for their real purpose, whether it be a love of competition, the desire for status or, the belief that what they offer the world is valuable and too valuable to sell away and entrust to others. There are likely many reasons, but it seems that the money itself is not one of them, otherwise they would be hoarding all of that beautiful fiat that they make... but they don't.

I think that the media has positioned the "rich", poorly in the psyche of the masses, as they talk about wealth from the perspective of money. A few days ago, Elon Musk and Jeff Bezos were dueling it out for the title of richest in the world, each with around 182 billion dollars to their name...

No.

Neither of them have anywhere near that amount, what they have is wealth, the ownership of products currently worth 182 billion dollars, with most coming in the form of shares. If either of them needed that 182B today, they couldn't get it and even if they tried to sell their stocks, they would collapse the value of their own stock heavily - as they are the largest fish in the pool and when whales dump, everyone gets dumped.

While this seems obvious to most, what many do not consider is that the wealth they have is not in dollars at all, it is in what they own and what maintains that wealth is their ability to keep what they own generating value. Bezos with Amazon keeps building market share and reducing costs anyway he can, Musk keeps building innovative products and being a cheeky bugger on Twitter to keep the hype rolling. But, they have to deliver - because when they don't, the sentiment in the market turns against them and they can lose their value quickly.

Though, neither of them will ever go hungry, because they own more than stock. They have diversified their portfolios in the same way that the profits a bank makes from selling access to customer funds and charging for the privilege, get used to invest into other profit making ventures.

Think about that scam for a minute - give the bank money, they make money off that money and use that money to buy for example into a business, then convince you to use more of your money to invest into the business that they have just taken some ownership of, charging fees for the management, as well as taking the benefits of having value stack on top of their own. Before it winds down, they will be able to exit their ownership, while leaving you to hold the bag.

But, what it is all about is ownership. It doesn't really matter what is owned, as long as it either maintains value and grows at or higher than the real rates of inflation, or will grow as an investment that generates an increasing amount of wealth, like the ground floor of a successful startup. A bank doesn't invest any money with the intention to lose it, and it invests everything it can, with far better data than most other investors, because they give loans to people who don't have money and know what that money is going to purchase.

I wonder, when they were lending the money to buy the houses that led to the global financial crisis, how much did they have invested into the goods and service industries that went into the building and maintenance of the houses. I would be very surprised if they were only planning on getting the stream of value from the loans themselves.

because we have been programmed into believing that wealth means money, we tend to give up the potential of our value in order to chase and even hold fiat. Not only this, while the investment firms are investing 100% of what they can into what they believe will make money, we are encouraged to spend as much as we can on goods and services (that they have invested into) that only lose money.

You want to buy the latest iPhone on Amazon?

Largest Amazon Shareholders

Humans:

Jeff Bezos - 55.5 million shares, representing 11.1%

Andrew Jassy - 94,797 shares of the company, representing 0.02%

Jeffery Blackburn - 48,967 shares of Amazon, representing0.01%

Institutions:

Advisor Group - owns 35.4 million shares of Amazon stock, representing 7.1%

Vanguard Group - owns 33.0 million shares of Amazon, representing 6.6%

BlackRock Inc. - owns 27.0 million shares of Amazon, representing 5.4%

Largest Apple Shareholders

Humans:

Arthur Levinson - 1,13M shares of Apple stock, representing 0.03%

Tim Cook - 847,969 shares of Apple stock, representing 0.02%

Al Gore - 113,585 shares of Apple stock, representing less than 0.01%

Institutions:

Vanguard Group - owns 336.7 million shares of Apple, representing 7.8%

BlackRock - owns 274.7 million shares of Apple, representing 6.3%

Berkshire Hathaway - owns 245.2 million shares of Apple, representing 5.7%

Who are you really buying from?

