A liquidity crisis creates the ultimate FOMO. However, unlike the Fear Of Missing Out, a liquidity crisis is actually more powerful since it is based upon need. Whereas the former is a want, when a true liquidity crisis hits, things go bonkers due to a lack of supply.

This is applicable to most anything where the supply-demand equation is in place. With HIVE, we are going to see this take place at some point in 2022. There simply is no way to avoid it.

One thing we have to keep in mind is the utility associated with the token. There are some rather unique properties which make this outcome unavoidable. When we compare it to the rest of the tokens, we can see how this operates in a different manner.

Even though it is the governance token, the utility is what is going to cause the crisis. It is also why we will see the price skyrocketing.

Here are the three areas that are going to exert enormous pressure on HIVE.

Resource Credits

This is something we covered a great deal since it is so practical. It is also akin to what Ethereum (and others) is doing with their chain.

In short, both instances show how the ability to operate is correlated to the main token. On many blockchains, the token itself is required to engage. Hive, however, established a unique system utilizing Resource Credits (RC).

At the moment, there are changes that are being enacted to enable the delegation of RCs. This will not generate a secondary market yet does lead to more demand for HIVE.

The key is that Resource Credits are generated via the powering up (staking) of HIVE. Termed Hive Power (HP), this is the correlation which provides the ability to interact on-chain. Everyone needs some RCs on Hive. This is unavoidable.

Having the ability to delegate RC puts more of it to use. At present, to achieve the same end, HP needs to be delegated. Due to the curation system, this might not be as desirable yet is the only way to get newer users what is needed to engage on-chain.

This is going to have a tremendous impact upon those applications which start to attain any degree of success. Personally, the expected activity from #ProjectBlank by the Leofinance team is one that we can easily see requiring a lot of RCs. Microblogging ("Twitter on the Blockchain") is a very popular activity online.

Essentially, successful games or applications will drive activity, requiring more Resource Credits. Due to the link with HIVE, this will help to drive more demand.

Hive Backed Dollar

A lot of this was spelled out in The Road To 10 Billion Hive Backed Dollars (HBD). However, as we ponder the HIVE-HBD correlation, it only gets more powerful.

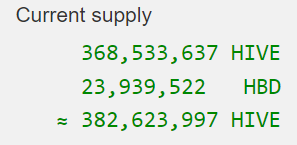

Let us take the present numbers to see what is required. Here are the present statistics from Hiveblocks:

Right now there are just under 24 million HBD in total. Leaving aside the idea of 10 billion HBD, even 1 billion is a big leap from this point. It is also a small amount for a useful stablecoin.

One of the ways that HBD can be generated is via the interest paid on savings. The challenge with this is not enough is produced. Even if every token put into savings (impossible since a significant amount is in the Hive Developer Fund) and the Witnesses decided to pay 100% interest, it would still take more then 5 years to get 1 billion HBD on the market. This mechanism simply cannot generate enough.

Therefore, the main way to get significant amounts of HBD into circulation is by converting HIVE-to-HBD. This means the amount of HIVE eaten up is going to be massive if we move towards serious HBD adoption.

We already see how things operating on a smaller scale, something that should be massively eclipsed in 2022.

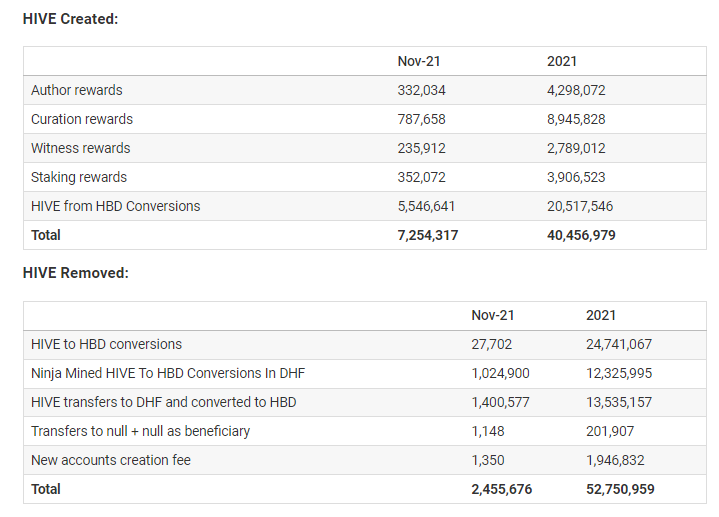

Here is a table put together in Hive Inflation And Supply For November 2021 | Is the supply increasing or decreasing?:

We can see the amount of HIVE on the market actually declined. This year, through the first 11 months, we also saw a great deal of HBD generated.

