There is a reason to be very optimistic about Hive. Many feel that it is a nothing chain with very little taking place. They feel the value is low in relation to other things out there.

Unfortunately, a great deal of this missing a major point about money. When we truly look at the monetary system, we see why Hive is aligned very well for the future evolution.

We are also operating in a completely different era as compared to before. Much of what is taking place is radically transforming most of society. Money is at the center of this.

This is a high-information age. While a single currency is beneficial in a low information time, the opposite is true now. Over the last 80+ years, the banking system advanced along with technology. This completely altered the state of money.

Pre-Depression, we operated on a hybrid of commodity money along with private bank money. In 1937, because of the bank's distrust of the Fed's ability to act properly when needed, they decided to ignore the idea of reserve based money. Instead, they opted for one ledger-based. A decade later we saw the emergence of the Eurodollar system.

This is the state we find ourselves in today.

Source

Governments Excluded From Money

For most of the last century, the major governments were excluded from the money game. The same is true for the Central Banks. This comes as a surprise to people but reserves are not given any consideration by the banking industry. The major currencies are generated by the commercial banking system and that is a small piece of the total. The reality is banks were creating hundreds of trillions of dollars that is totally outside governments or the Central Banks.

This is also the reason why the idea that governments are going to stop cryptocurrency is a complete joke.

Ledger banking was in place for decades. There is no way for any authority to step in and regulate it. As technology advances, this is only going to get increasing more difficult to monitor.

The Bankers Are Going To Be Excluded From Money

This might seem like a bold claim but it is also true. In a world of low information, the needs for an agreed upon standard is crucial. This also opens up the door for all kinds of middlemen. Ultimately, these entities end up becoming gatekeepers for the system.

The bankers gave us the model, technology is providing the capability. With Ledger Banking, money creation happens instantly. All that is required is an agreement between two parties. Since the industry served as the on and off ramp to most financial activities, it was in position to assume full control.

It makes sense if we equate it to a bridge. When confronted with a river, to enable the most people to cross in an efficient manner requires the building of a bridge. Of course, the one who controls the bridge has power over most activity.

Here is where bankers were positioned.

Money In A High Information Age

What happens when a bridge is no longer needed? In other words, how does the situation change if there are hundreds of bridges? The bridge is the bank. When we advance, the need for a single currency diminishes. This means we end up with thousands of bridges.

Suddenly, we have banking without the banks. Money, which was Ledger-based for decades, now can exclude the bankers.

For example, who needs a single unified currency when an application enables near instant swaps among thousands of tokens. There no longer is a need for everyone to operate using a single currency. Everyone can have their own yet the application manages all the information required.

Here we see where power is instantly sucked out of the banking system. Not only are unlimited number of bridges showing up but people can instantly jump from one to the other.

Nobody is in control.

Blockchain - New Version Of Check Clearing System

Many overlook the history of checking as a form of money. According to research by the Federal Reserve Bank of Atlanta, even as far back as 1910, most of the transactions took place using this medium.

This established a system of correspondence, payment processing, and settlement. Checks were treated the same as gold backed money as well as being transferred at rapid speeds. Over time, a massive network of computers was employed by the banking system to facilitate global transactions.

Money on deposit in Account A (ledger) was deducted while it was added to Account B (ledger) in a different bank in another geographic region. It was all done without any physical transference.

Due to the advancements in communication systems, this was able to be accomplished in less time than sending physical money. Yet, the legacy system became obsolete.

Blockchain not only replaced the bank, it provides near instant settlement. The transfer of money from Account A (wallet) to Account B (wallet) can be almost instant. On Hive, this occurs in roughly 3 seconds.

This also eliminates the need for:

- Payment Processing

- Interbank Settlement

- Bank Wires

Money Is Information

As we can see, the system employed over the last century is nothing more than an information system. The entire Eurodollar system (aka shadow banking) is just accounting. That is what ledgers are. However, we also notice this is a large portion of traditional banking.

Elon Musk likes to call money a database. He is not far off.

The advancement of money over the last century was not do some much to financial evolution as much as improvement in our communication systems. Information can now be sent around the globe in under a second.

