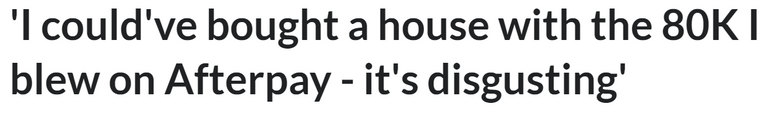

I was skimming through a trash news site (it is free) from Australia as I do most days, and an article caught my eye about a Buy Now, Pay Later (BNPL) company and how someone supposedly racked-up 80K of spending through it in quite a short time span.

80K is over a year's average salary in Australia.

But, other than the sheer silliness of what the person was saying and the excuses they were making as to how they justified the spending, the interesting thing that I found after skimming the article was after I left it.

I went back to get this screenshot of a line.

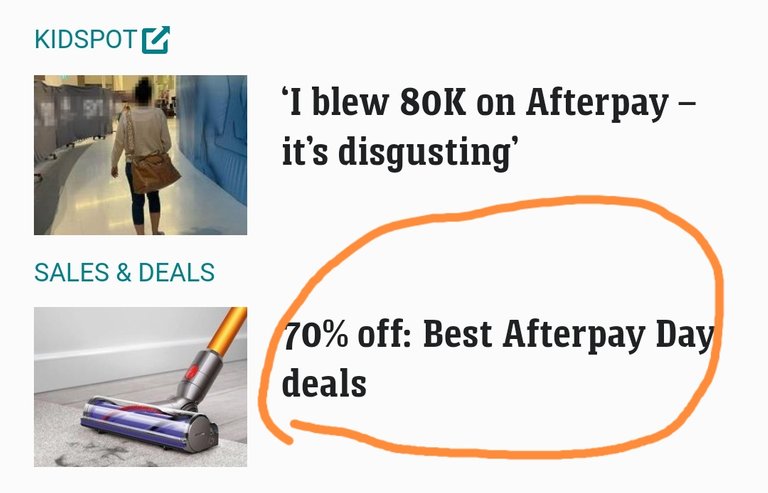

Because of this advert.

Yes, that is a Dyson vacuum in the image.

And no, it isn't Afterpay's fault. They are just incentivized to profit from our behaviors, which includes influencing our behaviors to increase their profits. If there is a demand for a service, no matter what it is, someone will generate a supply - no matter how harmful or depraved the demand may be.

Humans are very predictable in their behavior, especially at scale, which is what has driven so much of the online advertising and consumer activity, because they can identify and generate demand trends, then target triggers to drive a particular purchase activity. It might not be a particular product, it could be a group or a concept, but the process is the same.

However, a lot of these BNPL businesses are struggling lately in share price:

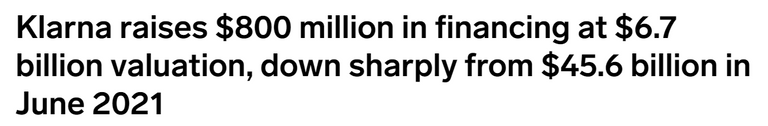

As you can see, that chart ends in January of this year, because Square acquired Afterpay for 29 billion dollars. One of their rivals from Sweden, Klarna, which is not publicly listed yet, has had its own valuations discounted heavily recently when securing more financing, coming in at less than 15% of what it was a year ago.

And while some take this as a sign that BNPLs aren't going to survive, that is only true for most of them, as just like the acquisition of Afterpay by Square, they are looking to consolidate, after an explosion in competition and a heavy drive to build customer base and claim market share, by burning through cash.

Square (now called Block) hasn't been immune to the market movements either.

If you bought Block at the top and BTC at the top, you are down on both, but more down on Block. Bitcoin is at around 34% of where it was from the high, Block is around 29%.

Neither are dead.

However, this is what I am calling the "Highlander Phase" of the BNPL industry.

There can be only one.

Okay, there won't technically be "only one", but this consolidation period is going to force more acquisitions and mergers to maintain market share, or weed out the weakest and releasing their market share back into the pool to be claimed. After this period, there will likely be far fewer player of far greater size, earning significantly better than what they were, as they are able to scale their activities, cutdown overheads and will no longer need to be aggressively burning through cash to attract customers. Brand loyalty of a kind will also likely set in a bit, locking people into certain providers out of habit and incentive.

