I have been here for many years and I have seen all the bad games run on this blockchain, formerly known as Steem, from ninjamining to bid-bots, downvoting wars, etc... and, believe me when I tell you I don't see any bad consequences in offering a 20% APR on HBD in savings.

On the contrary, I think it is a good way to keep many people on this blockchain, active and working on its improvement.

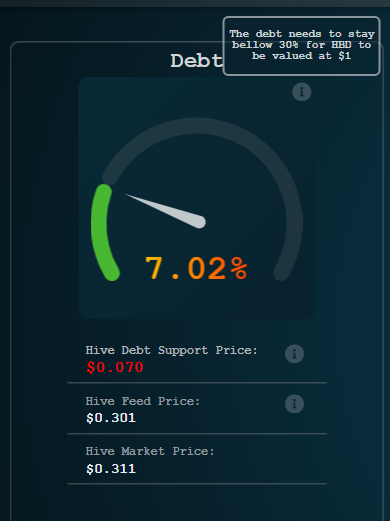

If the only danger that some of the witnesses see in this incentive is that it is putting the debt ratio with HIVE at risk, it seems to me that it is a motivation without any foundation given that, in these two years in which the APR of 20% has been active (since February 2022), the debt ratio has barely touched 7%, very far from the critical value of 30%.

Some say that the main reason why this incentive had been created was that, in this way, we would attract "foreign" investment capital and that, after these two years, this reason has not yielded what was expected...

Let me tell you what I think about this. This was undoubtedly a great idea that, however, we could not think of a better time to implement it than just when the market was sinking in one of the longest Bear Markets known in crypto, after the catastrophes of similar but much riskier schemes like LUNA and her UST...

Did we really want at that time to attract investors not only to crypto but in particular to HIVE like that?

Let me doubt that...because the HIVE chart continues to go down even though BITCOIN and other cryptos hit bottom a few months ago.

Simply put, when the 20% APR was implemented maybe it wasn't the best time to do it...

But today it could be, since BITCOIN is on its way to new ATHs, the other major ALTCOINS are also chasing it and, therefore, I am sure that HIVE's time will also come because, so far, this is what has always happened, that is, first BITCOIN, then Major Altcoins and then all the others.

If someone wants to choose a project not for its fundamentals but for its APR perspective, the time is from now on.

I'm sure someone is getting offended by what I'm saying, but I'm convinced that it doesn't make any sense to implement a "marketing" solution during the bear market and want to cancel it when the green shoots start to come back, don't you think?

On the other hand, I am not going to deny it, I am sure that many of us view favorably an initiative that encourages us to continue in HIVE, after so many years despite the little progress we have made in terms of visibility, to get something out of benefit from our effort I don't see it as bad.

In short, in my opinion, today is not the time to lower the APR of the HBD in savings.

Good weekend to everyone.

Posted Using InLeo Alpha

I agree and I think we need more HBD out there if we want it to be a stablecoin. The debt ratio is still fairly low and I think removing it during the bear market is not a good decision either. If the price of Hive was going up a lot and we were in alt-season, then maybe. I don't see how reducing the APR will solve the existing issues with Hive because the inflation just isn't that high due to the debt ratio.

It's just like we've seen the first stablecoins go down and then the project has had a bad time but we've seen that the project has performed very well within the bear market right now. We don't see its price going up, but don't worry, after some time, when investors pour money into the altcois, they will definitely bring it in.

The Hive chart goes down because of bad tokenomics on Hive. Unless they are fixed, we will see more NGD (number go down). Why would someone buy Hive when Bitcoin, Solana und co are going up? Just because Hive will have its time?

Bad tokenomics could be, but not related with the HBD's APR.

Look, If I were a new investor to crypto I would first buy a solid stake in the important assets for me to ensure the shot, then, I would look for more riskier ones as could be HIVE under the eyes of a novel person.

I am so sorry to admit it but, yes, HIVE is not considered yet as a primary investment but a second or third option actually, but, IMO, in a Bull market, anything that had survived to the Bear Market goes up easily

I think you just answered your own question. Do you invest in tokens that go up or down in value?

?

Obviously I always buy going down tokens😂😂😂

Same as you I guess 🤣

Right everything comes on its time just wait have hope and never give up

Never

!giphy lets hope for the best

@sagarkothari88 vote 15%

Via Tenor

| Hive Curators Community | Join Discord | Support Witness | Follow Curation Trail |

Keep Up the good work on Hive ♦️

yes, It will put sell pressure on HBD.

I actually believe the Apr will gradually increase back. It is just a matter of time

The Apr really need to return back to that which it was before as that should be the standard