Disclaimer: EOS is currently under development, and some of what we do know about the project is probably subject to change. Furthermore, I am not an Ethereum developer, just someone who uses Google reasonably well. With those facts in mind, consider the following post to be thoughtful speculation, based on my current understanding of both projects.

EOS vs. Ethereum for Dummies!

Introduction

Not long after the launch of Bitcoin, savvy individuals began to recognize that the technology behind Bitcoin has vastly greater potential than simply as the basis for a new electronic currency. In fact, within just a few years of Bitcoin's development, dozens of new decentralized applications have been built upon the same type of public ledger blockchain technology behind Bitcoin. Just a few of these decentralized applications include encrypted messaging (Bitmessage), decentralized exchanges (Bitshares), trustless gambling/betting (Peerplays), cloud computing (Golem), and of course social media (Steem/Steemit). One challenge for innovators and app developers in this new blockchain economy is the difficulty of actually building a new blockchain application from scratch. On top of that, with traditional Proof-of-Work (POW) and Proof-of-Stake consensus mechanisms, the security of the network and application depends on a large amount of hashing power and/or a large distribution of network tokens. For small business owners and startups, these challenges make the barrier to entry impractically high. There is no way a small startup company can independently fund a widely distributed, powerful computer network to secure their application.

Of course, other consensus mechanisms such as Delegated Proof-of-Stake (DPOS) can be operated by a relatively small number of processors without the same network security concerns, although other concerns would still be present for those developers, including achieving a large distribution of network tokens, and of course developing all of the cryptography and blockchain technology to interact with their application. For a comparison, imagine if every computer game designer had to both build a computer from scratch specifically to run a given game, and at the same time they had to develop a game specific operating system to communicate instructions between the game and the computer. It is likely that with such a design model, the vast majority of games and applications would never be built.

In order to solve this problem, the idea of smart contract platforms was developed and implemented, by far the most successfully, by the Ethereum network. Ethereum can be thought of as a decentralized platforms for developing and running decentralized applications (DAPPs), with the benefit that users can be sure that those DAPPs will run exactly as programmed without interference from third-parties. Currently, the Ethereum network has a market cap of around $30 billion (USD), testifying to the demand for smart contract platforms.

Recently, Dan Larimer (inventor of Bitshares, Graphene, and Steem/Steemit), along with the eos.io team, announced the development of EOS, a consensus blockchain operating system that provides databases, account permissions, scheduling, authentication, and internet-application communication to app developers. Thus, EOS will provide developers the tools they need so that they can focus on the specific business logic for their application, without worrying about the cryptography implementations or communication with the decentralized computer (i.e. blockchain). Furthermore, EOS will use parallelization to make possible blockchain scalability to potentially millions of transactions per second.

In this post I will describe some of the differences in technological capabilities and limitations, as well as differences in design philosophies between the EOS and Ethereum platforms.

What's contained in this post?

- Chapter 1: What is a smart contract?

- Chapter 2: Design philosophy

- Chapter 3: Consensus mechanism and governance

- Chapter 4: Scalability

- Chapter 5: Denial-of-service attacks

- Chapter 6: Economics of the networks: burning fees vs. owning a stake

Chapter 1: What is a smart contract?

For those who are very new to the ideas of cryptocurrencies and blockchain technology, it is first of all most important to understand exactly what a blockchain is. Essentially, a blockchain is a decentralized system, at the heart of which is a public ledger. A ledger is basically a way to account for the current state of the system (e.g. how much cryptocurrency is held in each account). Along with the public ledger, blockchain technology includes a consensus mechanism which dictates how the decentralized computer (i.e. the network of computers running the blockchain) updates the current state of the public ledger.

As a fun piece of history, a cryptographer named Nick Szabo realized in 1994 that a decentralized ledger system could be used to execute smart contracts (also called self-executing contracts). Mr. Szabo actually coined the phrase "smart contracts" with the goal of incorporating contract law practices into the design of electronic commerce protocols operating between strangers across the internet.

Smart contracts can facilitate the transfer and exchange of money or property in a transparent way, all while avoiding the services of a middleman.

Smart contracts also define all of the obligations and potential penalties involved in an agreement, much like traditional contracts do, but the smart contract platform also automatically enforces all of these obligations and penalties. These smart contract platforms essentially allow the development of decentralized applications to run on the network. Ethereum is currently by far the largest and most successful platform for decentralized applications, but the new platform EOS will seek to solve several of the challenges faced by the Ethereum network.