This is the value of ownership, this is looking long-term on investing. While we are thinking about profits so that we can buy a better life, they are building empires that will extract value from all of the sources we consume from and they know where that is, because they track everything we do -

Largest Facebook Shareholders

Mark Zuckerberg - 400M shares (about 57% of the total)

Vanguard Group Inc - 184M shares (about 25% of the total)

BlackRock Inc - 158M shares (about 20% of the total)

Largest Alphabet (Google) Shareholders

Larry Page - 40M

Sergey Brin - 39M

Vanguard Group, Inc. - 22.6M

BlackRock, Inc. - 20M

Do you understand yet? Is it starting to click?

It doesn't matter where you consume from, it is going to benefit a very small handful of companies that are going to use every bit of the enormous volume of data to which they have access, to extract all they can and then use that extracted resource to broaden and deepen their ownership reach. They aren't in it to find an exit, they are in it to have conduits of value extraction pouring through, endlessly. There is no beating them at this game.

The game has to change and the only way to do so is,

to own what we create to replace what we use, but do not own.

I hope you are starting to understand what looking long means.

Taraz

[ Gen1: Hive ]

Posted Using LeoFinance Beta

Yesterday I asked one anime reactor who I follow if he would be interested in joining hive. I said that he MIGHT or MIGHT NOT earn something and that I am not suggesting that he should buy any crypto or pay for something.I said that when I post something on facebook it likes and other reactions have no monetary value to me, and if he has any time to spare investing it into blogging might not be a bad idea... My comment got deleted REALLY quickly. I have no idea if he deleted it or if it was youtube. Either case this makes me sad.

Caveman me appears once again:Until reading this post I had no idea who those people are...

I have no idea, but a lot of platforms are not crypto friendly, because it isn't their crypto. If the person you are following is monetized, they might not want to risk upsetting their masters.

But you have heard of Tesla and Amazon?

Posted Using LeoFinance Beta

I see. that makes sense.

yes.

I think I have heard the names of Elon Musk and Jeff Bezos. But if someone asked me who those people are I would not be able to answer. Even after reading this I will likely put that information in some dusty corner of my brain and soon forget about it entirely. A bit like Tom Bombadil with the one ring.

Looking long seemed to be such an easy way to dedicate myself to this blockchain. Believing in the power of the people doesn't always seem like it will deliver dividends but the latest action has added some fuel to the fire.

Hive at almost the bottom with the sky as the limit may pay off yet! Until then, this is a hell of a lot of fun and learning is worth it.

I think that the payoff is important, but it should be a byproduct of making the world better. This is the problem with so much of the wealth generation today, it isn't connected to what aids society and once it is in the hands of the few, most are not going to use it to build a better world, instead, they use it to generate more useless, disconnected wealth.

Posted Using LeoFinance Beta

Good points "#ownership society". Most people have week hands and can't hold anything with value.

Consume is the first thing they want to do. New car, a new TV or whatever. Endgame will be the same with crypto too. The reason is simply that people don't hold.

The only things people hold onto these days is their sense of entitlement and feelings of victimization.

Posted Using LeoFinance Beta

What could possibly go wrong XD

completely unrelated you have "to the benefit" twice

I'm either very good or very bad at selling/quitting things XD I tend to hold on to things forever (I still have a couple of ancient forums kicking around on my server because people sometimes use them but I haven't been maintaining them as the time is better used elsewhere) or I will drop them with nary a second thought regardless of how much I've invested into it or how much I'm getting out of it at the time of exit ^_^;

That's my idea of looking long. I think for many "long" is an election cycle though XD

I will have to proofread later - I write in a flurry and type poorly :D

It is interesting that you mention the election cycle, which I see as a way to keep people feeling like they are part of decisions, but are actually being entertained. Just think, in the US, the election cycle starts about 2 years after the swearing in, so half a 4 year term is spent campaigning, the other half is spent changing what they last guy did.

Posted Using LeoFinance Beta

It still amazes me that some people believe their fiat is safe in the bank, never mind valuable. Do they even realise that most banks now have the green light to bail in if they mess up again? There are numerous examples across the would of banks taking their investors' (customers') money and hyperinflation when money became so worthless they moved it in barrows to buy a loaf of bread. SMH Nothing really has value unless we accept that is has value, which makes crypto no different to fiat, except that it isn't currently controlled by the government and banks. I'm still not sure that government won't try and take control of crypto if too many realise this.