Money transference is as simple as sending an email or text message. It is really no different.

A blockchain like Hive is really an information system. It is a database (Ledger) of transactions that travel around the world, without any banking system or third party involved. The decentralized nature of the system means that, once again, nobody is in control.

Understanding The Banking System

The key to replacing the banking system is to truly understand it. This provides the foundation upon which to build the application to fulfill the services presently handled by those entities.

Why is Hive ideally suited for this? To really get that answer, we need to go back to the basics. If banking is really a glorified communications system. then having a robust one is crucial. With Hive, we are dealing with 3 second transaction times. This is very powerful when it comes to global finance (communications).

It also has a fee-less structure to it. This is something that is vital. Eliminating the middlemen and replacing them with new entities is not much of an improvement. Essentially, there is still friction within the system, i.e. additional cost.

Hive is one of the few that removes this from the equation.

Cryptocurrency - The Evolution Of Money

With more than a century of Ledger-based banking behind us, it only makes sense that the next generation builds on top of this. Cryptocurrency is able to do that.

Here we see where blockchain expands the private money system. It is a realm that governments and Central Banks are not involved with. As we just showed, this is no surprise since they truly were not part of the money game for a long time.

Cryptocurrency is data and that is getting very difficult to control. We see systems being built out that are truly decentralized in nature. This means that network, with nodes all over the world, is unstoppable. The transfer of data simply keeps occurring. This is an issue for the establishment when that data represent money.

This is the next stage in Ledger-based money.

Of course, this time, instead of governments being cut out, the commercial banking system will be pushed aside.

Eventually, banks will become like newspapers, a relic of the past.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Awesome post! Agreed on the crypto side, that’s why I’m in hive and PeakD! Haha. Nevertheless, for some country like mine, legislation has made it such that we can’t really withdraw our crypto. I am currently in a situation whereby I’m not sure how can my crypto be one day monetised. I know it’s making us laggards, but it’s one of the huge reason why my country has yet to pick up on crypto

There is a lot of back and forth. Governments are going to try and retain control.

One step in the evolution is going to be the ability to buy everyday goods and services using cryptocurrency. This is what will satisfy one use case.

We also are evolving towards digital nomads. This will take some time but people are going to have options.

The key for now is for people to keep filling their bags and the network effect starting to take over.

Posted Using LeoFinance Beta

I know right! I’m just hoping for a more relaxed policy. When that happens, hopefully the idea of groceries will come soon after. I heard of many countries are already allowing that!

It likely will have to start with online stuff and stores there. Then perhaps it will spread.

Food and stuff like that might be last in line. Before that you will get stuff like clothing and shoes that can be purchased with crypto.

Posted Using LeoFinance Beta

Oh I heard, there’s a website that allows you to buy property! Perhaps I might be able to just buy one in the future!

There is something that allows one to buy tokens in real estate. I cant do it since it is barred to Americans. Europeans can get it.

Early days but that will be a viable option in the future in my opinion.

Posted Using LeoFinance Beta

I am so looking forward to it. It’s like things that you might never have once wondered, actually becoming reality very soon! Pardon me, but I’m still stuck with the fact that you can buy real estate with crypto! Hahaha

The governments are going to fight for control, and they will win until enough people get off their duff and do it themselves. Problem is these ledger systems do require some ledgering and most people (myself included at times) just want someone else to do the ledger work.

It is hard to follow the not your keys, not your crypto creed truly. It will come eventually and I do hope sooner rather than later, but people are gonna have to do a lot of waking up and a lot of self initializing.

Posted Using LeoFinance Beta

Blockchain is what handles this.

Posted Using LeoFinance Beta

After barter, it is believed that the first money was cowrie shells. In fact, their mining is real bitcoin mining, at first, you find shells near the coast, and when they start to run out, you have to look for them far from the coast, at great depths, spending more energy and effort, or, wait for a storm and get them on the beach, almost for free, how to buy bitcoin on the market without resorting to mining in the days of its fall).