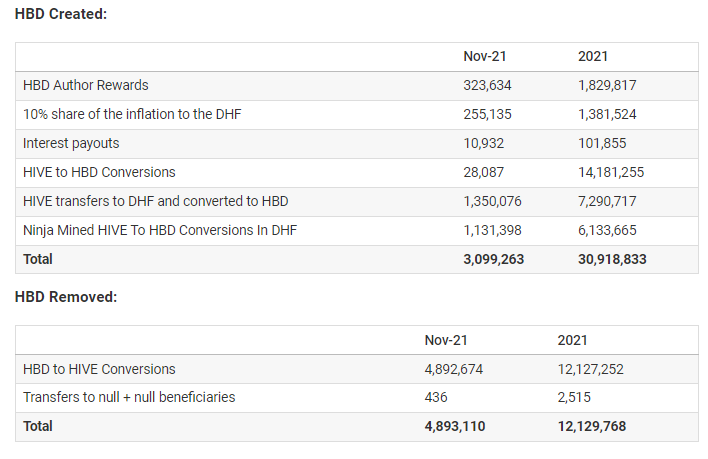

Here is the tables for HBD from the same post:

The net is just shy of 19 million HBD created in 2021. This is a far cry from 1 billion. What would the numbers look like if we progress down that path to create 1 billion tokens for an on-chain, algorithmic driven stablecoin?

Do not overlook how powerful the HIVE-HBD relationship is. This is something rather unique in the cryptocurrency world and not too many blockchains can 88enhance the value of the governance token by simply generating more of a stablecoin**.

Liquidity Pool

This is something that is, thus far, overlooked regarding the future of the HIVE token since it is not something that is presently being utilized. However, this is going to change in 2022 we see the entry of HIVE into a liquidity pool.

Before getting into this, it might be helpful to watch a short clip from the latest Leofinance AMA. The pertinent piece starts at the 42:30 mark. Here is where it is mentioned that LEO going into pools on different chains could encounter an issue since the supply is not that large.

Here we see another path where there is high chance of liquidity issues arising with HIVE.

We are aware of the road map of the SpkNetwork. One of the main features is going to be the Service Infrastructure Protocol (SIP). The basic idea here is to create an enormous liquidity pool for that ecosystem, using HIVE as the payment token for all miners and advertising.

While this is still in construction, the key takeaway is the more success the SpkNetwork has, the less HIVE that is floating on the open market. As more value is locked into that network, the amount of HIVE on the market will effectively be reduced. We know that tokens often go into liquidity pools and are left there if the return is strong enough.

The SIP is designed to utilize the value locked in the pool to generate returns that can help fund the expansion of the network (along with individual returns).

Massive Upside

As we can see, each of these shows the utility aspect of HIVE. Since this is more than just a governance token, its usefulness will be leveraged in a number of ways.

When we combine the totality of these three use cases, it is easy to envision how much HIVE could be eaten up.

Let us quickly recap:

- HIVE locked up as HP to produce more Resource Credits to facilitate the demand of on-chain activity

- HIVE converted to HBD, reducing the supply, to expand the amount of stablecoin available for commerce/DeFi.

- HIVE locked in a liquidity pool as a result of ecosystem activity on the SpkNetwork.

Some might wonder where is all this HIVE going to come from? That is a logical question if a couple of these start to become a reality. Obviously, the HIVE-HBD conversion is aided by a higher price in the HIVE token. In fact, this is required to reach even a minimum level to be a functioning stablecoin.

Where will this send the price of HIVE? This is, of course, anyone's guess. However, when we look at the expansion that is taking place within the HIVE ecosystem, it is easy to see how a liquidity crisis can evolve. When this happens, demand simply exceeds supply to the point where people start to accumulate no matter what. In many ways, they simply have no choice.

For example, if there is a massive amount of HBD creation, this will reduce the amount of HIVE available. In spite of this, applications still need the HIVE to get RCs for their users. This means they are buyers of the token, no matter what the price.

Reduced supply coinciding with an increase in demand tends to mean only one thing: higher prices.