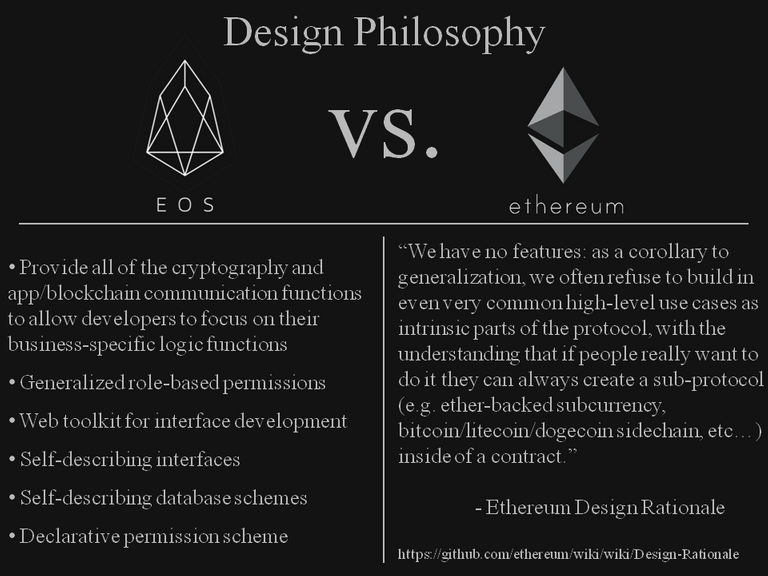

Chapter 2: Design philosophy

One of the key differences between EOS and the Ethereum network is in the design philosophy behind the networks. The Ethereum network could almost be described as application-agnostic, i.e. it is specifically designed as a neutral platform for all potential applications. In this way, as stated by the Ethereum Design Rationale document on github: Ethereum has "no features", refusing to build in "even very common high-level use cases as intrinsic parts of the protocol." This rationale reduces bloat among applications, but it also requires many different applications to reuse code, and efficiency gains for app developers could certainly be realized if certain more common functionalities were provided by the platform itself.

In contrast to this approach, EOS recognizes that many different applications require the same types of functionalities and seeks to provide those functions, such as implementations of the cryptography and app/blockchain communication tools needed by many applications. With this philosophy, EOS will feature the introduction of generalized role-based permissions, a web toolkit for interface development, self-describing interfaces, self-describing database schemes, and a declarative permission scheme. It is my understanding that these functionalities, provided by EOS, will be especially powerful for simplifying user account generation and management, as well as security issues like declarative permissions and account recovery.

Chapter 3: Consensus mechanism and governance

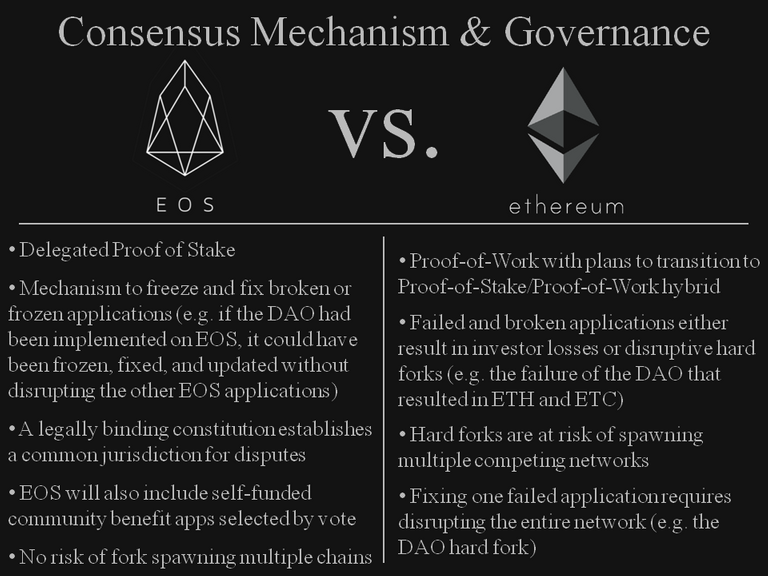

Another significant difference between EOS and Ethereum is in the blockchain consensus mechanism and overall blockchain governance approach. Whereas Ethereum uses Proof-of-Work (and will soon switch to hybrid Proof-of-Work/Proof-of-Stake), EOS will use Graphene technology that utilizes the Delegated Proof-of-Stake (DPOS) consensus mechanism. This choice has significant importance for commercial scalability, which will be addressed in the next chapter.

One issue with the current Proof-of-Work implementation behind the Ethereum network is the difficulty in fixing broken applications. For example, recently the DAO suffered a critical bug/hack/failure. It's important to note, that those with the "code-is-law" mentality consider the DAO hack to be a "feature", not a failure, and that users simply should have been more responsible to understand the code more carefully. In any case, the DAO failure showed that broken applications on Ethereum either result in investors facing potentially substantial losses or in disruptive hard forks. With the current Proof-of-Work consensus mechanism of Ethereum, each hard fork also results in a risk of spawning multiple competing chains, as happened with the Ethereum, Ethereum Classic split following the DAO failure. Furthermore, in order to fix a broken application, a disruptive hard fork is required which disrupts the entire Ethereum network.

In contrast, EOS includes a mechanism to freeze and fix broken or frozen applications. For example, if the DAO had been implemented on EOS, it could have been frozen, fixed, and updated without disrupting the other EOS applications. Furthermore, the DPOS consensus mechanism of EOS has no potential for spawning multiple competing chains during a hard fork. This is evidenced by the 18 successful hard forks experienced by the Steem network, which also runs on Graphene technology. Furthermore, EOS will include a legally binding constitution that establishes a common jurisdiction for dispute resolution, and it will also include self-funded community benefit applications that will be selected by stake-weighted voting.