Posted Using LeoFinance Beta

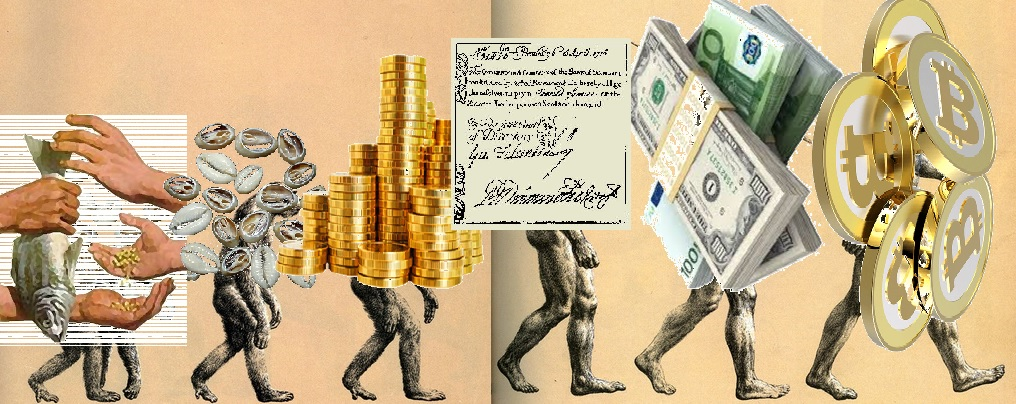

Lol, everything aside. That picture tells it all :D

It really does.

Posted Using LeoFinance Beta

Agreed with so much of this and I think we will see off line business in local areas developing their own communities and coins. Let's say for example where I live in Antigua, Guatemala have the Antigua area community that has there Arch coin since Antigu

a is famous for the Arch.

Give local businesses away to offer discounts for paying with the Arch and have a xArch coin issued when the Arch coin is used.

These have their own value and can be used to convert to Arch or stake and have voting rights. LOL I am rambling but my point is I think you are correct and we will have millions of different communities with there own DAO system and coin/token.

Without a doubt cryptocurrency offers communities a new path. Private money is nothing new, nor is localized money. What is different is the global ledger system. So while the money could be local, anyone around the world could support it.

Consider this idea with charities or other endeavors people support.

The possibilities start to grow exponentially and place control in the hands of communities.

After all communities are going to end up replacing corporations.

Why wouldnt everything else be targeted?

Posted Using LeoFinance Beta

No doubt people will be injecting funds into projects for multiple reasons.

I live a fairly humble life and it costs me about $2,000 a month and I have an expat friend that lives off of about $950 per month living in a boarding house.

That is definitely a form of community living.

My point is the normal pay around here for daily work is about $12.00

It does not take much investment to really help improve an alternative finance system.

The couple from the MoneroTopia YouTube channel works with importing coffeee to the states and give customers the ability to tip in XMR.

I believe they told me it averages out to be around $50 per month per worker.

That's four days of pay.

Walk away from banks and governments and the growth around the world will take off like a rocket.

The concept is the same everywhere, only the numbers change.

I believe people are going to start looking for ways to cut their expenses while making this shift. It is hard to argue with the fact that the potential keeps expanding.

$50 here, $100 there, another $25 else can add up.

Posted Using LeoFinance Beta

What is your opinion on universal basic income? Do you think it's sustainable all over the world? Or is it just another socialist scheme which may not work everywhere? I have that kind of feeling about it.

The problem with universal basic income is that government is in the middle of it. That means it is susceptible to political whims. It is also dependence upon the state (politicians and bureaucrats) that is never healthy.

Plus outside the US, nobody else can fund it since they are having a tough time selling their debt.

That said we will see UBI in the 2030s from most countries as governments try to remain relevant. Keep in mind we are developing all new starts, the network-state. Governments are going to have to compete, something they are not good at.

Posted Using LeoFinance Beta

One thing I am going to be writing about is that the US should do away with income tax and fund it through debt.

Posted Using LeoFinance Beta

Those are some really great points about what Hive has and what it can offer. It certainly does seem to have a lot of the ducks in a row that many other blockchains are still working to establish.