There is still a lot of "chicken or the egg" to this. We need to look at this in totality which leads to one factor being dependent upon other ones. For this reason, continued effort in a multitude of areas is required. Nobody has a magic wand that will instantly align everything to reach the end described in here. However, with each step forward, even in a small way, it enhances one area which have an impact elsewhere.

Over time, we will start to see all this coming together. Personally, with some of the road maps already out there, the path is evident along with the timeframe.

We are going to see massive changes in 2022 as some of these pieces roll out. It is inevitable.

Therefore, do not be surprised if, at some point, the price of HIVE starts flying.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

It's going to be interesting to see how the liquidity of HIVE will be. I know RCs are going to be an issue if we ever onboard a lot more users and each one of them will require some resource credits. Though RC pools might come out and solve it, I don't know just how much RC we can give out before that pool runs empty. I guess any app developers might want to stock up on HIVE before any supply issues happen

Posted Using LeoFinance Beta

The RC delegation is going to help a great deal. There are a ton of RC not utilized on a daily basis by most account of any decent size. I would surmise anyone over 500 HP does not use all the RCs he or she has on a daily basis.

That said, you are right, if we get big numbers in terms of users, all commenting (ala ProjectBlank), we could see RC usage explode.

Posted Using LeoFinance Beta

I would use more RCs if I had enough for account creation but I might have enough overtime to claim those tokens. As of now, I have a lot of RCs that go to waste.

Posted Using LeoFinance Beta

I'm interesting on this hive token. My own concern is to buy more of it, invest and stake it because I know Hive has a long way to move.

Posted Using LeoFinance Beta

i do feel liquidity crisis, i have no liquid hive 😂

More HIVE.

Posted Using LeoFinance Beta

Hive blockchain is looking very complicated to a newbie.

Hive itself can provide its own use case.

Every passing second #HBD is looking attractive with 10%,

20% could send Hive price flying, just saying.

You mention resource credit, this is another one that will bring a useful piece to Hive price.

Truly crypto is the future where everyone involvement will pay dividend.

!BEER

Posted Using LeoFinance Beta

I have a feeling we will see 20% in 2022. After a few things are done, I believe many witnesses will embrace it.

If they understand the need for more HBD to be generated, it could really motivate them to increase the interest a great deal.

Posted Using LeoFinance Beta

Very apt. The very reason government is fighting so that dividends don't spread into the hands of many.

Hopefully this will happen. I've been HODLing since Steem days and the gains compared to BTC or ETH is pretty dissapointing. :/

300%

Looking forward to the next year. I just look back at the 20 cents of not that long ago and Sweet Jesus, one has to be impressed. So much more to come and I'm ready!

Bring it on! And of course, Hive on! :)

Yes. Granted we had a pump and we dont know where things will go in the short term. That said, we are going to see a great deal more with all the development.

Look at the NFTs generated today on Dlux.io. That is a very inexpensive smart contract platform tied to Hive.

Posted Using LeoFinance Beta

I'm late in replying, but, thank you and I will do that!

Certainly, there'll be no more 50 Cents HIVE from the looks of things and the direction we're headed in terms of developments.

Is high price less Hive better for the chain?

The higher the HIVE price (total market cap) the more resilient the chain. However, we have to be careful about the reduction of HIVE due to the conversion to HBD. If that move pushes the prices higher, that would reduce the likelihood as an attack vector.

Posted Using LeoFinance Beta

I promise not to be too surprised if, in the near future, the price of Hive starts flying. In fact, I look forward to it :) Thanks, for the breakdown and the encouraging forecast @taskmaster4450. Cheers!

You were warned.

Higher HIVE prices coming in the future. LOL

Posted Using LeoFinance Beta

With threats like these, who needs sweet promises 🤪

I fully expect Hive to increase in value but had no idea it is going to happen so soon. You are correct it is inevitable.

What kind of value increase are you expecting?

If things truly take off, we could end up seeing it over $100 especially if a lot of HIVE is converted to HBD.

That is a powerful concept that few have really focused upon. How do we get to 1 billion HBD? The reality is to convert a ton of HIVE.

We could see stats like were shown here being 30 or 40 million in 2022. What I mean we are going to see another reduction in the total number of HIVE out there. Couple that with a bunch in the SIP, once that gets going, it could really get insane at the value as priced in USD.

Posted Using LeoFinance Beta

That is really exciting. Normally I would convert the HBD almost as soon as it comes into my account but this last week I have been letting it accumulate, and I like what I see.

