This would probably be my first and last crypto portfolio sneak-peek and I want to make sure that I'll be giving out the most important keys to everyone who wanted to be successful in crypto trading and investing. But just a short disclaimer first; Everything you read and see in this post does not correspond to any certainties of incurring great profits in crypto trading or investing. Moreover, does not give you the right and exact tool for generating a passive income stream using cryptocurrencies. Instead, this is a personal experience, which does not necessarily apply to anyone's preferences in accumulating cryptocurrencies in such different and subjectively convenient ways. The keys are, always do your own research, manage the risks of potentially losing capital and always invest in what you can afford to lose.

Losing is inevitable

It all started when I lose some of my cryptocurrencies in the early days of 2020(guess that it was a wake-up call for more consequent bad events that will occur in the next months). I did take it as a lesson, though I have hated myself for that worst decision. I will not go into more details of telling you that sometimes, we humans suck at deciding things that later will mount us regrets for its consequences. It's fuck*** life as we know it.

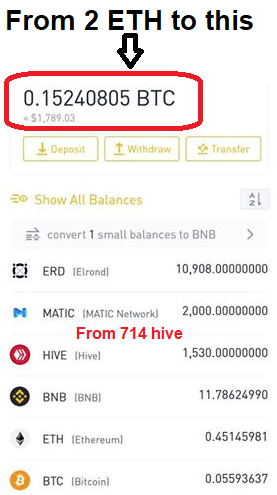

After that event, I contemplated a lot of time for myself. Then came into the riskiest decision of putting my personal hedged fund in a form of cryptocurrencies to get back those incurred losses. I moved my 2 ETH from my cold wallet to Binance to put them into the test.

Then processes took into place. I researched a lot of cryptocurrencies that were sitting in a consolidated position for a very long time. There are too many of them to mention, but to name a few, Vechain $VET, Aelf $ELF, Digibyte $DGB, and even Ripple $XRP which regarded by most as useless coin helped me get back 15% of my crypto investments.

Takeaway - "Losing is part of the game but what's good about losing is you'll probably learn something like a lesson that you can use as your future reference for your every decision."

Listen to your friends or even strangers.

Now, this is the part where you need to have a validation of your decision. I don't mean for you to depend on others but be open-minded to other's thoughts and biases especially to your friends in the same field of experience and expertise. Also, be on other social media platforms that are active in crypto like twitter. Do your due diligence while reading shilling tweets and hype from biased crypto users. Expand your understanding of cryptocurrencies and blockchain.

Think, listen and think again!

In my case, my 2 ETH tokens were diversified properly. I chatted with some colleagues of mine asking them what coin they're up to then they talked a lot about utility tokens like Binance $BNB and some oracle thing(terms that are so new to me at that time) like the Chainlink $LINK. I took the time to study those terms and the coin's technicalities while validating my action thru friends' biases and thoughts.

To be honest, I'm a fundamental guy in crypto. I always base my decisions on the fundamentals of the asset and the activities of the blockchain itself. And so far, 2nd to my best-performing assets of this year is the $LINK. Almost 50% of the capital was invested into LINK before they soared high from previous days. And up to now, my pure $LINK profits were sitting in a 500% gain. The most fulfilling part was LINK gave me my 2 ETH capital back and I was left with a certain amount of LINK that puts me at the lowest rank of the LINK Marines position. Guess where am I below 500 LINKS? xD

Takeaway - "You must diversify your knowledge stream as you diversify your assets in cryptocurrencies or any value-bearing assets."

Long term and short term

One of my keystone in crypto trading and investing is thinking both long term and short term. I chunked out my 2 ETH from my personal wallet in the hope of a great comeback in the market. For some, those 2 tokens were just bits of their bags but for me, those were my future treasures including my stacked satoshis.

I always instill in my mind that my capital is my home and my end game. I always protect my capital no matter how hard or long it may take.

My long term is my capital to grow or appreciates in value while my short term is for my profits to grow compounded thru short/long trading. To add, I make sure I get the protection of my capital intact like taking profit portion out of my profits. In layman's term, I set aside some cold cash as a back-up for my capital, or at least equivalent to my capital. I took my back-up cash from the desired profit in trading. Say, 20-30% of the profit I made goes to the protection.

I don't really wait for moons to come in cryptocurrencies, my goals will always be getting back the capital I invested first, create protection in another form of a valuable asset, and make use of the profits to grow independently.

Takeaway - "Desirable profit is very subjective. It depends on the risk taste of the investor. It can be 5% to 1million % and it's possible in crypto. But as long as you can manage the risks, you can hit your targets well."

Create more capital

Don't just stop at one point after hitting your goal. Create more capital and manage them diligently. What I mean from creating is literally investing more into other things with potentials and treat them the way you treat your first investments.

As you can see in the main photo, I am now enjoying my pure profits from my 2 ETH plus the free 712 Hive tokens I received after Steem split forked. I made a good fortune of Hive tokens after shorting those free forked tokens that Binance gave me and the initial tokens were now sitting safely on my Hive account. Isn't it cool?

I haven't cashed out my Hive earnings so far or converted them into other tokens since its inception earlier this year. Yaaas! One of my long term cryptos is Hive.