Posted Using LeoFinance Beta

The foundation is being developed to really make a difference. The point here is to open people up to what is truly happening and how big it can be. Since most truly do not understand the banking system and, by extension, money, they are underestimating what is taking place.

Posted Using LeoFinance Beta

I think even I fit into that category sometimes. I am learning new things every day.

Posted Using LeoFinance Beta

Most do. It is easy to see why. The system is one of a lot of misdirection. It is easy to get confused and then to buy into agendas people promote.

To get away from that requires reading a lot of dry stuff such as FOMC meeting transcripts and economic research by Fed members or economists over the years.

Trust me, it is a challenge but getting to the bottom of it opens up a new way of seeing how things operate.

Posted Using LeoFinance Beta

I think I will just stick to reading your posts! :) Haven't steered me wrong yet!

Posted Using LeoFinance Beta

LOL let me do the dry reading.

Here is one I will let you cover.

Let me know what you think.

Posted Using LeoFinance Beta

Looks like they have some kind of certificate error. They might want to get that figured out if they are a bank!

Posted Using LeoFinance Beta

This is a perspective not getting much noise in the crypto space. No wonder those on Hive are 10 steps ahead of others!!

The central banks ability to control the money supply through interest rates is slowly deteriorating and the use of off balance sheet lending and money has ballooned in the last 20 years. The need for central banks is disappearing!!

Balance sheet banking started in the 1950s so it is really not even close. The Eurodollar system was in charge by the 1970s. The Fed was basically impotent at that point.

Actually the bankers told the Fed to kiss off in 1937 after they realized the authorities were going to botch it all up.

Central Banks push reserves which the banking system has no interest in or concern about. In other words, it means nothing to them.

Posted Using LeoFinance Beta

So you are saying the commerical banks are running the show?

They are and have been for decades.

The international banking conglomerate operates far outside the reach of governments. It established a system of money based upon Ledger technology in the 1950s and still run it today.

On top of that, in a credit based monetary system, the money supply expands when commercial banks lend. That is how we get the "creating money out of thin air".

Now we are looking at eliminating the bankers from the equation.

Posted Using LeoFinance Beta

The money supply we have in the economy, banks increases that exponentially. They can create money easily, thanks to fractional reserve banking. The government and banks are in control of this. When they see they slowly lose control due to blockchain, they will freak out. That's the normal reaction. They cannot do anything to stop that since it's decentralized.

We have the option to choose what to use and how we will build our wealth. Now we have the traditional financial system and blockchain-based system. It is a blessing that we can do banking without banks. Thank you @taskmaster4450 for writing about this in detail.

Posted Using LeoFinance Beta

The governments of the major currencies have no control over it. Nobody can make the banks lend. And that is at the known level. The real banking sector is in the shadow realm. Here is where the trillions (and possibly quadrillions) are.

That is real epicenter for everything and it is all ledger based.

Posted Using LeoFinance Beta

Still I prefer gold as the most sustainable one but the saving system for gold and huge transaction is not so convenient here. But crypto has its drawbacks including the security issues for common people without proper Knowledge on the security and they can be prey to the hacker easily.

And another one is the governing body of the coin or token issuer, they become billionaire without any conceivable realization from the general people.

Hope more decentralization with 0 premined and worthy access of the system could evolve to solve these issues in near future.

It shouldn't be like free money and sudden collapse in the marketcap and price goes to zero.

I am thinking that most literature on the subject is really obsolete if it is really true that governments and Central Banks were excluded from the money game for so long. Just curious if you can introduce me to a book giving an overview of such a perspective. Anyhow, this is something badly needed to replace the current system that we have. Looking forward to the exclusion of commercial banking in the near future!

Posted Using LeoFinance Beta

Check out a series on YouTube called Eurodollar university. That is a good starting point. The two do a good job covering the basics of the topic.

Posted Using LeoFinance Beta

Thanks for the info.

Very little out there about it. Have to read through a lot of FOMC meeting notes and different things like that. Some writers out there touch upon it. Do a search on YouTube for Eurodollar and you will get some insight into it.

As for the exclusion, this was set up by the banks. Things such as LIBOR and Repo markets all are a part of this. Trilateral repo agreements are what is known; bilateral repo agreements are harder to uncover.