With Hive Power Up day being the first of every month training us to convert HBD to hp like pavlovian canines, do you think the Hive masses can be untrained and start converting Hive to HBD for liquidity sake?

Your posts are giving me a bad case of FOMO these days. I also learned that apps need resource credits for their users as well. One more thing to add to my all-in reasons list.

Posted Using LeoFinance Beta

It is really an interesting concept. If you want people to use your application, you have to ensure they have enough RCs to truly use it.

This is where the more that is built on Hive, the better we all are as token holders.

Posted Using LeoFinance Beta

Interesting indeed. Theoretically speaking, if we had 10 dapps that would bring in as many users as Splinterlands is bringing in right now, would that be a big shock for the Hive supply?

I think I'm actually asking how much HP they need per 100k users or some similar metric that could give you a better perspective.

Posted Using LeoFinance Beta

Yep you hit the nail on the head with that thinking.

We have a situation where we have 10K-15K on a daily basis. Add in the Splinterlands who are really just Custom Jsons and that is a couple hundred. However, if we have a ton of transactions similar what the 10K are doing, but that was 100K or 500K, small numbers in social media, what does that work out to?

The RC delegation will help but ultimately that puts a lot of buying pressure on HIVE.

And that is just one aspect. What happens when we see some HIVE being placed in the SIP by SpkNetwork or a reduction as more HBD is created.

Posted Using LeoFinance Beta

Yeah, that's exactly what I was wondering. This is definitely a big deal but thankfully the market still has no idea what is going on here.

Thanks for the free education!

Posted Using LeoFinance Beta

The improvement is gradually showing and I believe there is better progress coming soon.

Very interesting stuff! I look forward to seeing how all of this plays out next year. It still kind of feels like it is ages way, but then I realize it is already December and we are almost there. Is it going to be a smart idea to hold some Hive liquid just incase?

Posted Using LeoFinance Beta

Look back on a HIVE chart from 1 year ago and see how far we have come.

It is all perspective. A lot happening that will take some time to roll out. Nevertheless, it is going to be an amazing ride the next few years in my opinion.

Posted Using LeoFinance Beta

True, I always kind of feel like that is inflated though. It's hard to explain, but I have a feeling if it weren't for some of my autovotes that I get, my posts would struggle to make anything. For as long as I have been here posting and engaging, I would have hoped that I would have more name recognition by now.

Posted Using LeoFinance Beta

It is hard to stand out on any platform. We see a lot of people struggling on all of them. Consider the effort it would take on Twitter to get any name recognition whatsoever.

Posted Using LeoFinance Beta

Right, but Hive is admittedly much smaller than Twitter. I'd just hope that after four years people have heard of @bozz at least once or twice (hopefully in a good way).

Posted Using LeoFinance Beta

You are notorious whether you realize it or not. LOL

Posted Using LeoFinance Beta

Hahaha!

Wow!! We do learn everyday, never knew that one way HBD gets generated is through savings payout. So the more people save their HBD the more HBD will get generated.

It is spelled out in the Peakd wallet. You can also look at the Witnesses (they determine the payout) election by going to that page.

Posted Using LeoFinance Beta

To be honest I didn't understand 80% of the figures but that means I'm bad with economics not your explanation which I find really interesting.

In my opinion the most important booster on your explained process will be the HIVE blockchain expansion utility will it be dapps, games and many more we cannot think of by now.

As a friend says, the more value we create the more valuable the token will be. If you add the supply/demand to the fire I guess we will be seeing those described scenes.

This ecosystem has become a reality for lots of people that just live from the incomes they get from the system. If they massive sell HIVE to have FIAT, won't it be at some extent like a dumping scenario or wouldn't it be enough to exceed the growing demand?

Maybe I did not understand anything :P

Certainly the utility tied to the activity on the blockchain is one of the most impactful areas in terms of price (demand). However, that is not the only one. Yet, from that viewpoint, the development of apps and games is the pathway to that end.

As for the selling pressure, yes some will sell their rewards to get into fiat. However, others will be buying. It is what the majority are doing, not what a few. If more buyers than sellers, then we see the situation with prices going up.

Perhaps those who are selling to get into fiat are selling to application owners who need the HIVE for RCs to delegate to their users.

Or maybe someone is buying it to produce a large amount of HBD.

Posted Using LeoFinance Beta

Speaking of a HIVE liquidity crisis.

Did you see that Upbit now holds more than 60% of all HIVE on exchanges?

