Few days ago, during a conversation in chat, someone asked a question; Should I buy Hive and power it up, or should I buy HBD and deposit them in savings to earn a 20% APR, which is what the interest rate currently set at by the witnesses.

To which, a simple and direct answer was provided...

Powering-up hive and curating gives ~12% APR plus the influence on chain (which can be very important depending on who you ask), while depositing HBD in savings gives 20% APR.

However, I had to bring up the subject of "Opportunity Cost" which many tend to overlook. And the reply was "What is opportunity cost?", so that gave me the idea about writing this post to explain it.

What is "Opportunity Cost"?

It is the cost of doing an activity, rather than doing a different one instead. Some value which you are giving up by investing your capital or whatever you are investing in option A, instead of investing it in an opportunity with more lucrative returns, which we can call option B.

In simple terms, and to keep it Hive related. An investment in HBD is great, 20% APR is by all means awesome. Especially when taking into account the relatively low risk, and the short amount of time the funds would be locked up for before they are liquid and fully available at our disposal again.

Compared to the ~12%ish APR you can get from powering up Hive and actively or passively curating, and the whooping 13 weeks lock up period for powering down (This isn't a big deal depending on your HP or if only powering down some profits).

The thing that gets overlooked when making such a decision about which option is better to invest in, Powered-Up Hive or HBD, is that opportunity cost we defined earlier.

If we calculate our opportunity cost for investing in Hive instead of HBD, purely from an APR stand point, HBD being the option with the higher returns (20% - 12% = 8%). We would be making 8% less for choosing Hive over HBD. The choice would seem easy to make, but is it?

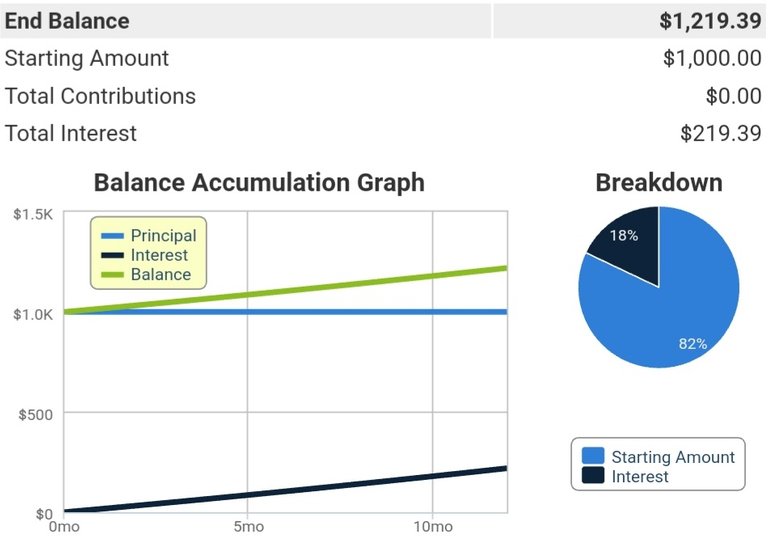

If I am to invest $1000 in HBD assuming the 20% APR stands, by the end of a 1 year cycle (claiming and compounding interest monthly) I would end up with $1,219.39

This is $219.39 In profit after 1 year, with my initial investment of $1000 remaining the same.

Pretty simple and straightforward so far, which is great, but now, let's look at what can happen if I invested in HP instead.

