I am not a fan of the central banking system in many respects, but at the same time, they are predictable, aren't they? This means that given conditions, they only have a select few tools to use and how they use them, is remarkably unsurprising, which is why the futures market can be used to indicate expectations of what they are going to do.

In the case of rising inflation, the response has pretty much always been, increase interest rates. And, because of the last two and a half years of pumping debt through various cash injections into the economy and supply chain struggles, all on top of the lowest interest rate period in the history of interest rates to the point they were negative, inflation was inevitable and therefore, so too were interest rate rises.

Yet....

Is it really thanks to the Reserve Bank of Australia (RBA), or does blame lay at our own feet, where we have played a part in driving this inflation And the conditions we find ourselves in? Especially because so many of us FOMO'd into house, because we didn't want to miss, making 30-year decisions on conditions that would last a couple years, like Corona. And, Corona lasted longer than expected, meaning that people were making those long-term decisions on what would likely be their largest purchase in their life, on conditions they expected to last several months and, those conditions weren't good "forever home" conditions.

When my wife and I bought our house, we moved the weekend that lockdowns were started in Finland, but we had already negotiated our deal before Corona was "a thing" globally. This meant that prices were still low (relatively) and we were lucky, because we were able to sell our apartment at a decent price and have equity to inject in. Not only this, we were also able to secure our loan at a low interest rate and collar it for ten years.

At the time, people thought we were crazy spending a little extra on the collar, but with historically low interest rates, I felt there was only one way it could go, even more so as there had been a bull market for some ten years already. At some point, the economy has to cool down, but there was also a massive amount of cash floating about, which has to go somewhere.

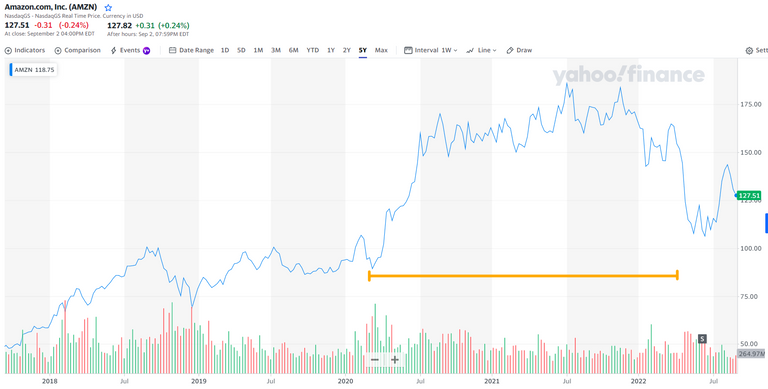

Then, from day one of Corona - all that debt pushed into the economy and whilst local businesses were forced to shut down, the global conglomerates with scaled online presence, were the only place to buy. Which, led to its own inevitable pathway;

This is a massive amount of capital getting driven into a small range of businesses that are capitalizing on a captured market by customer support, investment support, and government support through lockdown measures. Meaning, once lockdowns start to end and the reliance on these businesses reduces, the markets open again to competition again too, and inevitably, they are going to face a decline, especially since there are still supply chain challenges which they face in delivering to their customer base.

The large investment money withdraws from these companies, leaving the retail investors scrambling, but also, because of the increasing costs of living and increased cost of the loans people have taken, more of the money is being used to shore up defenses, with more ultimately going back into bank pockets, as they cash in on all of that debt they generated through the support of overpriced housing. As said;

Predictable.

Isn't it? Well, for anyone paying attention, but for people like those above who at least seemed to reign in what they spent on a house, considered the possibility of rate rises, but underestimated how aggressive they would be, it wasn't quite as obvious to all. So, now, there are an absolute mass of people globally who were convinced to push their debt out to the limits while interest rates were low, only to have those rates move very quickly upward, severely limiting their options, as the housing market starts to cool and in some places collapse and they have a debt that is larger than the value of what they hold.

A rock and a hard place.

For many people now, it is about survival, where they are looking to save where they can in order to cover their rising debt obligations, in the hope that it will be enough to make it through until there is some respite. Easing isn't "expected" until 2023 at the earliest, but even as it eases, it is going to ease slowly, so if using saved resources and investments to cover the rising costs, they will still be depleted at a decreasing rate, which means that once things are "normal" again, there isn't much left, if any at all.

Where did it go?

Into the pockets of those who encouraged them to get into this position in the first place so that they are able to buy the dip in the markets, getting in at the bottom. As things recover and the rest of us will be able to spend again, most will go into consumer items from the very companies that have been financed by that group, pumping up valuations. For those who are going to invest instead, they are going to be buying into these companies that will see a return, but on the back of the dip buyers, inflating their profits once again.

Debt is the devil

At least for most of us, because we aren't taking on debt to generate a higher rate of income than what we are paying in interest, we are taking it on to cover our living arrangements and then, to cover our debt obligations, worsening our ability to invest to generate, by digging our hole just a little bit deeper.

Predictable.

Taraz

[ Gen1: Hive ]

Posted Using LeoFinance Beta

We've discussed this you and I but I will say that ANYONE that thought opening the money tap to cure a covid slowdown wouldn't be inflationary is deluded at best.

The housing market is contracting everywhere in the US, and 'tourist' destinations are in collapse. A hell of a lot of places were bought for short term rentals (AirBnB) and many, if not most, tourist locations have taken steps to curb the problems that come with weekend rentals. In some places that I know the citizenry is in revolt (Hawaii and San Diego) due to bad actors in the short term rental business. Plus it has driven 'worker grade' housing prices way up so the workers have to move on. On top of record inflation and high interest? What could go wrong?