Is there more to this than just leftover HIVE being brought across from their pumping?

cc @dalz

Posted Using LeoFinance Beta

Yes I saw that. It is very intriguing and something to keep in mind. We need to spread things out as much as possible.

Fortunately, the amount of HIVE on exchanges is only a portion of the total HIVE out there. We have a lot in HP which is really the resiliency of the system.

That said, if there is a lot of demand, that would make it hard for people to get since Upbit is basically a closed system. Hence if Westerners really want to jump in, it will be chasing a lot less supply on the other exchanges.

Posted Using LeoFinance Beta

I'm loving the other comments and the HIVE discussion spurring from them, as much as the post itself.

Great work as always mate!

Posted Using LeoFinance Beta

It is good to see discussions resulting.

Sadly, like pulling teeth but the time we hit upon topics that strike deep with people, it can flow.

I only hope it helps the SEO.

Posted Using LeoFinance Beta

Okay, economics isn't really my forte. The way I understand this we shouldn't be staking and holding all our hive and use some of it instead.

Nothing wrong with staking and hodling your HIVE. That is what most of us are doing.

The point of the article is the value of HIVE is going to explode in 2022 since we are going to see a liquidity crisis if other things unfold. The examples I listed here are the most likely to take place. There could be others.

Either way, it is going to spur demand for HIVE, something we have not truly seen up to this point.

Posted Using LeoFinance Beta

Okay and thanks for the clarification, @taskmaster4450le! Sounds like a really good thing to me. Happy Monday! 😀

!ALIVE

Made in Canva

@taskmaster4450le! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @lisamgentile1961. (5/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want.

Good Morning and Thank you, @youarealive! Enjoy your day.😀

Made in Canva

Couldn't agree more regarding the link between the utility aspects of HIVE and the incoming liquidity shock. This is very much what has been seen on-chain in BTC for some times now, where folks have been (in the case of BTC) removing liquidity from exchanges and storing it elsewhere. However, the key difference with HIVE is that there are multiple avenues with which liquidity can be tied up by participating in the network activities. Furthermore, if you also factor in that (particularly for the resource credits scenario) it isn't quick (taking time to power down) to reintroduce the liquidity back into the market. This could mean that rather than the usual boom and bust cycles that we can see with kneejerk reactions of the market price (short term pumps etc), HIVE will most likely follow a more gradual sustainable path and encourage individuals to have a much more long-term mindset, instead of being reactive to the market at all time. It will be very exciting over the coming years to see just how this drop in liquidity affects the dynamics of the HIVE marketplace and the community as a whole. Exciting times ahead!

Posted Using LeoFinance Beta

You seemed to grasp it fully. I also am very intrigued by the HBD-HIVE correlation. That is something which is going to really cause some push in the demand for HIVE.

I am still trying to figure out how we can get enough HBD out there other than the conversion mechanism. So far, I haven't found one. That means a lot of HIVE would have to be used to get the HBD.

Posted Using LeoFinance Beta

Yeah the HBD dynamics are interesting and in my mind has two main layers to it:

Provided Hive continues to grow and the community continues to opt for the 50-50 payout then I believe that this (along with the interest earning element) will be the main source of HBD generation. While conversion is an option, the success of the Hive would continue to squeeze resource credits so I think it may be unlikely to generate a substantial portion though the conversion without diminishing operational services.

What I mean by this is that pressure will be put on the generation of HBD provided folks are incentivized to create more and use them for something specific. Be it lending protocols (stable-pair pools), in-game purchases, product access etc.

However, one caveat comes along with HDB because of the peg. The overall value of HBD will be very closely linked with the value of the dollar (as you would expect) which means as the US continues to devalue the global reserve currency so to the purchasing power of the HBD diminishes over time due to the peg. That said if the US were to pull the rabbit out of the proverbial hat, or maybe move to a BTC standard backed currency HBD could benefit from this. Though that kind of value is not governed by the Hive chain developers/communities so when we choose to peg we're putting trust in another party to not trach the economics for us.

Posted Using LeoFinance Beta

The only way I can see HBD actually utilised as a stablecoin, apart from more being produced the coin needs to be useful on the Hive blockchain. If you could purchase NFTs or do anything with it other than purchase Hive it would be useful.

However no one accepts HBD outside of Hive, so I just don't get this obsession with making it a stable coin. Like you say 24 million is a big gap from 1 billion.

In that that gap is so big, that to put it in perspective, imagine I gave you 1 HBD for every second that passed.