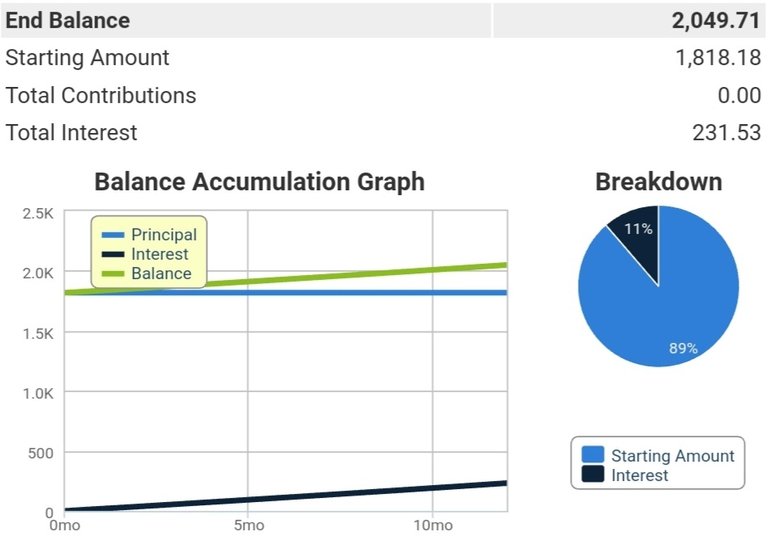

At the time of writing this article, Hive is priced at $0.55 each. So, if I dump $1000 into Hive, I would get 1,818.18 Hive that I can power up and get approximately ~12% APR (About 9% from curation + About 3% interest rate on powered up Hive). With a slight edge over HBD being that the compounding of the interest rate happens in a smaller time frame. It's very rapid regarding HP interest, but can be considered weekly in regards to claiming curation rewards, so let's just go with compounding it weekly for easier calculation.

At the end of a year, I would end up with 2,049.71 Hive. A profit of 231.53 Hive. If we assume the same price holds for Hive at the end of that period ($0.55/Hive), I end up with $1,127.34, so a $127.34 in profit.

The real Opportunity Cost:

HBD, as you may already know, is an algorithmic stable coin. Its price should remain stable at around $1 each, despite some quick peaks and dips that might happen from time to time. Its price keeps stabilizing around the $1 mark.

This fixes our profit in one year with $1000 invested in my example above at $219.39. It can be less if witnesses decide to lower the 20% APR. But it won't be more than that.

Hive's price on the other hand is not fixed at this current value of $0.55, it fluctuates, it can moon and it can dip! Its price is decided on by the free market's law of supply and demand on the various exchanges it's listed on.

An increase of 10% from its current price of $0.55 which we presumably bought for with our $1000 investment, so a $0.60 price of hive by the end of that one year investment, we would end up with:

2,049.71 x 0.60 = $1229.82

A profit of ~$230 which already surpasses what can be made from the same investment in HBD. If Hive goes to $1, that would be a profit of $1049.71, and if it moons, well.. You do the math!

Such profits are not possible with that fixed 20% APR on HBD, as its price will remain somewhat fixed.

This potential that can be missed on the investment made with the same capital, is the cost of that opportunity. Assuming an end price of $1 per Hive, the opportunity cost would be the difference between the end results of those two investments.

Potential profit from HP with $1 end price ($1049.71) - Potential profit from HBD ($219.39) = ($830.32)

So the opportunity cost in this example would be about $830 of "missed on" profit. Almost 400% more profit than what you might have made when investing that $1000 in HBD. Which is about 103% profit on the initial investment, instead of that 20%

Risk vs Reward?

Assessing the risks involved when making an investment is part of the game as well.

And the cost can be calculated similarly.

True, Hive will most likely increase in price, but it also might go down too.

A downturn of 10% ($0.50/Hive) by the end of that year investment, would leave you with $24.85 profit for example. Still in the green, but way less than what a deposit in HBD would've made. Or even worse, if Hive crashes to $0.10 You'd end up with a loss of $795 on your initial investment.

No one can predict what will happen, but one can predict what might happen, what is more likely, and what is less likely to happen.

This is Crypto after all, and it is wild! But, I try to be realistic and look at the worst case scenario as well as the best case scenario.

Best case is, of course, Hive moons. And we have already seen an ATH of over $3/Hive last year, before the whole crypto market came down crashing in a fierce bear market. And Hive did actually hold up pretty well in this bear run compared to all the others.

