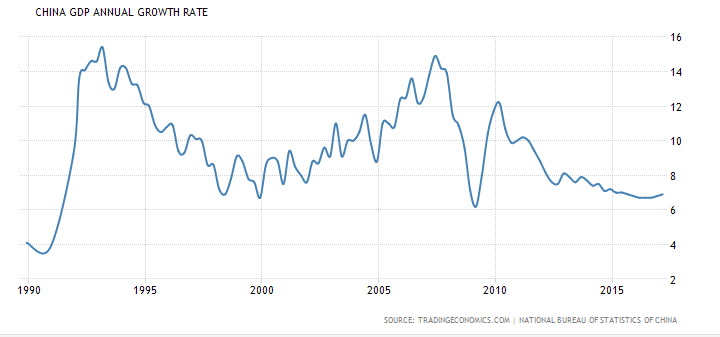

China has been embattled with aggressive devaluation of the RMB as the economic growth has slowed to the lowest level in over 25 years. Meanwhile, the USD has surged on the back of strong economic growth in the US.

New policy on foreign exchange and cross-border remittance comes into effect July 1st

Source

For those unaware of what the policy entails. These have been in place for a while but not officially enforced as the government has given financial institutions a lead time of several months to implement systems safeguarding their policy.

As of July the 1st, the rules officially go live.

The policy states :

Individuals are limited to exporting $50,000 per year.

Transactions are capped at $10,000 each, and once per day

Individuals must fill out a large transactions report

Individuals are prohibited from export of capital for buying bonds, insurance products and real estate

You may not lend your quota to other people to send money abroad

Individuals will be strictly investigated for money laundering if the rules are broken

What about Bitcoin?

The three largest Bitcoin exchanges in China (Huobi/Okcoin/BTCC) have only recently re-enabled Bitcoin withdrawals after several months of investigation by the PBOC pushed the exchanges to tighten up on Know Your Customer / Anti-Money Laundering policies.

LocalBitcoins Volume in China

With the main exchanges enabling Bitcoin withdrawals, volume on localbitcoins in China has seen a significant drop. But remains above the multi-year average.

Bitcoin prices in China still command a 3% premium over average Bitcoin prices on western exchanges at time of writing.

Impacts on Bitcoin and other industries post July 1st?

Capital controls seem to be working as USD reserves have actually started going up since controls began tightening late 2016.

Now that investing in real estate is prohibited, the global property market will no longer be propped up by the worlds largest buyer of overseas real-estate.

Some reports have suggested capital flight is a large contributor to the Bitcoin bullish market.

With the PBOC closely watching the exchanges, Bitcoin may become less attractive as a method of sending larger amounts of money abroad. This is evidenced by the muted volumes on the top three exchanges.

However, our "favourite" person in Bitcoin - Jihan Wu thinks otherwise :

But I don’t think the Chinese Government will do very aggressive regulation over bitcoin. I just think they want to control the risk for those investors who don’t have enough knowledge about bitcoin.

Is the July 1st going cause some more volatility on the markets?

Most likely.

Whilst most people have been focused on the Bitcoin UASF for August 1st, it is difficult to ignore the potential significance of the Chinese capital outflow measures officially being enforced starting July 1st.

People completely unaware of Bitcoin are now asking me about it, many of them also showing great interest in ETH.

It's been a wonderful opportunity for me to introduce Steemit to them whilst general chatter about crypto is at an all time high.

What I see, is a fine example of human psychology. People see assets like Bitcoin and ETH soaring only to invest for a quick buck. Meanwhile, smart money secures their exit.

Have they not learned from the Shanghai Stock Market? Apparently not.

Set your calendars for July 1st. Something big might happen!

I want to take this opportunity to say a big thank you to Steemit and all my followers and friends who have supported me throughout my journey, giving me the opportunity to be free of the chains from China. It has been truly liberating and for that I extend my gratitude to all of you. Under normal circumstances, avid travellers such as myself would no longer have the means to go freely abroad. Steemit has changed my life forever. Travel with Me and Miss Delicious will live on!