Chapter 4: Scalability

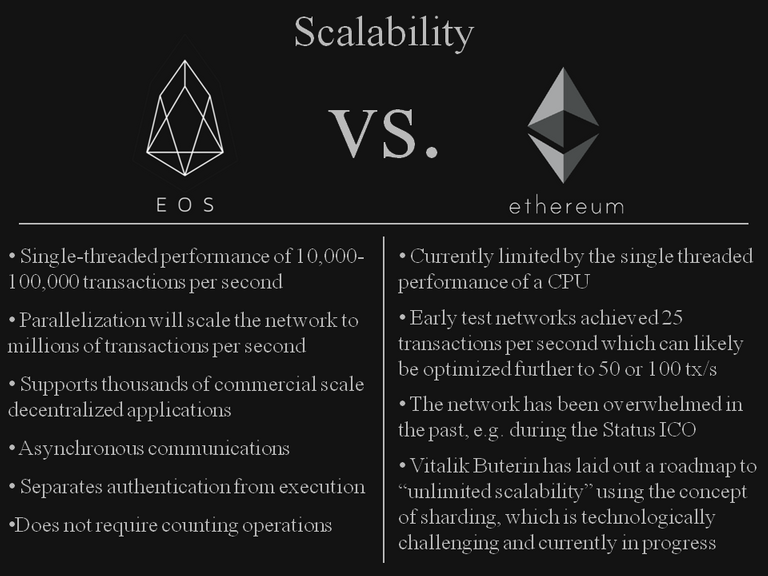

In order to consider a platform as commercially viable, scalability is of utmost importance. This is one key area where EOS and Ethereum will differ. Currently, the Ethereum network is limited by the single threaded performance of a CPU. Early test networks achieved 25 transactions per second (in somewhat optimized conditions), which could likely be increased to 50 or 100 tx/s with optimizations. However, under load from real applications, the current transaction limit of the Ethereum network is likely 10 tx/s or less. In the past, the network has been overwhelmed and overloaded with transactions to the point that all but the highest-fee transactions were rejected. This is especially obvious during recent Initial Coin Offerings, such as the Status ICO, in which the network was completely overwhelmed and the ETH tokens suffered a massive flash crash. Note that Vitalik Buterin has laid out a roadmap to "unlimited scalability" which heavily relies on the concept of sharding. As far as I understand (which is NOT well), sharding is a technologically challenging concept that certainly increases the complexity and attack surface of the network, and potentially lowers the security of the network. I am in no way discounting sharding as a viable approach to successfully scale the Ethereum network, and it is likely that it will be successfully implemented to achieve reasonable gains in scalability.

However, in terms of scalability, EOS will have two significant advantages over the Ethereum network, and once implemented, EOS will likely be on the only platform that can handle truly commercial-scale decentralized applications. First, EOS will rely on Graphene technology, which has been shown in stress tests to achieve 10,000-100,000 transactions per second. Secondly, EOS will use parallelization to scale the network, likely up to millions of transactions per second. If these benchmarks are realized, EOS should be able to support thousands of commercial scale DAPPs. EOS will use asynchronous communications and separate authentication from execution to achieve speedups, and because it will have no transaction fees, EOS also does not require counting operations.

Chapter 5: Denial-of-service attacks

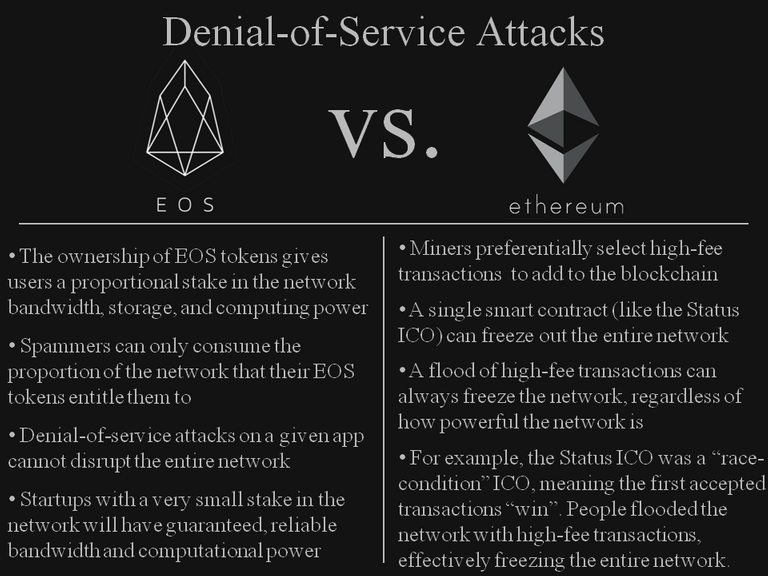

Related to the scalability of the network, it is also important to discuss potential attack vectors to the network. In this chapter, I will briefly discuss the potential for denial-of-service type attacks. This type of attack is when a malicious attacker spams a network with traffic in order to prevent legitimate traffic from getting through. It is my understanding that the Ethereum network has been proven to be vulnerable to such DOS attacks, while EOS should be invulnerable to such attacks.

In the Ethereum network, it is well-known that miners preferentially select high-fee transactions to add to the blockchain. Since there is finite bandwidth and computing power in the network, it is easy to imagine a scenario in which the network is spammed with many high-fee transactions, effectively blocking out many lower-fee legitimate transactions. You might think that typically this would be an expensive attack to execute on the network, but there are situations where there are financial incentives to do so. For example, with the recent Status ICO, it was effectively a race to contribute funds to the ICO smart contract in order to effectively receive the ICO tokens at a huge discount. This created an incentive for wealthy players to spam the network with high-fee transactions in order to ensure that their transactions went through. However, this creates a serious weakness for the Ethereum network, since a single application or smart contract can effectively freeze out the entire network.