Worst case is, well.. It's the crypto world.. You know how it goes. Never risk what you cannot afford to lose. 😎

It is very unlikely that Hive would get zeroed out, honestly, even with a zeroed out BTC... Because despite everything, this is a social platform that offers in the least a "free blogging space". With a token that does have a use case, and a community that considers this blockchain and platform as their home!

I believe, even a low of $0.25/Hive is NOT an option anymore.

AND, for the sake of our comparison between those two options (Hive vs HBD). If Hive goes to 0, then rest assured HBD would be worthless too.

With all that said, we now know that the risk is there, for both. One possibly is riskier than the other but with far greater possible outcome (profit margin wise).

So, all those things and more, need to be included and thought of when making a decision about any investment, Hive vs HBD in this case.

Last but not least, and needless to say that this is not a financial advice.🙃 But I personally think that an investment in Hive is far more superior than its HBD counterpart. Little riskier? Maybe, depends who you ask. But that small extra risk pales in comparison to its potential rewards.

At the cost of 8% less profit, for the solid potential of 103%+ profit. And between those two options (Hive vs HBD) I personally think it's fair to say that it's well worth taking the Hive ride! 🤘

Header Stock image and Page Dividers were created by me using Picsart Mobile App.

© 2022 @yaziris.

Posted Using LeoFinance Beta

~~~ embed:1563763291377340423 twitter metadata:c3RlZW1zdHJlZW1zfHxodHRwczovL3R3aXR0ZXIuY29tL3N0ZWVtc3RyZWVtcy9zdGF0dXMvMTU2Mzc2MzI5MTM3NzM0MDQyM3w= ~~~

The rewards earned on this comment will go directly to the people( @taskmaster4450le, @steemstreems ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Great breakdown between HBD and HIVE. Newbie here.

For fiat US currency, I usually invest in index funds and have an allocation between stock and bonds. This diversifaction helps me maximize the returns while protecting against downturns. I’m younger and can take more risk so I’m at a 80/20 split (80% stock, 20% bonds).

I wonder if this same investment approach works for this scenario. I’m new to crypto so my understanding is that HBD is similar to bonds where it’s stable and less risky. HIVE is more risk for more reward like stock. So I’ll probably do a split to diversify.

Any thoughts there?

Also basic question: How long do HBDs stay in the savings before you can withdraw?

Hi @sizzlinkola. Welcome to Hive! Yes, that's a great question. And yes, that approach would work perfectly fine with those two. The 80/20 is a very solid strategy for the diversification between low risk and high risk investments.

This article wasn't intended to delve into investing strategies (not that I'm an expert on them either). It was merely meant to explain the opportunity cost of going in one "safe" direction with a tempting fixed APR, vs the seemingly less lucrative APR.

So yes, I didn't discuss what can be "the best" approach in general.

Personally, for example, I even keep some liquid in both Hive and HBD for some market fun ;)

One more thing to note however, you might need to put everything into HP at first as a newbie, since this is a social blockchain, you shouldn't neglect the social aspect. And building up your HP a bit at first, would be a good idea!

The withdrawal period for HBD from savings is 3 days only. (Any amount, the whole amount).

Always hard to compare two completely different coins. HBD is more in the fixed income realm whereas HIVE entails speculation. I guess it comes down to the type of investor and market cycle.

HBD is risk off whereas HIVE is risk on.

Posted Using LeoFinance Beta

This is true, it is hard to compare. I considered it as a comparison between a bank deposit with a fixed interest rate (HBD), and buying into a stock of a company (Hive).

There would be so many factors to consider, but in the end I do think both are somewhat risk on (what really isn't?) and it really depends on the investor as you mentioned.

Thank you for stopping by!

Posted Using LeoFinance Beta

Great information and certainly a lot to consider. Personally, I divide everything equally and invest 65% into HP and the balance to savings in HBD 🤗❤️💕❤️❤️🤗

This kind of hedging you mentioned is a very legitimate way of investing. I do tend to try to do that, but always find myself taking the riskier approach 😂

Thank you for stopping by ❤️🤗

Posted Using LeoFinance Beta

🤗 I’m not much of a gambler. 🤗❤️💕❤️❤️🤗😎😎🥂🥂🥂

