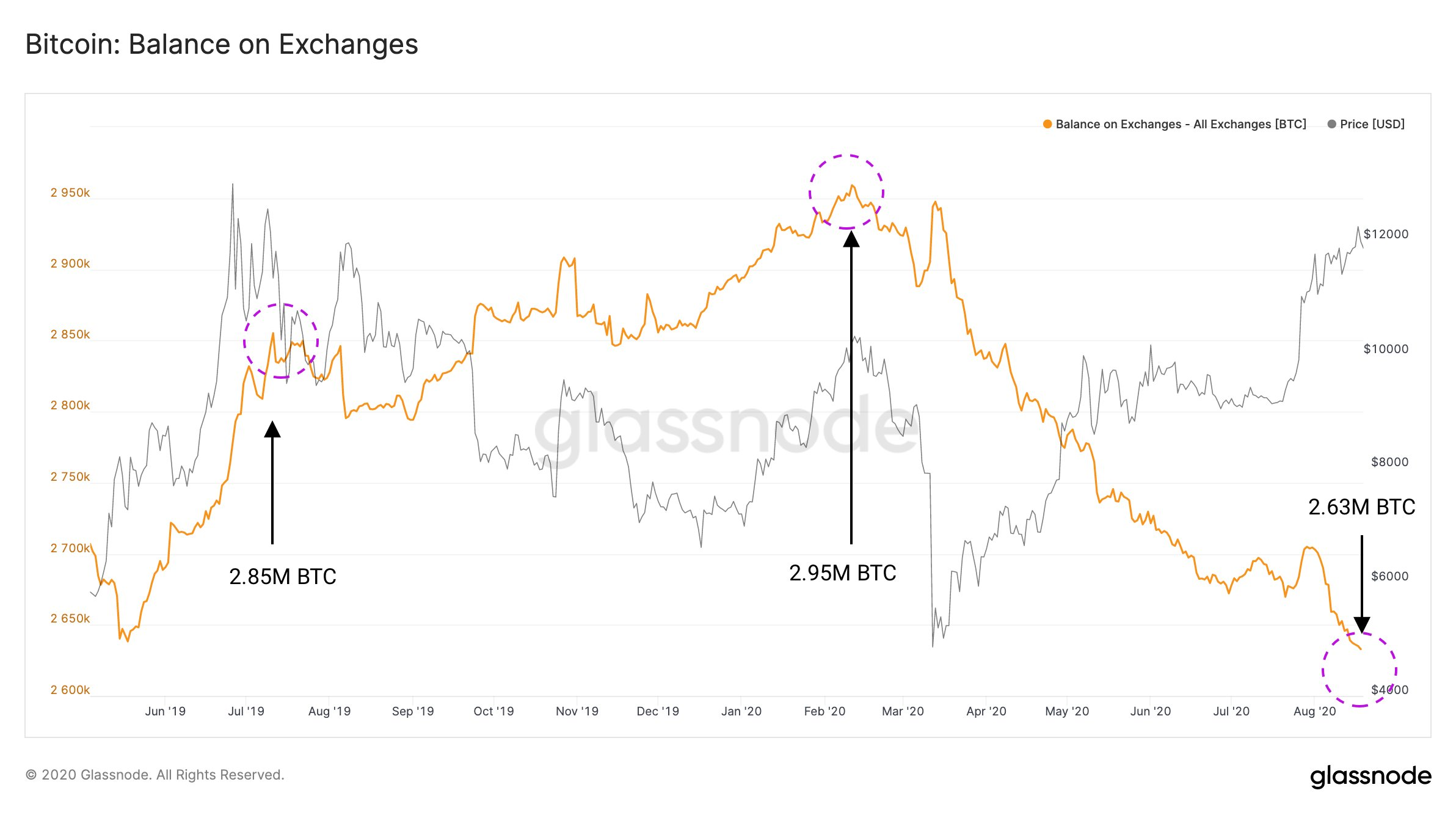

Bitcoin held at exchanges at very low levels compared with previous tops...

Historically, when bitcoin has topped out, there has also been a surge in the amount of bitcoin being held at exchanges.

Which makes sense, right?

When the price goes up and people are wanting to sell their coins, they move them to exchanges.

That is exactly what we saw back in early 2019 and again in early 2020.

Check it out:

(Source: ~~~ embed:1296087237365575686/photo/1) twitter metadata:Z2xhc3Nub2RlfHxodHRwczovL3R3aXR0ZXIuY29tL2dsYXNzbm9kZS9zdGF0dXMvMTI5NjA4NzIzNzM2NTU3NTY4Ni9waG90by8xKXw= ~~~

As you can see, as the price shot up, so did the balance of bitcoin being held on exchanges.

Also interesting to note is that both times this happened, we saw a significant drop in the price of bitcoin not long after.

What is this telling us?

In very short form and plain English, this is likely telling us that we are not near a top.

If you look at the above chart, the price of bitcoin and exchange balances have tended to move together, they are positively correlated, at least they have been.

However, when you get to the far right side of the chart, where we are currently, you see that the have completely diverged from each other.

The price climbs higher and the number of bitcoin on exchanges continues to grind lower...

Why is this happening?

My guess is this is mostly related to the defi phenomenon.

People are locking up their bitcoin and ethereum in defi projects chasing yield.

For this reason they are pulling bitcoin off of exchanges and locking them up in these defi projects.

Last I checked there was close to $10 billion locked up in defi currently.

A number that will probably keep climbing in the near term.

So, not only is the defi craze helping the coins that are seeing astronomical returns, but it's also removing supply off exchanges that may have been readily sold.

Stay informed my friends.

-Doc

Posted Using LeoFinance

That's an interesting indicator, but it actually makes a lot of sense. The defi thing defi-nitely must be playing a big role 😂

That makes the most sense to me as well. Hopefully this means if we get a surge in demand that there just isn't enough supply to hold it back and it takes off.

Nicely done!

Congratulations @jrcornel! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @hivebuzz:

Thanks.

You're welcome @jrcornel🙂👍 Posting every day of the week is a great achievement! You can be very proud of yourself!😉

Support us back and vote for our witness.

You will get one more badge and more powerful upvotes from us on your posts with your next notifications.

In our delight #defi is all about what is moving crypto

right now.

Is it safe enough for $10 billion and more to go in there?

We will see, 120+ days left in the year.

Depends on your definition of safe. It seems like one of those things that keeps working as long as the price doesn't crash, if the price crashes well then the yield farming doesn't work so well. Though admittedly I haven't looked into most of these new defi projects.

When I search for your quoted source, this is what comes up:

https://steemit.com/hive-101145/@jrcornel/bitcoin-held-on-exchanges-shows-we-are-nowhere-near-a-top

Of course, from there I can find it.

If you go to the studio.glassnode website, you should be able to find it and all sorts of other interesting stats/metrics.

https://studio.glassnode.com/metrics?a=BTC&category=Long%2FShort%20Term&m=addresses.AccumulationCount

I want to see the levels of December 2017.

People are locking up their bitcoin and ethereum in defi projects chasing yield.

For this reason they are pulling bitcoin off of exchanges and locking them up in these defi projects.

Possible