As always, I appreciate your up-vote, follow and comment!

Great report. Bureaucracy is slow. We are faster :-)

Advice worth heeding ! Thank you

interesting

really? shoot

that sucks out there then if this is the case

this is the short cut to becoming financially independent

July 1 - noted!

hello can you support #faithinhumanity

https://steemit.com/landmine/@tinashe/when-life-becomes-living-hell-for-landmine-victim

"economic growth has slowed to the lowest level in over 25 years"

to only a 10% growth? i guess china is doing pretty well compared to numbers in the western word. i may wrong

Remember, it's the rate of change of growth that people respond to.

6.7% for 2016.

you "wowed" me again, by coming up with the right stats

like i mentioned in some replies to you earlier, you dong a fine job over here :-)

thx for it, i was too lazy to find it myself. but i knew u will come up with something

This post received a 19% upvote from @randowhale thanks to @sweetsssj! For more information, click here!

Didn't know you are also expert in economics. So used to seeing your travel blogs

Great post my cryptobrother, awesome! Thanks for sharing, I agreed, the asian market are going to play a big role on the whole cryptocurrency market, if you check the trading volume of Ethereum you will see that 3 of the top traded exchanges for Ethereum come from Korea (KRW). This can be seen in this link https://coinmarketcap.com/currencies/ethereum/#markets

cryptosister! Thankfully the Koreans have been helping keep things alive. Not a massive economy though.

the entire Korean population is only 3% of China's.

I recognize that this was posted 4 months ago but I was wondering about your opinion of where you will be in ten years.

I must apologize to you because I felt that your postings suggested that you very superficial. There isn't anything wrong with posting about travel and food ... I am jealous of your success. However I am afraid that I dismissed you as a little cute girl but very shallow in your view of the world. This single post and your responses to the comments showed to me that I am very wrong. You are both intelligent and thoughtful and I hope that you will occasionally post similar articles so I can learn from your perspective.

Hoping for your continued success...

What do you think is causing the Chinese economy growth to slow down? Is it because the US is slowing down? USD is actually down and possibly trending even lower.

Growth of an economy has to be measured not just in change in GBP. Other internal metrics to support the rise in GDP have lagged behind.

For example, mature laws, regulations, education and even cultural. There was a lot of FDI which helped the two decade long miracle growth, but it was not matched by strong domestic consumer demand.

The government took steps to tackle the rampant embezzlement of money because it made the wealth gap between rich and poor grow.

Resteemed! Good info. Globally the Central Banks are losing control, and Capital Controls are a last ditch effort in most cases. With the USD/Petrodollar on its way out, do you think the Yuan/RMB will be a gold backed currency?

Honestly, I don't sere any currency being backed by Gold.

No one really has a grasp on thee actual supply of gold, the governments (US) have been manipulating it and suppressing it for a long time, even straight up naked shorting it.

It's clear they don't want people moving their wealth into asset classes that have a finite supply.

"... even straight up naked shorting it."

Your perspective, that as I know you - is determined by your research, is highly interesting.

Jim Rickards, Jim Rogers, Mike Maloney are all propagating different views on this. I am therefore interested in more information about this. I would very much appreciate if you could point me in the right direction where to collect more info. Thanks, you are so SWEET sssj.

Both China and Russia are holding large amounts of gold. I have my doubts that the US has any left. A gold standard isn't likely as you say, I agree.

The COMEX and LBMA are heavily manipulating the monetary metals with naked short contracts, that's why it is best to hold at least some of your wealth in physical form. Become your own central bank.

The tyrants at the Federal Reserve in the U.S., and on the other side of the pond in the City of London, are, and will do their best to keep people in their fiat debt-based monetary system, with capital controls.

Very interesting read, thank you. It's pretty obvious goverment has complete control over the cryptos cause if the exhanges are made illegal then bitcoin has no direct link to fiat and it's gone. That`s why I don't get why people think we are "free from the banks", even in the USA, if the banks found crypto their enemy they could shut it down in days...

I'm sure people will continue to trade over the counter with cash. In China, it's really difficult because even sending large amounts to people domestically now requires application and investigation.