And, they will probably do well overall, because their business model in theory is sound, because they know that on average, people do not have the financial literacy or aptitude to manage their finances effectively, so they will always have customers. The only way that they can fail is if people start to take more responsibility for their own financial wellbeing and improve their economic hygiene through changed behaviors.

“It’s so easy to say that you’ll spoil yourself if you’ve had a hard week at work, but I’ve realised I need to prioritise my future instead.”

Prioritizing our future is far easier said than done, because we are in-built with consumer instant gratification tendencies, meaning that there is more force driving us to "buy now" than save for later. These companies leverage these traits, but as we are ultimately responsible for our own experience in this life, it is up to us to identify the challenge and handle it. Some are better at this than other.

Talking about financial considerations for kids with a client today, he was saying how his daughters are very different from each other. One is good with money and looks to invest, the other looks to spend, even though they have both been raised under the same roof and similar conditions, without too much of an age gap.

However, regardless of how much is nature or nurture, each of them is going to have to experience their own outcomes and with a straight line path to the future, it would seem that one will be financially comfortably, the other struggle.

Which is more likely to use a BNPL?

And if they both do, which is more likely to use it strategically to increase their wealth, and which because they must?

We are consumers by nature, but the financial system isn't natural, even though the laws of economics may be. This results in us needing to actively learn how to use the system to our advantage and if we don't, we are going to be used through it by the people who do know how to use it.

Essentially, the financial economy is a technology like a computer, with complex processes and mechanisms involved that means that there can be a spectrum of users. Those who understand the system well, all the way down to those who understand just enough to use it as an interface, a consumer, not a creator.

This is business.

And if we don't take care of our own business, someone will take care to build their own business, with our resources.

“A Fool And His Money Are Soon Parted”

_Thomas Tusser

By nature, we are all largely born economic fools, demanding that someone takes care of our needs for us, reliant on those around us to provide. As we grow, we are expected to learn and take on more responsibility for ourselves and add to our community through our activity, earning capital ownership of some kind in the process. We then choose how we use our resources and through our consumer behaviors, we signal who we are and what is important to us.

Action expresses priorities

_Ghandi

What does it mean when we are getting into debt, buying nothing of consequence?

That is something to think upon perhaps, but the fact is that because this is what we demand, the supply for services that enable us to do it more easily, aren't going to go away any time soon.

Whether the return is for us or for someone else, every purchase we make is an investment.

Taraz

[ Gen1: Hive ]

Posted Using LeoFinance Beta

Lol, Afterpay aren't getting that money back though.

So she wins?

Literally buy now, pay never!

Posted Using LeoFinance Beta

Actually, I think in this case she paid it all back, according to the article.

Whether a debt is good or bad depends on... who owns it. :D

Busted not reading the article I shared my opinion on.

Damn it, I am part of the problem!! ;)

Posted Using LeoFinance Beta

Here in NZ the govt is talking about bringing these BNPL contracts under the law that covers other consumer debt. That clarifies distressed debtors and puts some onus on creditors to check the customer has some chance if paying. I hope so.

They aren't small numbers:

Yep. Huge numbers.

Ouch, that is a big hit

I know some people who are not good with money but fortunately not to that point.

I used to be very bad at it as well and I realized some people who made considerably less money than I did were in a better situation than I was. That's when I decided to learn how to better manage my finances

Posted Using LeoFinance Beta

It definitely must have hurt to look back and ask, "what else could I have done with that money?"

I was going to write something about this, as over the last years, people are talking more openly about personal money matters, which I think is a good thing. Now during the "down" times, it has taken a different tone - it feels a bit like people are trying to probe to see if others are struggling too.

They are not the first and won’t be the last, there is a reason why it’s called retail therapy.

For sure - I wonder if there is a correlation in spending between generally happy or sad people?

Will have to have a look :D

It does release endorphins I'm told. Plus think about it... Companies aren't selling you an item. They are literally pushing happiness. Once you totally KNOW happiness is fleeting, you can resist the urge to buy into such myths.

But when depressed, anything to escape the feeling.

Yep. Which is how I ended up buying a $12 vase in Kmart - a tightarse's happy pill, haha! But damn my kitchen table made me smile with some banksia and bluegum in that vase, with the light streaming in - I reckon I might get more than 12 bucks of happiness out of it. Thing is, a 100 dollar vase does the same thing and I can't image it'd be 10 times as nice.