Posted Using LeoFinance Beta

Reading FOMC minutes is quite challenging. Not familiar with LIBOR and Repo markets except that I usually stumble with the terms reading articles on finance. Thanks for this info.

You arent kidding. The most recent paper I read was a study in 2008 by the Atlanta Fed on how checks became the main form of transactional money in the 1910s.

Posted Using LeoFinance Beta

Mine, I forgot the exact year. I think I read at least two to have a peek into the mind of the Fed coz stock traders are confident in their strategies, but not when it comes to the impact of the decision of the Fed.

Ignore the Fed. They often get the reverse results of what they are trying to get.

It is a game of expectations. That is what they play. They do not control the money supply nor do they truly control interest rates, especially the long end of the curve.

Hence what do they really do? Fool people.

Posted Using LeoFinance Beta

Finance people who get signals from the Fed are mostly those of the traditional type. I forgot the exact year when I stopped following it.

Concerning eurodollar, I enjoy my initial reading on the subject. It is something really new and surprising to me. I wonder why I never encounter this system in reading literature on economics. I think this is one major reason why most people are kept in the dark when it comes to the monetary system. Thank you for introducing the subject to me!

I don't think the banks will step aside very easily. What do you think about CBDCs and their play in this system? After all, the CBDC will knock away the banks as well. I am looking forward to the point when crypto becomes more common as a payment option. Also, do you think the dollar will still be the unit bias we will be using when we make the switch?

Posted Using LeoFinance Beta

No banks wont step aside.

CBDCs are very interesting for the banking system. You are right, it could be a major screw job depending upon how it is set up. From what I read, the Fed appears like they will protect the banks through the wallet system and have much of it still go through them.

Of course Treasury is no talking about E-Cash.

Posted Using LeoFinance Beta

Great post, the cover image is beautiful. What I am wondering is how taxes will be dealt with in order to keep the national social system in place. In Italy we have a good health system for now, how can we pay taxes to keep it going? I must already start thinking about this seriously. The time of obstruction to cryptocurrencies is over, now it is time for integration.

Governments will eventually be obliterated, for many reasons. Crypto is just one of them.

As we experiment with new governance models we are going to find that our present systems get whacked.

After all, some thought the feudal state was a good idea too. That is now in the history books.

Posted Using LeoFinance Beta

Woh! your comment makes me understand that I am not considering that even the form of the State / Nation can be revised. Congratulations on how you see far away.

A lot of things are changing and it takes some vision to see what is possible now. We will see what comes about in future years.

Posted Using LeoFinance Beta

Absolutely, the crypto is an Evolution Of Money and this has potential to strengthen the financial system by giving more control to people which currently banks have. DeFi is the great example of this.

Posted Using LeoFinance Beta

DeFi is really going to alter things. It will take the Ledger based monetary system and decentralize it.

That is effectively what we are doing here.

Posted Using LeoFinance Beta

Crypto emerged as a natural transition towards digital sovereignty and independence, lowering the barriers for people to transact and participate in the global financial world.

Globalism demands a fast, secure, and transparent way of conducting businesses, and transferring funds. There's a huge market demand for such systems, both in the financial, gaming, and social media world.

Fun times ahead.

Posted Using LeoFinance Beta

This was in place for the last few decades. The challenge is that it only extended to the international bankers. Not the rest of us.

Now cryptocurrency is bringing that forth. We will see how quickly we can ramp it up.

Posted Using LeoFinance Beta

I agree that cryptocurrency is the evolution of money. When I talk about such things with those who don't crypto I ease them into the conversation by telling them they already swap digital numbers from one bank account to another with each swipe of their bank card.

Posted Using LeoFinance Beta

As shown in the cover image of this publication. Money or the way the economy moves is constantly evolving, it is incredible that 100 years ago you would never think that money could be digital and that physical paper would be almost unnecessary, and now we have cryptocurrencies, a 1000 times better way to get money.

That is why I think that from now on what we will see will be a major evolution in favor of decentralized money.

Posted Using LeoFinance Beta

Crypto is still that best Plug