被我抢了个第了个座,真难 :)

欢迎欢迎!

We are watching @sweetsssj

meep

I'd agree that some of the rise in bitcoin is due to Chinese demand for moving money. I'd also think that this regulation would probably be bullish for Bitcoin going forward, as its probably will remain the best option for moving money outside the $50,000 limit. Or, at least, other crypto that you will need BTC to move in and out of will be.

The only problem is that the exchanges will be required to report withdrawals to the authorities as well.

Yes, it will be far from perfect. But, I imagine you'll see the Local Bitcoins traffic spike right back up, and the market will always find ways to launder money. The amount of people that launder will be mostly based on how likely they are to be caught and how easy it is. I think crypto does make it both easier to do and easier to get away with than before Bitcoin was an option.

In June, there are many important dates as well, where the price of Ripple and DGB will go up. Keep watching after 20th June.

Upvoted @sweetsssj

In terms of macro economic hard hitting factors though, I think this is pretty big.. what are the reasons for ripple and dgb?

I have to say, I'm mostly just interested in Steem and Bitcoin, but that's interesting.

There are few more coins too, from which you can make lot of money. I am a cryptocurrency trading. I trade with DGB, ripple, steem, eth, and few other coins. I trade these coins for BTC.

Government usually go for vague ruling regarding cryptocurrency.

The usual "I do not allow nor disallow" action....

Like what Jihan Wu said, such action is to prevent any clueless people to invest in cryptocurrency.

After all, nobody want those losing investors to come back at the government, screaming for help later on.

It's a double edged sword, because at the same time, they don't want to stifle innovation in blockchain development.

I heard that Chinese government is planning to come up with its own regulated cryptocurrency, right?

Yes, it's suppose to be a crypto-currency. Part of it's war on cash.

interesting, marked the first of july in my calendar. I do believe there is only one direction for the bitcoin price in the long term...

I agree.

nice informative post.with the daily cap and all, it would really have a big effect on the global import/export industry as china is one the leading countries in the industry.

Definitely a huge impact there. I'm not sure about businesses, but I believe they must also report everything to the authorities as well.

Exchanges here in the USA have also enacted very strong anti money laundering practices over the past year, yet traffic has soared. I'm not sure if laws will really deter interest in crypto in China. As they say, "where there's a will, there's a way".

The difference is people aren't rushing to sell the USD, quite the opposite. The US does not have to worry about an over leveraged economy ramping up money printing either - wait, that's not true ;)

Oh snap! :)

Governments nowadays is in a frantic mode. With the rise of crypto currencies, regulations are at stake. Governments will lose control to every ones holdings.

We have to figure out how to break free of fiat.

That's the real fear of the Governments and also the banking sectors. They will be regarded useless in the long end since they will lose control.

Even with the internet, it's really difficult to understand what's happening in other countries. Thanks for giving me some insight into what's going on in China.

You're welcome. This is something directly affecting me, so I'm following it fairly closely.

I'm looking forward to what you have to report.

China has a lot of factors that will always lead to big growth.

But they have a closed policy and excessive selfishness.

Let's hope we can embrace each other and promote further improvements.

It's a problem for sure. Lots of government officials have been embezzling money from the country for years - and getting away with it, taking loads of money abroad. This is part of a move to stop that.

BTC? No. ETH? No. Steemit? fxxk yeah!

Go Steemit!

Nice article

thanks!

Good to have beautiful AND smart women on steemit. Great post and interesting arguments.

aww thank you, I feel like since joining steemit i've done so much learning, it's made my brain buzzy all day long !

If your brain calms down i invite you to learn German :D

German sounds scary!

But we have the longest words!

-Rindfleischetikettierungsüberwachungsaufgabenübertragungsgesetz

-Grundstücksverkehrsgenehmigungszuständigkeitsübertragungsverordnung

:D

I need to hear a sound bite of how those are pronounced!

listen closely

I've always wondered, can't the Chinese buy bitcoin in large amounts, then trade them for cash overseas (using local bitcoins for example)? Doesn't that allow them to export more than $50,000 a year?