I also know that the RE market here in Arizona is going south and that there are a lot of new home starts that will not end up being new home finishes any time soon.

Predictable is a real good word for all this. How long until the central banks open the money faucet again due to rising energy costs? I think not long. At least we should get some infrastructure for our pain with energy. More solar and wind.

and conniving in the midrange - at the worst?

It is amazing that people who are renting are able to live anywhere these days - it is all going to end in a lot of slums, crime and the average person worse off financially, socially and with their opportunities available to them.

Every day it seems, I read of a construction company collapse from Australia. Considering how much they are getting paid to build, that is worrying. The supplychains markups are insane on building material. To keep costs down, our builder is using offcuts of gyproc for the walls, when he would have used fresh sheets before. Not because it makes much difference for us (due to the size of the space) but it is his habit now.

I suspect, it won't be too long before a reversal and, the markets will drive again.

One last price gouge on energy through the winter perhaps.

My mortgage will probably go up $6 a month because of this. Don't know how I'll survive. People need to learn to live below their means. :)

It should really be "living well-within your means", shouldn't it?

Why not both? :)

I think most people take the "live well, with their means" approach :D

I am living well, while also being below my means, I think :D It gets all very confusing with all these "buy now pay later" services that most people opt for these days. Sure they're good for debt recycling and keeping your money yours for as long as possible, but its just friendlier, more apparently ethical pay-day lending.

It is funny isn't it? Not too long ago, pay-day lenders were seen as sharks - put it into an app however and suddenly, they are innovative businesses.

Incidentally, the highest paid CEOs or Managing Directors in Australia, too. Riveting stuff. :) I guess that financial literacy isn't taught in schools here, so it is no real big surprise, shock, or horror to discover this information.

Maybe they are predictable, but they have been the root of capitalism and let the free market operate for at least two centuries. The coronavirus is an exceptional event that does not occur often in this world.

So far, the alternative financial decentralized system has not made it through, but maybe in a few decades, who knows?

Yes thing will change a few decades from now and I believe decentralized system will always win over the long run.

Posted Using LeoFinance Beta

predictable, not good. But, knowing the predictable not good nature of them, it is possible to combat the affects they have. Most do not, instead choosing to support the system that abuses them - like having Stockholm syndrome.

DeFi will come into its own, but only once there is enough wealth built on actual products to do so.

Those who took out a long-term loan at the historical lowest interest rate in my country have made great profit today in terms of two points. The repayments of the loans they took out are now devaluated due to the economic crisis. The other is that the value of the houses they bought have been incraesed.

yes, if they bought just before or at the beginning, all is well. As long as they are increasing their income according to the inflation, they are able to pay back faster. But, the cost of living is eating their ability to do so, which means most pay back at the same rate they were earlier.

I'm a little extreme on this issue, Mr @tarazkp.

The hole gets deeper when the calculations go wrong and will instantly bury someone who is in debt for lifestyle needs to reassure others that all is well.

All debts are always in a bad condition if they are intended for other than investment. Even investments with accurate calculations also always have a risk of missing. What is always fine is that those who give the debt, who freely act on behalf of the lending service and guarantee that the debt remains to be returned.

Yes - I don't recommend getting into debt to invest, as some do, but there are ways to mitigate those risks also - which means that for those who are willing and able, there is opportunity. I don't invest with debt.

The world will survive this crisis easier than in 1973. Cryptocurrencies will no longer be below summer lows. Hive will be above $1.20 in 2023.

I am hoping for the 1 mark to be the base-low for Hive (2 would be ideal), but the upside from there is far higher and I expect that once the markets start recovering, we are going to see some real volatility.

The interest rate is one of the driving forces in the turns of market. Over here in Ghana, we are facing a lot of high interest rate compare to Western Countries.

Thanks for your good post.

Posted Using LeoFinance Beta

Is it manageable? Are people coping, or have they been getting into more debt over the last years and are now hurting more?

The central banking system around the world are all predictable this way. We only owe it to ourselves to invest into income generating assets while others don't want to in order to stay above the curve. Debt is a killer of freedom if we don't avoid it or find our ways around it.

Posted Using LeoFinance Beta

Absolutely. That is why it is called debt slavery.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share 100 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Congratulations @tarazkp! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 1210000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Repossessions will be a big thing over the next few years and great if you have spare cash lying around as there will be some bargains to be had. Your master plan has worked out perfectly as the timing may not have seemed that great, but it couldn't have worked out any better really. Why do people love living on credit as you are living beyond your means and don't deserve it as it is a fake life that cannot continue forever.

At this point, I am not surprised to see what happened with all the money pushed out. Most of what passes through Congress ends up with the bags filling up the powerful and only a little bit going down to the average person.

Posted Using LeoFinance Beta

The interest rate is really one hell of an issue . Here in Nigeria, an increase in interest rate means it will now cost more for Nigerians seeking to borrow money from the banks for loans such as personal loans, car loans, mortgages, and other forms of consumer loans. In general; those who borrow will likely witness higher interest rates while those who save may attract higher interest depending on their financial muscle. It’s really an extreme sport coping with these policies .

The headline feels more like a clickbait. I think people should be responsible for their personal financial situation and if they don't understand the context behind all the interest rate hikes then they need to go read up about it.