Hmm, Vanguard and BlackRock seen to have fingers in every pie. I wonder who the humans are at the head of them. 🤔 I believe the wealthiest people on the planet are actually not named in rich lists.

They are already trying to take control of crypto, but if we are active, it won't be possible, as it will keep changing form outside of their abilities. Every corner they think they have trapped us, has holes in it.

I agree. Most of the wealth in the world is in the derivative market, which is 3x the size of all other value on the planet combined. Most of the derivative market is traded over the counter and as such, i tis unregulated. That makes the majority of the world's wealth also untaxable. Pretty interesting...

Posted Using LeoFinance Beta

So much wealth it's probably inincalculable by physical standards. If we didn't have the ability to keep it all in numbers on a computer, could anyone actually physically hold that kind of wealth?

Provocative and full of crystal-clear truth, @tarazkp.

We live in an enslaved world where the oppressed contribute to their own oppression, none-the-wiser to the true cost to self, to the whole, or to the generations that will succeed them.

I absolutely agree, the 0.1%'s game is not a winning one for anyone but themselves. It is built to sap every human of all value and leave them wondering just why they feel so molested. I love the topic you've written on for this in the past "Too Big To Fail..." At least, I think it was one of your posts...

Do you think it's possible for a large enough group of human beings to truly identify the problem and move together to fix it? Without massive control over social networks and all forms of media, I don't see it happening easily -- and unfortunately, it seems the same companies have control over those things as well.

They control the news we get, they control the messages we send, they control the content that's created, they control much of the 'advice' given, and everyone buys into it -- at least, in the main stream.

Maybe... just maybe... there is a fighting chance for some of us here...

Anyway, great post. Thanks a ton for that. I need to start getting back onto Hive again. Your post reminds me of that fact.

It is frustrating that we are also the key to the cage, but choose to knock our cup on the bars, begging.

I do. If you consider what happened on Reddit with GameStop, it proves that organization and targeting is possible. Now, decentralize the process globally on multiple platforms that are owned by the uses, including exchanges owned by the users, and what isn't possible?

It is time to take responsibility for our lot in life and clean it up.

Posted Using LeoFinance Beta

Oh yes! My email inbox was blowing up from fairy mainstream financial news outlets about Gamestop. They couldn't stop the momentum -- which goes to show the consumers (the 'us' conglomerate) still dictate power with our attention.

It is time to take responsibility for our lot in life and clean it up.

Well said. A great example, and thanks for the hope and encouragement -- as well as the word of exhortation. :)

I wonder how many people think "I am going to sell $100.00 of my fiat token for 455 Hive tokens., or think "I'm going to convert my fiat into crypto". It's nothing to think of people saving 10% of their weekly fiat paycheck for the future, yet to get people to save 10% of their crypto earnings to earn more crypto takes a very good hypnotist it seems.

Indeed, people have been brainwashed to not do what is in their best interest. Most people will never save the 10% of their income either and these days, 20% is likely not enough considering what is going on.

Posted Using LeoFinance Beta

Money is irrevocably broken. I'll use it when I have to, but I'll never try to stockpile it. If I could take out a second mortgage and drop it all into crypto, I'd do it in a heartbeat.

Owing dollars has never been less scary.

I have considered extending, but I have a high fear of debt, even though I carry some. Having said that, I could reduce my exposure to debt a lot, but choose to hold crypto instead.

Your one sentence tells it all: "We have created a system where money buys power and with that power it is possible to change the rules of the game." !WINE

Cheers, @fiberfrau You Successfully Shared 0.100 WINE With @tarazkp.

You Earned 0.100 WINE As Curation Reward.

You Utilized 1/3 Successful Calls.

WINE Current Market Price : 1.100 HIVE

Vanguard and BlackRock own a bit of everything!

Yep and they have plenty more fingers in pies. I wonder who the biggest investors within the funds are.