We can't be the same regarding to such situation as been said because one will struggle while the other would find the ability of finding financial means more easier to achieve without much challenges.

We can't be the same, but we can learn from each other :)

btw, over the last few months, you have improved your comments a lot. Have you noticed?

It is a stark truth that we are born economically fool. In spite of this, we have many dreams and we have to achieve them. Maybe it's easy for some and hard for some.

It is definitely easier for some than others, as from a young age, some children exhibit delayed gratification tendencies, while others instant. However, it doesn't mean we can't improve.

Right, we are all born non financial-reader and we tend to do what they say us as financial advices. However, by time, if one use his mind strategically, they could increase their wealth. You don't have to be a master.

This is something I reckon many miss.

The Afterpays and the Klarnas of the world charge a hefty sum for their services. What's even more disgusting than ending up splurging money like that is having to pay high interest on the money.

It is crazy - a lifetime of running from debt seems to be "on the cards" for many.

In Finland alone, there are about half a million insolvent people. Not all of them are in that position due to their own irresponsibility but many are.

Yeah it is high. 10% of the population.

A few years ago, I was looking at how many had drinking issues and gambling issues. There was something like 600K drinking, 130K gambling (top of head). There is probably a lot of overlap in these types of areas, but still, if you add them all together, a lot of people are having issues.

Much of this is due to the availability of easy credit.

I read somewhere that a few generations ago, neuroticism was one of the most common psychiatric disorders. Back then, people were perhaps more inhibited in general.

These days narcissism is said to have become more prevalent. There are more people who are overindulgent and disconnected from others.

The way that affects politics is how more people than before perhaps want quick solutions. Con men like Trump or the many European populists capitalize on that and promise the Moon (while delivering a pebble). I think politics is somewhat more infantile than it used to be as I remember it from the past.

And, I think this feeds into the loop of how people handle (or don't handle) relationships too, as they are unable to connect and when they try, they are only focused on themselves, not what is required for a healthy partnership. This might also then have effects on finances too.

I agree. It is also because it has become a consumer sport, entertainment. It isn't about actually getting anything accomplished, it is about winning over the audience.

The most prevalent pathologies are different now. In the past, more people were pathologically inhibited and violence was much more normalised.

Identity politics.

But I wouldn't put it that categorically. It is still mostly about getting things accomplished. But the quasi-tribal element is significant and impossible to miss these days. The part which is all about who said what to whom in a wrong tone or who snorted or drank what is bigger now than a mere decade ago.

When it comes to consumerism and relationships, this song sums it up perfectly (make sure you have English subtitles on if your French is not adequate). The song and the video are quite amusing, too:

That's a lot of money to blow.

It is a massive amount. The equivalent of a deposit required for a 400K house.

The person in the article is renting.

I guess when you have a lot or it comes easy it easier to run risks.

Of course I could be wrong too.

it is easy come, easy go - but I also think that when it is "hard come by" it can be that people think they deserve to spend it more, often wasting it instead.

You have a point there.

Either way losing so much money 💰 must be a little painful.

I went to Kmart yesterday and got a vase, two new pillows, some lemon essential oil I use for washing machine, four bowls and a long sleeved tshirt for cold weather and it came to $50. Look Kmart isn't squeaky clean but it's not After pay and it satisfied my shopping urge to blow 80k. I only used afterpay once for a new wetsuit because it was far more essential than a vacuum cleaner.

After we paid our mortgage off three years ago, we have been entirety debt free. I never want to owe anyone anything ever again

I was just having a look, Afterpay has 5.9 million customers - that is like 20% of the country!

Goodness. Buy, buy, buy! It's like the old layby system I suppose, except you already have it - which leaves you wanting more stuff, because you've already had the happy buzz from the purchase, and now you're onto the next one. Clever, capitalism.

This is true✨ The last line hit me hard every purchase made is an investment whether to the buyer or seller. Economic /financial management is something that nature shapes you into because by nature we're born economic fools. This! Weighing my expenses with my income has always been my principle💆♀️ You always do well with your writing @tarazkp

That is a lot of money and debt to spend but I do recall a bunch of these companies running into issues by issuing bad loans. It doesn't make that much sense to me to give that much money out to people who were already having trouble getting money.

Posted Using LeoFinance Beta

Damn that’s a lot of Cheez Whiz !

80k will buy a house in many towns and villages.

Sorry to hear they blew it on consumer goods.

Posted Using LeoFinance Beta