I am writing a series of articles, to assist non-technical users and newbies to the world of Crypto to understand more technical concepts. My main goal is to enable the non-technical audience to have conversations with the more technical audience.

Today we are talking about ICO's (Initial Coin Offerings) or Tokensales.

Venture Capital

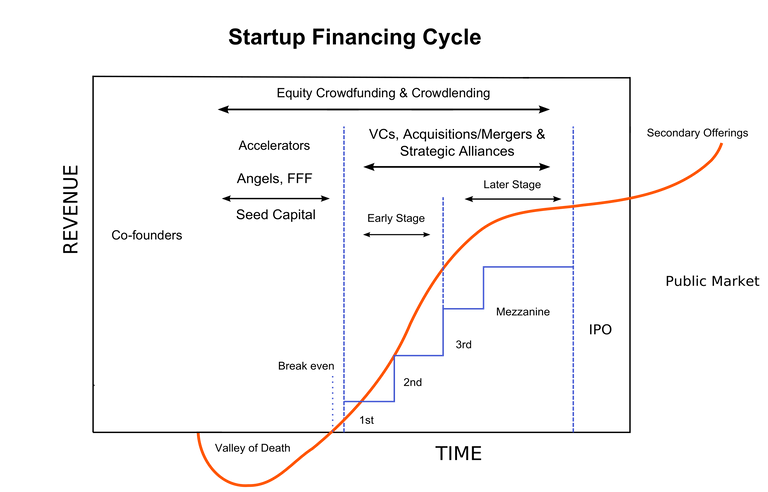

Historically Venture Capital was one of the key methods for Start-up companies to raise funding to get their new business off the ground. It is great to have a business idea, but everything costs a lot of money. In my opinion the idea for the business is not even 10% of what is needed to take a business to market. You need to market the idea, you need to travel to meet people to introduce to the idea, you need to bring in other people to help you build the business. And this is only mentioning a few of a start-ups expenses.

The most terrible part of using a VC to raise capital to start your business is that they take a massive part of the equity in your start-up in return for providing you with the money to start your business. If I say massive, we are talking about even 70%-80% of your business is not yours when you start.

What is an ICO or Tokensale?

The Financial Times calls ICOs “unregulated issuances of cryptocoins where investors can raise money in bitcoin or other [cryptocurrencies],” which is accurate, especially if you focus on the word “unregulated.”

Sticking close to the older financial publications, The Economist also took a look at the financing mechanism, describing what you buy in an ICO in the following fashion:

ICO “coins” are essentially digital coupons, tokens issued on an distributed ledger, or blockchain, of the kind that underpins bitcoin, a crypto-currency. That means they can easily be traded, although unlike shares they do not confer ownership rights. Investors hope that successful projects will cause tokens’ value to rise.

Quoted from WTF is an ICO?

As with any thing where you can make a lot of money, there are risks involved with investing in ICO's. A good friend once told me that Not all people in Crypto and ICO's are crooks, but all crooks are in Crypto

For me this means that you need to be very careful when investing in ICO's or Tokensales. There are a lot of things investors look into before investing in an ICO. Typical things that potential investors usually look into before investing in a tokensale are:

- The people involved in the business. Take some time to look at their profiles on LinkedIn, Facebook or whatever means you can. Google them and see if they have histories. At the end of the day, these are the people that will build the business and execute on their business plans.

- The Whitepaper - A Whitepaper in the sense of an ICO, is a document that provide you all of their information on how the business will work.,

I hope this gives you a better idea of what an ICO or Tokensale is.

Disclaimer: This post is by no means financial advice, or in any way a suggestion to invest into any ICO. I am just trying to explain what an ICO is in Laymen's terms.

Some of my other in Laymen's Terms Post.

- Crypto Wallets in Laymen's Terms

- What is Quantum Computing in Laymen's Terms

- Artificial Intelligence in Laymen's terms

- Blockchain and Digital Signatures - In Laymen's Terms

- Trustless - What does it mean in laymen's terms?

- Cyber Attacks explained in laymen's terms

- Machine Learning - In laymen's terms

- Internet of things and what it is in laymen's terms

- Big data - What is it really about - In laymen’s terms

Happy Steeming!

love the quote: "Not all people in Crypto and ICO's are crooks, but all crooks are in Crypto", graphs and due diligence is on-point, thanks for the article!

Thanks for tips and info, valuable!

great job for the explanation.

Thanks for the article it really helped my understand ICO's. I have bought into several but only for speculation purposes :D

that is definately helpful man!

Thank you very much @jacor. you have shared a very useful knowledge to us new users. This is very important for my personal progress and other friends. Hopefully you are always happy and successful wherever you are

Thanks for sharing this. I've only been in this space for a couple of months and this helps me a lot. I have never bought into ICOs since I don't have a solid understanding of it yet.

There are times when I feel sorry I did not ride the ICOs that became successful, but at the same time I also am glad that I haven't taken risk that I do notyou fully understand.

The only white paper I read so far is steem's, and you're right there are tons of information that helps in making the sound decision.

Regards,

@steemitph

Woow outstanding story great post interesting history @abutaleb365

Nice explanation worthy of a resteem.

This time we live in is being called the modern "Wild Wild West".

I think this is very healthy, as once again you and I are the investors.

Millions of $1's is better than $millions from 1 entity.

👏 Thanks for composing this valuable piece of crypto-info. It's an excellent starting point for newbies, and upvoted and resteemed to help with visibility.

Really good information, this post would help me a lot when I started in cryptos. Good job!

Your ideas and inspiration are good, may you succeed in applying them, regards. Follow n upvote me @zuric

understanding the dynamics of Initial Coin Offering is really helpful for people who want to invest in cryptocurrecies. Your article really helped to understand ICO and make right choice o investing in ICO

Será viable ?

Thanks so much!! following and looking forward to learning more!

Very informative!

Thanks for the article.

Good information.

Good article...thanks

We need more efforts like this to help the average consumer understand crypto so that it becomes more mainstream faster. Thanks for your articles!

Nice article!

Would be nice to get a little more in depth in regards to how ICOs work from an end users perspective and how to go about investing in an ICO or the general process for that! Found it a little awkward or confusing on some of the ICOs out there, I want to contribute but they make it convoluted.