My 2 ETH capital is well protected now with diversified valuable assets including cash. I got myself a new capital portfolio because of $LINK and I don't treat them now as my profits from my previous trades instead, I looked at them as my hard-earned capital but in a long term. *whispers "not shorting them" XD

Everyone's bullish about LINK and I couldn't let myself hope the opposite.

Have I already recovered my losses? Definitely! In fact, $ERD(though currently at staked) alone skyrocketed my portfolio into x30 fold. Yes, you read it right! From $20 worth of ERD tokens, it's now worth $600 in unrealized value. That's like zero to hero achievement considering the hurdles of today's crypto ICOs and projects. It was a managed risk of investing in what I can afford to lose yet, turned out to be one of my great decisions ever.

Takeaway - "Investing is risky and scary, but only if you don't know what you're doing. Take time to study and assess your goals before taking the risks."

Don't let emotions control you

Though it's totally understandable that sometimes emotions overtook us in controlling our decisions, one could overcome it easily. There are many ways to do that and it's all in the mind.

There are such times when I get devoured by my own emotions and it totally affected my decision-making and reasoning. But thankfully, I didn't let it control over time. And for the longest time in my crypto career, I'm more now in control of my emotions. Emotions that are directly affecting my cognitive thinking.

In crypto, FUD and FOMO are famous terms you always encounter by. Don't let it ruin your comprehension, focus on the fundamentals and technicals of the assets.

Greediness kicks in when you see your assets performing well. You will try to hold hoping for extra cash ahead of that lucrative profits but think again before taking the profit or holding for more. You may be gaining but losing opportunities in reality. On the other hand, dysphoria will linger into your skin when you see your assets taking the opposite way or down to the pit. But don't topple down, look into the opportunity side of investing. Do cost averaging instead or battle for recovery on your other assets.

Those are just the basic terms you may encounter in your trading/investing journey. You can make use of those to cope with frustration or confusion and battle emotions associated with trading cryptocurrencies or other assets. But you see and will realize soon that that's all in your mind. The way you assess your mind and counter those setbacks depends fully on your cognitive approach.

Have a mindset of an investor and an instinct of a trader - anonymous.

Takeaway - "The market expresses everyone's mixed emotions. Master those emotions so that you can master the market."

Final thoughts

I intend to make this post not show off but to share to everyone that failing is indeed part of a brewing success in life, in this case, it's about cryptocurrency investments. The risks and the rewards of cryptocurrencies are the major concern of this write-up and somewhat motivate others who are failing to keep pushing and continue the journey they have started.

As I have always read about someone from the crypto sphere in the Philippines, a maestro, a "gurang" yet full of wisdom, he would always say and remind everyone new and old into crypto, that the industry is still in the infant stage. Everything is in steadfast development and always ready to take over traditional finances. And he never missed mentioning the fact that everyone sees this as a great opportunity and that we're lucky to have the very first taste of future wealth.

Though I may be ahead of him in terms of exposure to crypto, he molded most of us more about investments, that it should be taken seriously whether you're in stocks or in crypto. And I like how he manages to put cryptocurrencies in a third world country. I could say a noble act of educating Filipinos about any forms of assets.

My last Takeaway - "Be always healthy first. Being healthy gives you enough sanity level to focus not just on a single area but to many as possible. Prioritize income-generating skills before income-generating assets. Head over to your needs and secure them before aiming for your wants. Be water and get a life!"

What is HIVE?

If you want to know more about Hive, visit some links below.

- What is HIVE and how does it work?

- Where does the value of HIVE (the token) come from?

- Where does the money on your posts come from on Hive?

- What are the different ways to earn HIVE?

About the Author

The author has exposed himself into cryptocurrencies and blockchain since 2014 where his first bitcoins was used to fund his education and his first assets in life. Years later it molded him to have a wiser look in life and finances. He's an engineer in the profession but an investor by passion. He desires to know everything he's capable of doing. He loves to have more hobbies that are fruitful, energizing, and fulfilling. A strong believer.

I like your thinking. There are profits to be made in trading on hype and rumors which can be fun to play with. For any of my main trades I look at utility and long term value.

That's why I stack hive bitcoin bat and eth.

I have other bits that I think can make profits but those are long term holds. They will be sitting there for the next few years regardless of market price.

I bought a few bits with my old steem to play with and try to multiply it over time. If I can I will buy into a hold coin and add to my ledger. I'm playing the long game here.

We're definitely on the same page with regards to evaluating the short and long term coins. But all in all, taking it seriously is the crucial part of investments whether for short or for the long term. It's money after all unless you can throw it carelessly in the market.

I don't hold for years, similarly to how I look at stockmarket of today, crypto's going to the same direction regardless of how volatile are they.

I highly appreciate that you've shared your knowledge about the cryptocurrency, very informative, i've invested the coins that you've suggested and it is so helpful, thank you @themanualbot :)

Hi @fernwehninja, really glad that you're here again, blogging. I'm looking forwards seeing some posts of your beautiful daughter. :)

awee, thank you, i was thinking what to post with regards to my beautiful daughter if that so :P Currently I am just into blogging quality content of travels for now, but soon i will include her in one of my posts :-))