Another amazing post @yaziris!

As you saw firsthand earlier today, I’m learning here haha! I’ve been really confused on the distinction between HBD and Hive merit wise, and I still don’t fully understand of course… but this post helped define some gray areas for me! As Hivians who have been here a long time always tell me, I will read this again in a day…and then again!

I can say that my faith in this platform is very deep already- in my (9?10?) days here I’ve been inspired by many to try and write HTML, to share in curation groups, to be genuine and open in my expression. No social media could compare to what we have here, a dynamic group of creators who love to help each other! The craziest part is even if you are selfish, there’s not much point in it here, it’s not gonna get you an extra slice of the pie from what I can see. This is a ground breaking undertaking in so many ways that pull new users like me in to find a home here!

I’ve thanked you a lot today, but I find myself needing to once more- this post is INSPIRING! I think we will all moon together personally, but if we don’t I know that we will have a great time anyhow!

The easiest way to think about it is as if HBD are US dollars which you can "deposit" to get a "fixed" interest rate on them. While Hive are stock shares in this "company" called Hive. Locking up shares (AKA powering up Hive) generates some extra shares, and gives you more say on how rewards will be distributed, and how the "company" functions.

With that out of the way, if said "company" grows and thrives, its shares become more valuable, and we all benefit from that! 😎

So, basically, we all are working towards the same goal.

But in the end, it's a personal choice on how invested one likes to be, and how comfortable they are with risk taking.

Yes indeed. You'll find this as one of the best advices. Just be yourself! 😉

Pretty sure you will. The people on Hive are mostly amazing, you'll get to meet many, and make awesome friendships. We do have a saying in The Terminal; "Came for the crypto, stayed for the community".

Last but not least, I wish you the best in your journey @grindan. Feel free to reach out if/when you need help or have any questions. You know where to find me! 🙃

Oh boy, do I have a headache 😄. My eyes started to glaze over--not because your description was unclear, but because I started pretty much with my mind set.

I love 'playing' with Hive. I love voting. I love tipping. I love getting votes. What fun would I have if my Hive were in HBD?

As you mention in the end of your post, Hive is a blogging platform. The joy of it (for me) is the writing and the interaction. It seems I'm in a minority, but imagine if we attracted more people, many more people like me. People who didn't care that much (alright, I notice sometimes) about the price. Imagine how stable the coin, indirectly would be (at least, I think so 😇)

You dazzle me with your understanding of the platform. I'm glad Hive came out as a better investment, even for those who understand the practical side of this issue.

Hahaha. I already know your view about this, and no, I wouldn't say that you are in a minority.

I know many on the platform that share your view about it (me included to a certain point 😁) but nevertheless, it is a an investment. And not all investments or returns need be $ 😉 although it is a plus!

This is exactly what we need more of! And this is why I think Hive is here to stay regardless of the price or how the crypto world is doing.

But investors are needed too, whether they invest in Hive or HBD, it's a good thing. I tried to be unbiased as much as possible when looking at those 2 options from a purely financial investment stand point.

Sorry for any headache this might have caused you 😅

Thanks for the infos and analysis you shared. This new APR of HBD is tempting enough for new and relatively small investors.

Though I don't have enough HBD in my wallet, I am working on it..

🚀

My pleasure. Yes indeed, 20% APR with relatively low risk, is very tempting.

Thank you for stopping by!

Congratulations @yaziris! You received a personal badge!

Wait until the end of Power Up Day to find out the size of your Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Congratulations @yaziris! You received a personal badge!

Participate in the next Power Up Day and try to power-up more HIVE to get a bigger Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

This was a really good comparison and laid it out so clearly. Thanks for putting it together.

My pleasure. Glad you like it!