In contrast, EOS should not be vulnerable to DOS attacks. The ownership of EOS tokens gives users a proportional stake in the network bandwidth, storage, and computing power. Therefore, spammers can only consume the proportion of the network that their EOS tokens entitle them too. DOS attacks may be possible on a given application, depending on the apps design, but those attacks can never disrupt the entire network. Startups with a very small stake invested in the network will have guaranteed, reliable bandwidth and computational power, even if many other malicious actors try to spam several large network apps.

Chapter 6: Economics of the networks: burning fees vs. owning a stake

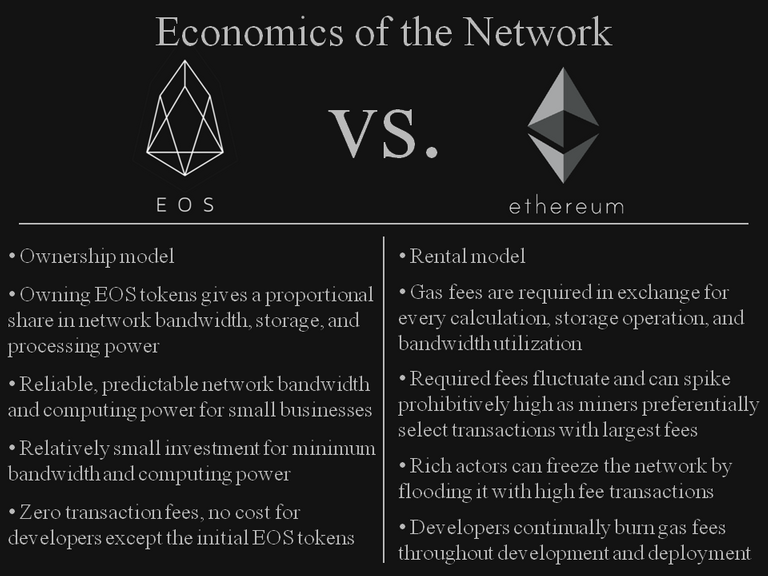

Finally, I want to briefly discuss the different economic models of the EOS and Ethereum networks. Essentially, this is a comparison between and ownership model and a rental model. With Ethereum, gas fees are required in exchange for every calculation, storage operation, and bandwidth utilization. Furthermore, the required fees fluctuate and can spike prohibitively high as miners preferentially select transactions with the largest fees. This was especially obvious during the recent Status ICO, in which $100 gas fees were still too small, even for trivial transactions. Furthermore, as discussed in the previous chapter, this economic model creates a scenario in which rich actors can potentially freeze the entire network by flooding it with high-fee transactions. Furthermore, this model requires developers and startups to continuously burn gas fees throughout development and deployment of their applications.

In contrast, EOS will utilize an ownership model, in which holding EOS tokens gives users a proportional share in the network bandwidth, storage, and processing power. This means that if someone owns 1% of the EOS tokens, they will always have access to 1% of the network bandwidth, regardless of the load on the rest of the network. In this way, small startups and developers can purchase a relatively small part of the network in order to receive reliable, predictable network bandwidth and computing power, and simply purchase more EOS tokens when they need to scale up their application. Furthermore, since the network will have zero transaction fees, there is no network development cost, except for the initial purchase of EOS tokens. However, these can of course always be sold in order to reclaim the initial investment if desire.

Conclusion

Of course, I am a strong believer in Graphene-based technologies, largely because of their impressive scalability and minimal transaction fees. I recognize this post has had an obvious EOS bias, but keep in mind that Ethereum currently has a viable product with a market cap of ~$30 Billion, while EOS is still under development with a current market cap of $0. If you want my honest opinion, I am bullish on both EOS and Ethereum, and I believe once EOS is launched, both platforms will still have tremendous room to grow. Plus do not consider anything in this post to be investment advice, and remember to always do your own due diligence and research!

Hi @trogdor !

I really liked your post! Thank you!

I translated it into Russian and published on golos.io (rus fork steemit)

Link:

https://golos.io/eos/@vnukkarpov/eos-protiv-ethereum-dlya-chainikov-perevod-s-angliiskogo

All I can say is THANK YOU. Now, How do we get EOS? I have been hearing about it for a couple weeks.

Keeps these informational Highways rollin!!

Have a great evening!!

Hi @thinksalot. You send ETH to the EOS account which will then be credited with a share of EOS early next week (3 days 21 hours from now as at today). The website and instructions to obtain EOS can be found here: https://eos.io/

I use the Exodus wallet, you can exchange Bitcoins (among others) for EOS, it's very convenient

There is a simple way I just found out about:

Get coinomi mobile wallet. Put some Bitcoin or altcoins into it. Open an eos wallet inside the ethereum wallet just by swiping to the side until you see it. Use shapeshift to transform whatever crypto you have into eos tokens. Done.

sweet. way to go on translating it, vnukkarpov, you cryptopreneur .

https://steemit.com/ethereum/@architmehrotra/why-ethereum-price-fell-from-over-usd300-to-10-cents-in-a-day-simplest-explanation

Good work.

....next hardfork must add page system. Too much comments. I can't scroll down it all cause my browser is freezing.

It would be a great post to translate into Spanish! I'm going to try using google translate and alter some of the grammar since the translation can go so far... great post!!

I agree that EOS has a great potential. But there is simple fact. ETH is already build and used (and will be improved over time), EOS is in development.

Definitely important to keep that in mind. Thanks for reading!

Ethereum is being used? What businesses are using it?

let's go over a few (very) important things coming in the near future for Ethereum.

Metropolis (Ethereum 3.0) - This upgrade is slated for Aug/Sept and will be the first upgrade since Homestead (Ethereum 2.0) from early last year and for reference Frontier (Ethereum 1.0). Metropolis will bring with it some huge upgrades.

Raiden - Currently Ethereum can process a max of 15 transactions per second, Bitcoin can do about 7. This is nowhere near what Visa does at 40k/tx per second. You've heard of Bitcoins lightening network which will enable Bitcoin to do infinite tx/sec? Well Raiden enables the exact same thing on Ethereum by creating what are called "Payment Channels". Not gonna go into too much detail but it's like Bob and Carol agree to put a $100 deposit into an account and write notes saying one or the other owes $x amount, then on a predetermined day one of you squares up the account by making one large transaction on the Ethereum blockchain.

ZN-Snarks - You know how your friends tell you Ethereum isn't anonymous like Monero or ZCash? Well ZK-Snarks will enable you to selectively make transactions public or private. It's the same standard used for ZCash but implemented on the protocol level on top of Ethereum. This is a big part of Enterprise Ethereum Alliances road map which is why JP Morgan is working with ZCash to implement it into Quorum (JP Morgan private Ethereum Chain) as well. Ethereum is basically taking all the best features from other coins and implementing them.

Ice Age - Currently, there are ~93 Million ETH circulating with 5 ETH created every 15 seconds (15% annual inflation) during the last upgrade (Frontier) there was an "Ice Age" coded into Ethereum which would slow down the creation of ETH on a curve that would eventually freeze up Ethereum. The reason for this was to force the developers to finish up Metropolis before the network froze up. One side effect of the ice age is that the creation of ETH slows down thus reducing the rate of inflation but also increasing the transaction time. We're beginning to see the first effects of it and by August it'll be 5 ETH created every ~30 seconds.

Casper - Shortly after Metropolis, Ethereum will release the actual figures for Casper as well as the first of 5 phases which will move Ethereum from PoW (Proof of Work) using mining rigs and computers to approve transactions to PoS (Proof of Stake). What happens with PoS is instead of miners running all the time, you will have people holding ETH "Stake" their ETH and basically lock their ETH up in a smart contract while running software on their internet connected computer. In return for locking their ETH up, they will earn interest on it at an undermined rate (figures Vitalik has floated around varies from 6-12% annually). Not everyone will be able to stake, Vitalik has stated that the inflation rate of ETH will drop from 15% currently down to 0-2%. With basic supply and demand math you should be able to figure out what that means for the price.

Casper is a major reason people are stocking up on ETH. Imagine if in 1 year you could lock up 1000 ETH and earn 120 ETH per year? If the price is $1000/ETH you're talking USD $120k annual without selling any of your original ETH.

Edit: some typos, was writing on the treadmill

Awesome. Amazing summary of features and upcoming landmarks. I am one of the idiots that got really excited about Ethereum when it was around $8 and talking about it to friends amd just never invested. Kicking myself hard at this point. I've been waiting for a big correction to maybe put 50% of my BTC in ETH, but it just keeps surging. Not sure what I'll do at this point, probably miss the boat as usual. Think it's too late to jump on the ETH train, or are we going north of $1000+ for sure? Haha wish I had a crystal ball... Also, I thought Vitalik was really pushing sharding vs lightning channels?

I'm out for the moment. Believe in ETH long term. Look at the one month chart. It's a declining trend since the 12th of June or thereabouts. Now it may be in a turnaround phase. However if it dives, the downward trend continues.

I'm in this long term. I'm keeping plenty of cash to the side for the moment because there is crazy volatility in cryptoland. Furthermore the problems (seemingly related to ICOs) of recent times don't help. I was sold on ETH because of it's promise of scaling well. However we have seen that it is not without its own issues. I'm sitting on the fence for the moment. Also IOTA looks seriously promising...

I'll finish by saying I think both ETH and IOTA have a future. Not so sure about bitcoin...

We live in interesting times...

It's declining in part because of all the massive ICOs. Companies that did ICOs cashing out is suppressing the price.

What's the incentive for ETH stake producers to increase the resources their node make available to the network ? Is holding 1000 ETH in itself mean anything in terms of keeping up low latency with very high number of transactions, resilience and large redundant storage ?

Still, it seems that not all of the advantages of EOS have been addressed in the Ethereum roadmap.

Ethereum wont make it. And you wont make 120k year annually. When all these new eco systems start coming out that make it more user friendly then Ethereum, Ethereum will be an obsolete product. Bitcoin is an obsolete product. The reason prices are so high is from chinese investors that don't have a clue of what is going on. 90% of the crypto market is from chinese investors and they are not experienced with investing. They over inflated the prices and the prices will come crashing down. These prices are not realistic. They did the same thing with their stock market. All these smart hedge fund managers were investing heavily into china as I shook my head that its not realistic market.

What makes ecosystem work and take on mass adoption is ease of use. Its hard to even do a transaction with ethereum. You have to sign on to your wallet make sure the long address is right, the erc20 token is the right one and then make sure your gas costs are right before you send out your crypto currency to whatever address. That is not taking on mass adoption. People want it to be like a credit card. Swipe and your done. Or put in your credit card number click send and done. Not do 3 or 4 steps and try make sure everything is right. If you think that will work your being delusional. Ethereum is to slow, and when they do updates its never smooth. They always run into tons of problems because try to push stuff out to fast. Even some of their own community complained about doing things to fast.

One day their will be a eco system that is user friendly, can update the network smoothly and will take on mass adoption. Don't know what it will be but all these new cryptos coming out are new and improved from what Ethereum is. More and more will come out. But all ethereum and bitcoin did was get the train going. Its like the first cell phone came out. Then apple and samsung make smart phones and take over the market. Ethereum and bitcoin are like the first cell phones out. Cheap, put on market to fast and not well made.

Anyone invested in cryptos at these over inflated prices will be broke in a few years. I seen this over and over again. Warned people over and over again to stay out of over inflated markets from novice investors over buying in the market. They learn the hard way. Patience is key and waiting for that one product that is putting out a quality product. I don't see one on crypto space yet. I remember this old man told me I was crazy to think oil can ever free fall. I said it will. He said but oil used in everything even tires and we will run out and it something world has to have. I told him don't ever fall for a sale pitch that technology over time will replace everything. He lost tons of money. I seen people argue same thing about housing and gold. Its just novice investing. . Always check the background of the people who make the coin not their idea. Then look at the idea and see how they handle ddos attacks, how they handle new software updates, how they deal with tech problems and always study their competition and compare products. Technology is so fast anything can be replaced at any time. No coin has stood out to me yet. The only thing that has impressed me so far is actually steemit.

Actually, I think the Chinese investors know what they are doing. They'll relocate their funds once Tencent comes out with their own currency that will absorb wechat and alipay.

So glad i never listened to you

Six letter summary:

EOS > ETH

:)

ether is still the best but who knows one day when EOS launches and crush both ether and bitcoin...

It's interesting that EOS may improve upon Ethereum, but maybe the future is a split system, where a good currency works on top of an efficient social contract blockchain, such as EOS.

And then something better may come along and crush EOS :)

hahaha So every time a better thing is going to come ;))

I agree, maybe a blockchain mixed with an AI.

ether ftw!

EOS > eth

Make ethereum poor again!

Thats a great write up, have $4

Thanks for reading!

One thing I'm curious about. You said eos will have an automatic common jurisdiction established adjoined to the smart contract being set up and executed. That's pretty cool as a default selection, I really like that. However there might be times where I want to specify my own more private jurisdiction with a separate entity for dispute resolution, do you know if this would be possible to program so my own personal jurisdiction was the one used and not a common one where eos already has its own arbitration system set up.

That's kinda a big deal for corps and the like to use their own arbitration system, like I said as a general rule a default arbitration system is great like awesome, but for specialization it would be nice to be able to specify our own specific one.

I'm not sure exactly about the details of the jurisdiction details, but I think it will be similar to a terms-of-service. I imagine it will be fairly general. It would be possible to program a private jurisdiction that is specific to a certain application.

Excellent, that's awesome to hear. Oh boy am I looking forward to eos. Great post as always :-)

Great work, really liked

Wow.. This is some serious work you have put in here dude.

I've still not quite understood ethereum, hope this cleara things up.

Thanks for the post!!

Thanks for reading!

waw 2 millions happy for you :p

50% 50 % ok :p ?. keep your great job :D!!!!

Thank you for very detailed post about EOS and Ethereum comparison. It is so much helpful to understand this improved technology. And to motivate to find out more about it. I am still new to steem! BUt I like it a lot, still trying to understand it to use it to maximal potential. I think EOS will be huge, since it is similar technology. I am trying to understand Steem, Steem Power, Upvoting, how to write new article which could bring money similar like yours, etc. It is such revolution. I believe EOS will also be. Beacause of the same technology and the same developers. Looking forward!

Thanks for reading! Best of luck.

Thanks

Thanks for reading! Best of luck.

Great post! Thank you for info.

Thanks for reading!

Here are somethings that can help. Do not invest during a price surge. Make sure the company has a product, and or service that will be used. Beware pretty faces on the front of a page, emotional connections. Follow the facts and results. Finally determine what the soft cap will be for said crypto coin. Is it $100? $10?

LET ME BANNG BRO!!!

1up🙏

Good tips, thanks for reading!

good tips thanks

I run a mining group. No big money yet. But I have prevented them from losing a lot. (:

EOS has consensus. So, is consensus better not having consensus? Does ETH have consensus? Isn't decentralized cryptocurrencies like Bitcoin, Lifecoin, ETH, and others, by definition, using a consensus system with like the block chains, the information, the bits, the money, between the computers online, which adds security to the blocks?

.

I thought they already had consensus. I thought ETH already had consensus. I am a beginner to all of this. I am still trying to learn it all. I am a dummy here. I am not a whale yet. I am not a real boy. I am Ariel, a mermaid hoping to make it up onto Bitcoin Land.

All blockchains use a consensus mechanism, they just use different approaches. You can do some research on "proof of stake", "proof of work", and "delegated proof of stake" to learn more about the different mechanism.

Right. Yeah. Good. I have heard of those things before. I am starting to understand the differences. I think Steem had or has something like a delegated proof of stake system and Bitcoin used proof of work for the blocks.

Referring to this post, there's 2 types of Google user: You and...the rest of the world 😂😂😂. Such a great article here. You nailed it bro! 😎

haha, I don't know about that, but thanks, my friend!

EOS = blockchain + bots

There’s not much technical information available currently. But EOS is not just about smart contracts + high scalability. It has a completely different design and vision compared to Ethereum. EOS uses Delegated Proof-of-Stake just like Graphene does.

It uses Network Bandwidth Allocation system to effectively share the blockchain.

It’s like time sharing. It’s like owning an instance on an Amazon web service that you can share

In EOS the human-readable source code (the “bot”) is uploaded directly to the blockchain. As we know, the Ethereum smart contracts are binary data instead.

Very useful post, always wanted to know something more about this coin!

Thanks for reading!

Fantastic post. You just convinced me to sell at least half my ETH. I was an investor of the DAO, luckily, I was able get back my original investment plus a little extra from the chain split.

I’ve been taking for granted that there wont be another chain split. The amount of code hosted on the Ethereum platform during the DAO pales in comparison to the amount of code hosted today. With the recent rise in ICO launches and the amount of money raised I think that there is a high probability that there is some buggy code and an incentive to exploit it.

I think it’s just a matter of time before another DAO type of event surfaces. I hope that I am wrong but I can’t help to think that even if the code is being audited it doesn’t matter, if their tool set cant test or measure an unknown variable.

Resteemed

Thanks for reading. I definitely think that the mechanism to freeze and fix applications on EOS is one of the major advantages that it will have.

Yes agreed, it's a great failsafe feature to have and it creates confidence in the project.

I dumped some ETH to double up my on my STEEM power.

Thanks again!

A lot of words but it is worth the time to read.. I am following you now, resteeming this article

Thanks for reading!

Thanks man! That is a very detailed description of EOS. I tried explaining EOS to my friends but can't do it well like you. I will point ur article to my friends so that they understand EOS. Appreciate your efforts. Upvote and follow. Thumbs up!!!

Thanks for reading! Glad I could help :)

This is going to take a while to read but hear goes nothing lol ,

If you put this much work in thumbs up to you 1 vote from me

Thank you, my friend! Steem on!

No problem, you definitely deserve to be praised

Im steememe ing 😂!!!

#dead

Made my night

The ownership Model of EOS is the perfect platform for Businesses to use as its truly decentralized. Rental model is too centralized and would just be the same governmental system.

I definitely agree that the ownership model is one of the things I am most excited about for this project. Thanks for reading!

The ownership model definitely sounds like a comfortable solution for businesses but I am not quite sure how the incentives for the block producers will work out.. they will be paid by the network itself, I guess?

Also, if I remember correctly there will be only a few wealthy block producers (that's dPoS, right?). I guess that makes consensus across the network fairly easy but doesn't this also leave a lot of the capabilities of the network unused? Imagine a network which uses the resources of the entire network efficiently (something like IOTA) but still has the capability of supporting smart contracts.. Maybe this is impossible. Maybe Ethereum can get close to that using Casper and Sharding. Let me know what you think.

Interesting thoughts. I need to do more reading about IOTA. Actually my impression is that DPOS is highly efficient, at least compared to POW and POS, which is partly what allows the network to process so many more tx/s. I'm guessing that the block producers will be paid by the network itself just like with Steem. Thanks for reading!

I think you are correct that a network using DPOS is able to process many more tx/s than POW and POS. But I think DPOS isn't much diffenent than the current system where the processing power behind the applications is limited a few big companies. Now what about the billions of smartphones around the world? Because most of them aren't able to store an entire blockchain their capabilities remain completely unused. I guess this is where IOTA comes in and tries to provide the ability to make transactions from every device. The main problem with IOTA is that, while it could make even more transactions than DPOS possible (probably, this still has to be tested), currently it doesn't plan on supporting smart contracts because it doesn't use a blockchain but a Tangle (Directed Acyclic Graph) (looks pretty efficient, but there are some safety concerns). Can you see where I am coming from? My main concern is that DPOS makes it close to impossible for me to contribute to the network directly (processing power/ storage space) even if I wanted to. Maybe this problem simply can't be solved using just one cryptocurrency and has to be extended using systems like Golem/Swarm. Thanks for reading :D

DPOS is much more centralized than PoW or PoS in my opinion.

At first the voted in producers may not know each other, but over time they will get to know each other and even start working with each other (just like miners in PoW). Once all the most influential block producers learn about each other, they can start forming deals that benefit themselves at the expense of the normal network users. Then run misinformation campaigns to make sure they stay voted in, or even change the voting rules to keep themselves in.

It's a system that's highly efficient on the technical side, but relies quite a bit on trust. If major corruption goes on at least we can (theoretically) fork the system and start over with new producers. Not sure right now if EOS will allow forks like that but I think it needs to in order to keep the block producers honest longterm.

I had the same question here in regards to how the miners/people who run the network will be reimbursed for their efforts. @dan himself replied by block rewards. So that answers that. New coins will be mined and miners can sell them for profit. Like new Bitcoins. At least that is how I understand it up to now.

In DPoS, block producers needn't be wealthy at all (that's what the 'D' in DPoS is all about).