Please upvote if you want to know the answer too.

Because, domestic transactions above a certain amount will be screened for suspicious transactions. This means if you intend to use anything other than cash for over the counter trading, you pose a risk of being investigated for money laundering.

Would they be able to trace it if a China national buys bitcoin, Then travels overseas (lets say Australia) and sells it for cash in Australia?

They can't know what you do with the bitcoin once you have it. That's why they're doing their best to stop people from purchasing larger amounts and letting bitcoin become the best way to shift money out the country.

I see.. Thanks for your reply :)

@sweetsssj as I am not so much in math and all, what you personally think where is bitcoin going. I mean where you see it after December 2018 ?

I don't really know to be honest.. And i'm not sure anyone could predict that accurately either.

Just asking about your personal feelings about that @sweetsssj, like I think it will cross $10k. just a rough idea...

That's very optimistic. I'm not sure what to think of it.

anyway you did a really good job here and i can see that you spend a lot of time on research and here's the result... a successful post... a big thumbs up for your dedication and hard work...

thanks raja;

I pressed follow button, I keep focusing you news ^^

thank you. I haven't written a news post before, but I thought i'd write one on the topic which is adversely affecting me the most.

Very interesting, thank you.

You're welcome :D

great work....do you get a sense that China is still in the very early stages of awareness? Where do you see things going ....please and thank you .

Actually, Chinese people are really quite crypto-savvy, every young person under the age of 40 I have spoken to knows about Bitcoin and more recently ETH. This is not the case outside of China.

I would agree vs the US....are they investing....adopting....using at this point?

Some are becoming mid term investors, if they can pick up enough reason to hold long term, then I think we'll see increased use. The problem is, the incumbent remittance services are actually very well integrated into society, and extremely efficient, albeit centralised. It will be difficult at this point to use bitcoin, atleast for micropayments.

i see....so you see them more as trading vehicles....them maybe some investment as a "store of value"....thank you in advance

Very insightful thoughts. Thank you for sharing that!

thanks terry, something very concerning for Chinese nationals who spend a lot of time abroad such as myself. But also something significant to consider for crypto savvy people as we all are!

Not good not bad.

potentially could be bad in the short to medium term, but overall good for bitcoin long term.

upvoted and followed you !!

Be in touch

thanks!

Could shapeshift or coins like Monero help curb these rules?

The problem is how to purchase any crypto-coins when the surveillance of domestic fiat transfers are being closely monitored.

https://steemit.com/bitcoin/@animatormatthew/iota-a-new-world-currency-promo-video-amazing

Great value adding read. Thanks a lot for the report.

You're welcome. Not normally something I share, but it actually relates to me quite a bit.

Thanks for sharing ... July 1st market in calendar .... FOLLOW @tuakanamorgan

Thanks!

Great post. You are inspiration to others. World debt is so big, whit that printed money from thin air, that fiat currencies could collapse.

wavi

We are waiting @sweetssj !!!

Intensifying our need for a cooperative agorist internet.

Let's secure the ability of human beings to transfer their own information and capital with privacy and securely, no matter what their government thinks about it.

Individuals have values and value, not made up collectives.

This is sick :O

Dispassionate and clear yet passionate and heartfelt all at once. So very beautiful.

Please be careful though. I fear your government- or to be more accurate I fear its fear.

What prevents miners and others from sending their Bitcoins outside the country to other exchanges or by physically exporting Bitcoins in a hardware wallet?

Does the "Great Firewall of China" some how interfere with these types of transfers?

Therw is no issue once you have bitcoin in hand. For the large majority of cash rich people needing to send money abroad, the new policy is an issue. Exchanges are constantly under the watchful eye of the pboc. Btc is already well on the gvt radar for being used as a method of laundering money.

People will find a way to get around this. Old way was to pay X number of people to fund a account and then funnel the money back into one account. Then there's old time smuggling of expensive goods etc :-)

Hi there sweetsssj! Do you know anything about Antshares/NEO, and whether or not it has been on the news in China at all? Thanks very much.