Cryptos Hit Session Highs After Regulators Announce Plan To Define Legal Crypto-Related Bank Activities In 2022 - https://www.zerohedge.com/markets/cryptos-hit-session-highs-after-regulators-announces-plan-define-legal-crypto-related-bank

A group of Federal bank regulatory agencies today issued a statement summarizing their interagency efforts focused on crypto-assets and providing a roadmap of future work related to crypto-assets. The statement (link here) describes the preliminary work conducted by the agencies and summarizes the agencies' plan to provide greater clarity throughout 2022 on whether certain crypto-related activities conducted by banking organizations are legally permissible, and related expectations for safety and soundness, consumer protection, and compliance with existing law and regulations.

The Office of the Comptroller of the Currency, whose next head may or may not be the Marxist/Leninist/Communist Saule Omarova, the Federal Reserve and the Federal Deposit Insurance Corporation summarized their policy "sprint team’s" work over 2021 in the statement, saying the group studied crypto custody, sale, loans and payment activities that banks and similarly regulated entities might want to take part in.

According to the statement, "the emerging crypto-asset sector presents potential opportunities and risks to banking organizations, their customers, and the overall financial system. The interagency sprints quickly advanced and built on agencies' combined knowledge, which helped identify and assess key issues related to potential crypto-asset activities conducted by banking organizations."

The interagency sprint team focused on creating a common vocabulary around digital assets, identifying possible risks to consumers and evaluating how regulations currently apply to digital assets, the document said.

“Based on this preliminary and foundational staff-level work, the agencies have identified a number of areas where additional public clarity is warranted. As a result, the agencies have developed a crypto-asset roadmap that is summarized below,” the document said.

Over the next year, the group plans to “provide greater clarity” on whether custody, purchase/sale, loan, stablecoin issuance and holding crypto assets are legally permissible for regulated institutions, and how banks should comply with laws if so.

“The agencies also will evaluate the application of bank capital and liquidity standards to cryptoassets for activities involving U.S. banking organizations and will continue to engage with the Basel Committee on Banking Supervision on its consultative process in this area,” the document added.

Acting Comptroller of the Currency Michael Hsu revealed the sprint team in May during a Congressional hearing, saying at the time that the group could create a common definition of cryptocurrency for legal purposes in the U.S.

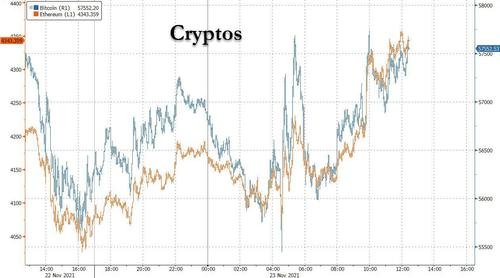

The news of continued benign regulatory intervention helped push cryptos prices to session highs even as real yields are surging dragging down both tech names and gold.

Source: Zerohedge - https://www.zerohedge.com/markets/cryptos-hit-session-highs-after-regulators-announces-plan-define-legal-crypto-related-bank

The full statement is below (pdf link): https://www.federalreserve.gov/newsevents/pressreleases/files/bcreg20211123a1.pdf

Board of Governors of the Federal Reserve System Federal Deposit Insurance Corporation Office of the Comptroller of the Currency November 23, 2021Joint Statement on Crypto-Asset Policy Sprint Initiative and Next Steps The Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation and Office of the Comptroller of the Currency (collectively, agencies) recognize that the emerging crypto-asset sector presents potential opportunities and risks for banking organizations, their customers, and the overall financial system.

As supervised institutions seek to engage in crypto-asset-related activities, it is important that the agencies provide coordinated and timely clarity where appropriate to promote safety and soundness, consumer protection, and compliance with applicable laws and regulations, including anti-money laundering and illicit finance statutes and rules.

To that end, the agencies recently conducted a series of interagency “policy sprints” focused oncrypto-assets. Similar to a “tech sprint” model, agency staff with various backgrounds and relevant subject matter expertise conducted preliminary analysis on various issues regarding crypto-assets. This joint statement summarizes the work undertaken during the policy sprints and provides a roadmap of future planned work.

Agency staff focused on quickly advancing and building on the agencies’ combined knowledge and understanding related to banking organizations’ potential involvement in crypto-asset-related activities.

The focus of the sprint work included:

Developing a commonly understood vocabulary using consistent terms regarding the use of crypto-assets by banking organizations.

Identifying and assessing key risks, including those related to safety and soundness, consumer protection, and compliance, and considering legal permissibility related to potential crypto-asset activities conducted by banking organizations.

Analyzing the applicability of existing regulations and guidance and identifying areas that may benefit from additional clarification.

To place the sprint work in context, staff reviewed and analyzed a number of crypto-asset activities in which banking organizations may be interested in engaging including:• Crypto-asset custody.

Facilitation of customer purchases and sales of crypto-assets.• Loans collateralized by crypto-assets.

Activities involving payments, including stable coins.

1 By “crypto-asset,” the agencies refer generally to any digital asset implemented using cryptographic techniques.

2 To assist in identifying key risks, agency staff reviewed comment letters submitted in response to the FDIC’s Request for Information on Digital Assets.

Activities that may result in the holding of crypto-assets on a banking organization’s balance sheet.

Based on this preliminary and foundational staff-level work, the agencies have identified anumber of areas where additional public clarity is warranted. As a result, the agencies have developed a crypto-asset roadmap that is summarized below.

Throughout 2022, the agencies plan to provide greater clarity on whether certain activities related to crypto-assets conducted by banking organizations are legally permissible, and expectations for safety and soundness, consumer protection, and compliance with existing lawsand regulations related to:

Crypto-asset safekeeping and traditional custody services.3 • Ancillary custody services.

Facilitation of customer purchases and sales of crypto-assets.• Loans collateralized by crypto-assets.

Issuance and distribution of stable coins.• Activities involving the holding of crypto-assets on balance sheet.

The agencies also will evaluate the application of bank capital and liquidity standards to crypto-assets for activities involving U.S. banking organizations and will continue to engage with the Basel Committee on Banking Supervision on its consultative process in this area. The agencies continue to monitor developments in crypto-assets and may address other issues asthe market evolves. Further, the agencies will continue to engage and collaborate with other relevant authorities, as appropriate, on issues arising from activities involving crypto-assets.3 Traditional custody services in this context include facilitating the customer’s exchange of crypto-assets and fiat currency, transaction settlement, trade execution, recordkeeping, valuation, tax services, and reporting.4 Ancillary custody services could potentially include staking, facilitating crypto-asset lending, and distributed ledger technology governance services. The agencies may seek additional information on these activities through arequest for information, prior to providing any further clarity on these activities

Posted Using LeoFinance Beta

Congratulations @dailyeagle! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 150 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Congratulations @dailyeagle! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking

Check out the last post from @hivebuzz: