I was listening to the LEO finance AMA on replay today, and one of the questions that came up was how much has the LEO bridge being used.

The answer was that it has some usage, but gas fees are preventing it to be used more extensively, and marketing hasn't begun until the swap caps are increased. However this got me curious on actually how much it is being used. So I looked up the contract address on ETH (its 0x7db1afc626fa16e6c35acc71ab98ffbfeb087ba8 for those that are interested), and I have provided a summary below of how much it is being used.

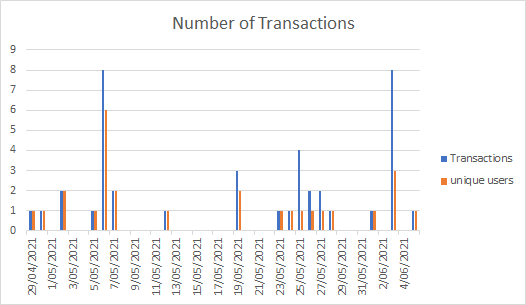

Number of transactions

There are total of 40 Successful transactions. there were a few unsuccessful ones, often due to the user being out of gas, or other reasons, but I have removed them for the analysis. the graph below shows how many transaction per day, and also unique user interactions with the contract.

As you can see there are some transactions by the same account o the same day, this might be people testing with low amounts, or splitting a larger amount under the swap caps.

Total unique users

I also looked at how many different user accounts have interacted with the bridge, and the total so far is 16 different ETH accounts, that means on average there are 2.5 transactions per unique user.

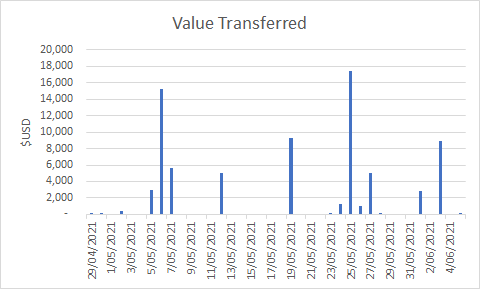

Value Transferred

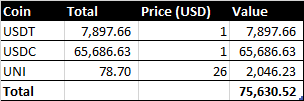

The table below shows the total Value transferred which is over $75k

The graph shows the amount transferred by day

CUB Burned

So for every dollar transferred, 0.25% fee is used to burn CUB and LEO. For CUB, 80% of the fee is used for burning CUB. This means that approx. $151 worth of CUB has been burned, which at todays price is about 240 CUB.

Concluding thoughts

I think LEOfinance should be happy with the gradual adoption of the LEO bridge, and this is without any marketing effort and high gas prices, however its usage is not yet material enough to impact CUB prices yet, as the CUB burned to date, reflects about 20 mins of CUB inflation only.

That's not to say volumes won't increase, and the impact on CUB can be huge if this takes off.

For those interested in looking at the transactions themselves, feel free to visit the link

https://etherscan.io/address/0x7db1afc626fa16e6c35acc71ab98ffbfeb087ba8#tokentxns

All graphs have been produced by myself off the data from Etherscan

Posted Using LeoFinance Beta

Great report! It’s been a fun time launching LeoBridge softly and deploying fixes to make transactions work smoothly

Can’t wait to see how much monthly volume we can grow it to now that the bridge is operating properly and we’re working hard to deepen liquidity and market the benefits of using LeoBridge 🦁

Hope to see more reports like this every week/month from you!

Posted Using LeoFinance Beta

Hi Khal, ( @khaleelkazi )

I noticed the contract address for LeoBridge in this post, and realized I hadn't added it to the DappRadar listing. I think it should be included for usage volume and sales volume figures, both daily and accumulative. I will add it today.

I will also double check that the WLEO contract is on the list also.

Additionally, I greatly enjoyed the AMA and I think the number and types of projects your team produces monthly are simply amazing !

You and your team are doing a lot of hard, complex work to make this Community and project successful, and I / we appreciate it.

Thank you.

Posted Using LeoFinance Beta

Keep up the great work @khaleelkazi

Posted Using LeoFinance Beta

Ohhh all right. I kept on trying to retrieve the data from bscscan API that's why I wasn't able to see any transaction at all.

Thanks for sharing this , will help a lot in analyzing the data.

Posted Using LeoFinance Beta

Great to see even if the numbers are small. Better to start off slowly and to get things right before you attract more attention.

Posted Using LeoFinance Beta

thanks i've been hoping to see this sort of information somewhere.

Sadly the results are not what I was hoping to see which is too bad.

Seems like some other leo users are motivated by this information and if so I don't quite understand it and would like to understand why?

But to me $151 of cub burned during an entire month does not seem like it will make any noticeable impact on the inflation of $20k+ cub a day (aka $604k cub a month)

I guess i never understood the big push for the bridge because it seems to be a one time thing. I for example used the FREE binance bridge with a VPN and ever since using it at the beginning there is now nothing else to use it on. The sub segment that are US citizens, big into crypto and who are unwilling to use a VPN and are going to move enough to make a $20 eth fee worth it and yet not enough they don't try to figure out how to use a VPN system to get the free bridge to work... anyway that seems like a small market to hit. And the issue is where to find that group of people who have ETH who don't care about the fees? Seems like a hard job to find that sub-segment.

Maybe the best way to approach it is to advertise to people who don't want to trade out of their small ETH/BSC tokens into eth to do a binance bridge move because of TAXES. They want to show they never sold these tokens or something. Anyway maybe that's the pitch... find the really really law conscious individuals who won't use a VPN (even though it's not illegal) and who don't want to be shown as ever leaving their random project token.

Best of luck... i obviously want this feature to do well and maybe there's somethign I'm not seeing. I have made many many many features that not many people use however right now 600k a month is being printed and very little burned.

Next it would be interesting to see how much kingdoms will be burning.

or maybe who don't want to trade in and out of their tokens for tax reasons so

I must admit I haven't used the bridge because I don't have any ERC tokens. But I have used binance bridge to convert EOS to BSC. I'm not a US citizen so no problems there I don't need a VPN. However I did have to wait 8 hours for the transaction to process and I was nervous about where my money was in that time. The Leo bridge however is transparent, you can see the code, you can see where it's upto on the blockchain, and essentially it's trustless and I believe that's the true benefit. Admittedly you need to be well versed in blockchain to be able to see this, and that's why there are 3rd party audits essentially for those to trust a 3rd party as opposed to binace which might be slightly conflicted. For the record I have trusted binance in the past so I don't have a particular issue with the company, it's just better not to have to trust.

Overall I think it's still a worthwhile service, and 0.25% is not too much to pay, I pay more than that converting fiat into crypto. The real problem is the gas fees.

the .25% fee isn't too bad... but there's lots of slippage also happening on those LEO pools. I would be very interested to see how it impacts some actual trades.

@leofinance Twitter account sent me here :)

!PIZZA

Posted Using LeoFinance Beta

@notak! I sent you a slice of $PIZZA on behalf of @d-zero.

Learn more about $PIZZA Token at hive.pizza (8/10)

The fees charged for transactions in any blockchain network are increasingly complicated for a novice and to ender you have to read a lot.

Posted Using LeoFinance Beta

'gradual' is one way of putting it!

Posted Using LeoFinance Beta

Well, everybody starts somewhere right? At one point in time Apple and Google were just making 1000$ sales right?

Let's be optimist then :)

Posted Using LeoFinance Beta

This is great information. Thanks for taking the time to dig this up. Intuitively, we know that all of these things are transparent, you just need to know how and where to look. In reality though, we all need someone like you to find it and put it out where us novices can read it. Thanks again!

Posted Using LeoFinance Beta

Most of that USDC is my real estate buddy I onboarded lol ;-)

Posted Using LeoFinance Beta

nice one, that's a big chunk of chain he exchanged.

Hi @notak

Thanks for this report. I wrote a transcript of the AMA and I will add your data to this transcript to better quantify Khal's statements during the AMA about the Leobridge. I will put a link to your post there also.

Additionally, thank you for posting the contract address, I will add that to the Cubfinance DappRadar listing I did, that will sow more activity for the project. I am still looking for the contract address of WLEO, so the transactions and activity there will show up. I will try to see if the contract address is on CoinGecko.

Have a great weekend.

Posted Using LeoFinance Beta

Thank you, I am not sure how dapp radar deals with cross chain apps though, because this address is an ETH address, whereas the other addresses are BSC. I don't know the BSC contract address for the bridge, as I haven't used the bridge myself to find out, and haven't had the time to dig through the code.

Also dappradar is active on discord, they could help you there https://discord.gg/SGwmnxJn

Posted Using LeoFinance Beta

Cool, thanks

Posted Using LeoFinance Beta