You would have 24 million in under a year, 277 days to be exact.

Now the same to reach to a billion? 31.7 years!

We are never getting to 10 billion, and if we do, then I hope there is an actual use for HBD otherwise I just think we should faze it out.

Cg

The difference is we can generate more than 1 HBD per second.

I can convert 100K HBD in about 3 seconds, the time it takes to create a block. So your math doesnt work in that regard.

Posted Using LeoFinance Beta

Yes point taken, I was just pointing out that there is a lot of blue sky between 24 million and 10 billion

Cg

@taskmaster4450le it's doesn't make sense crises helps hive price to goes up 😂

Yes it does. It sets of a FOMO that is not based upon want but need.

It is similar to a short squeeze in the markets. Prices go flying because people honestly have no choice.

Posted Using LeoFinance Beta

I would add also: market cap transfer from steem to Hive. We've seen clearly that hive has won. Steem investors know it. You just see Steem keep going lower in crypto positions and hive going higher... Add that to Web3 marketing efforts + Network effect from rewards increasing. And Hive is going to fly.

I think the time to look at STEEM is passed. The obsession is now to the point that it carries no sense.

That is just another blockchain. Those who stayed are enjoying their life while those who left are onto something different.

I am not sure why people still believe that STEEM has any impact or correlation to what is going on with Hive.

Posted Using LeoFinance Beta

Because people like stories, it unites them. Transformation gives trust to build something new and better. To win STEEM has the meaning that we've been successful to do that and outsiders want trust/confirmation in order to build here. To win over STEEM has been the first confirmation, and it has showed in price. We still need more wins, now on our own of course. Stories have more power than money.

This is why I enjoy your posts as they are simple to understand. I feel this could happen very easily and the beauty is these are down to all use cases and no pumps involved.

Posted Using LeoFinance Beta

I agree, that's why I love Task's breakdowns as well. They are understandable for me, a not-techie. That's a skill not many people possess.

View or trade

BEER.Hey @taskmaster4450, here is a little bit of

BEERfrom @pouchon for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.~~~ embed:1469368381849624585 twitter metadata:ZGFvbW9pcmFpfHxodHRwczovL3R3aXR0ZXIuY29tL2Rhb21vaXJhaS9zdGF0dXMvMTQ2OTM2ODM4MTg0OTYyNDU4NXw= ~~~

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

!PIZZA

PIZZA Holders sent $PIZZA tips in this post's comments:

@juanvegetarian(1/7) tipped @taskmaster4450 (x1)

nastyforce tipped taskmaster4450 (x1)

Learn more at https://hive.pizza.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Grateful for making a complicated subject appear so simple and comprehensible. I think I just listened to someone few days ago saying that Hive will reach 10 USD early next year, but the reasons for such price appreciation were not clear to me. Here, you spelled out a case why Hive could be flying this 2022. Re-blogging it for my future reference. Thanks!

You're right. It's gotten to the point where If I saw my RC percentage dropping under 100% I'd start to think something was wrong. :) Makes me realize just how little of that is in use on a daily basis since I'm so busy, and the utility of RC delegation in 2022.

Posted Using LeoFinance Beta

Shouldn't the 50/50 make those two numbers equal?

Very deep research and reporting. Thanks for the figures presented which provided a lot of insights into the supply and future liquidity of Hive and HBD. Certainly, we're still in the beginning of things. Hive has got no adoption yet. When adoption finally arrives, we should be on our way to $100 HIVE. Time and development heals it all.

These are economics I can understand. Basically, it confirms my motivation to buy more $HIVE through December. Thank you!

Posted Using LeoFinance Beta

After reading this article, I got the feeling that Hive's supply is going to be smaller than Bitcoin's itself. Maybe at some point in the long-term future

Great piece. Thanks for explaining all this stuff

Posted Using LeoFinance Beta

We essentially get HIVE, HBD, and LEO for almost nothing. By just posting and commenting, the value we get has the potential to be life-changing. It's all a matter of perspective. Adding in other factors, such as liquidity pools, the HIVE-HBD relationship, the explosion of gaming, microblogging, need for resource credits, etcetera, will have a huge impact. If this happens in 2022, then I'm buying myself a new house. LOL

!LUV this post.

!PIZZA

@juanvegetarian(1/1) gave you

So insightful.. just saw a broader view to the Hive market.

_

@taskmaster4450! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @germangenius. (3/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want.