Posted Using LeoFinance Beta

The sad thing is that, by your friends definition, it isn't real, the money in the bank is only a bunch of 0s and 1s.

Further, its number kept by the bank, and only the bank, so one computer mess-up, and you have nothing.

PLUS! the bank is under no obligation to give you your money back!

It is a funny view of the world, isn't it? People don't think about it in this way as they seem to trust that they are protected by governments, without understanding how they work either.

Posted Using LeoFinance Beta

Ohhhh man, I feel like I should share this with some people off the hive...

This is a holistic view of wealth which is pretty rare out there though it may become more popular thanks to crypto and wealth disparity in the old system just becoming so ridiculously exaggerated. I make all my investments thinking about how to build systems that benefit myself and other people. It’s not about a dollar value except when that dollar value can buy something that I can make use of to improve those systems.

You really hit the nail on the head for why crypto is exciting for me. As things are, they’ll find a way to dominate this game too but at least some of their power has slipped out of their fingers and has reached people who may do great things with it

I think that when they try to dominate, there will be new opportunities opened up. rather than a closed system, finance becomes like the internet itself, a continual game between all participants. for too long, finance has been a game for the rich, to the detriment of everyone else involved.

Posted Using LeoFinance Beta

We humans are greedy and we are chasing ephemeral money. only to prove that we became rich and that we managed to catch the eye of others. In this way we think that we will gain value among the world and that we will stand out from the crowd. We cannot comprehend the supreme value of union achieved through the same belief in something.

We jump from faith to faith with the sole aim of making money. when for a moment we manage to cash in a little of this profit, we think we have succeeded and that we have found the solution where others can not find and are poor. Then we lose 99% of this profit and we are charged even more, but at some point we felt that we succeeded.

How funny we look!

FAITH => UNION = CORE = STRENGTH = WEALTH

Thank you for your article.

Friend, it is very unfortunate for me to read that this bad move of losing everything happened to you, I also lost more than 200 dollars in a very bad game and I felt too bad, it cost me too much to get up.

It was a UI glitch. I didn't lose 99%

What game were you playing?

strip poker

They took the shirt off his back

Oh dear

Is that the dark side of the force?

technically its the light side since he is parting the covers

@tarazkp

It happens...

I did this myself back in 2017 on the stock market into some crypto stocks that still has not recovered...

And still I sold many of them at -95+ to get the little that has there...

Most of the crap in 2017 won't recover - though there might be some pumps.

Posted Using LeoFinance Beta

Absolutely...

In the light of the recent events, i totally agree with you. we are making small steps in the right direction, but we are making steps at least. DEX, decentralized emails, decentralized share trading NFT, and so on. We will get there, even if it will take decades, or years. We have time. We are immortals. Ok, i got a bit too enthusiastic. But there is hope. RobinHood will understand when people move to FTX, Whatsapp will understand when people move to Telegram and so on. I think the biggest problem is that we do not have enough choices. When the alternatives will be available, the shift will start and it will be quite fast.

Gracias!!! Aunque no entiendo nada de criptomonedas usted hace un recuento de compañías y analiza como funcionan y lavan el cerebro para que la gente tenga miedo y no se arriesgue a usarlas y a documentarse donde y como hacerlo.

Seria deseable que para los nuevos nos digan donde leer sobre criptomonedas y su funcionamiento seguro.

Muy de acuerdo con usted miedo y mas miedo domina a la sociedad donde vivimos

FELIZ TARDE!!!

100% THIS.

HUMANS ARE FUNDAMENTALLY SUBJECTIVE.

BlackRock Inc. - owns 27.0 million shares of Amazon, representing 5.4%

BlackRock Inc - 158M shares (about 20% of the total)

BlackRock, Inc. - 20M

BLACKROCK EXPLAINED IN 10 MINUTES

Long-term thinking isn't selling, it is building conditions where value can be generated as an owner.

The essence of what somebody has to change in order to challenge the status quo is written right there. Consumerism without ownership is easy if you have a lot of capital. If you don't, it's just debt and pawning time for money