Maybe I am misinformed on that one, but I thought the plan is to have only a very limited amount of block producers at any time who are being "delegated" (is that what the 'D' is about, or am I wrong here?) by the network users, so I would make sense to delegate someone (or a group) who is capable of providing a lot of processing power compared to the rest. And processing power is somewhat expensive so that is what I meant with "wealthy".

Thats one reason why Antshares/NEO is also such a good model, with an edge up over Ethereum. (And still so undervalued).

Check out a recent post I wrote on that, if you're interested. :)

Thanks for reading. I am actually not that familiar with Antshares/NEO, will check out your post.

I'm also going to check out your post. I've followed all you guys who commented

Great Information on EOS very indepth, going to take a second and a third look at the project. You have my Vote! Trogdor!!

Trogdor I just resteemed the article would love a vote from you for getting a Newbie started on Steem IT. Thanks.

No problem, Steem on, my friend!

Thank you much appreciated the Vote you got a follower in Me, very insightful and really enjoy reading your articles. Looking forward to more in the future.

Thanks for reading! There is definitely a lot of valuable information out there about this project :)

Awesome guide, trogdor!

Thanks so much!

I resteemed.

Thanks for reading, I appreciate the resteem.

Thanks for doing some research for all of us. You're welcome, I thought it was a good post to try the resteem for the first time.

@trogdor Now thats some good info and even better coming from someone who actually seems to know what they are talking about! followed and upvoted

Thanks for reading!

@trogdor what a well researched and well written article. Was this an extract from your PhD? If so, I'd like to know if i could access the full thesis? And if so, where? Thanks so much for sharing

Thanks for reading! No, my thesis is about fluid mechanics, not crypto :) I just read about this as a hobby

I need to learn a lot more about smart contracts, I'm a foetus in this world. But i first need some deeper understanding of blockchain technology. Any pointers?

Just do as much reading as you can, I'm still just learning about all of these topics as well, a lot of it is still over my head!

Sounds promising. Not sure if it'll ever take over ethereum but certainly has the potential.

Thanks for reading! I think they'll both probably exist with their own market shares. It definitely has potential!

I am bullish on both Eth and EOS too. But comparison of present Ethereum and future EOS is not quite correct. Both have to deliver yet to their promises. I have stake on Eth and am going to invest in EOS.

Meanwhile, it seems we have new kid in the race - NEO/Antshares looks very EOS like (information is scarce though).

Good points, it's just speculation on my part, but EOS definitely sounds promising (of course they still have to deliver). Actually I just heard about NEO for the first time a few minutes ago. I need to do more reading about that project.

What I like about EOS is they are taking the known lessons from BitShares and improving upon the platform. Seems more grounded than NEO.

meep

I agree completely. So much still to prove for all. Sometimes I can't find the ground with all this speculation.

Will eos be more expensive than ethereum? Or eos would just be an uncontrolled currency with a price that will increasingly decline day by day.

I fully support eos. Is ICO still open for this? And I can invest there while having a chance?.

Thanks for reading. You can check out https://eos.io for more details about the ICO.

This is quite well written! I am still new to Ethereum and EOS and the whole cryptic world as it is. I wonder what your thoughts are on the NEO (ANS) platform.

Thanks for reading. Actually I haven't heard anything about NEO yet. I need to do some reading.

Thanks for sharing the information about the EOS, I have some understanding on this new coin after reading your detailed explanations on this new coins.

I think EOS has high potential since ethereum is now at a relatively high price.Some people may invest on the EOS as both of them has similiar features on digital coins.

Definitely. Thanks for reading!

Serious question: One thing I fail to understand yet is the sustainable funding of the EOS network. Where is the incentive to run an EOS node/ mine EOS? With Ethereum it's clear, give computing power to the network, in return receive the gas fees, hence network grows as users pay for it continuously. But EOS? Once all EOS tokens are sold to users the miners don't have anything anymore to generate income to pay for the servers. They basically work for free. Tokens might explode in price or not, but they're only exchanged between users who initially got them during ICO. I'm sure the mechanism to fund the network is there somewhere. So, what did I miss?

Block rewards

Oh, so there come new coins all the time and the once created amount for ICO, devs, etc is not the max number. Apparently that's what I missed. Ok that is easy then. All in :D Thanks @dan and maybe see you in Portugal : )

What are the block rewards?

WOW now that was a good read and thank you for posting

Thanks for reading! Glad you liked it.

Nice write up. Thanks! Where/When can I buy some EOS?

Thanks for reading, check out https://eos.io

Frickin awesome content and post @trogdor , this might be the DUMMY question of the month but I followed EOS for awhile, get the notice for token sale, then I go to click on it and it says.

"US ip detected, cannot participate"

Whats that all about? Any clue? Thanks for any help!

It seems like they are blocking United States IP addresses for participating for some legal reasons. From a technological point of view, participation is probably possible using a VPN or the TOR browser. I am not sure about the legality of that.

Damn that is annoying lol, Have been following them a long time, did not know they would block out the US.

This is a great intro to EOS and the compare/contrast with ETH really helped illuminate some of the advantages that the EOS platform presents. Bravo!

Thanks for reading!

What my first thought was being ignorant of what eos actually is

Glad I'm not ignorant any more. This was very helpful.

ohh dude thank you so much for writing this up, you explain everything so well, there was quite a bit I wasnt completely understanding, it was hard to find info and I was a little embarrassed to ask anyone xD

thank you very much ^_^

Thanks for reading! Don't worry, there is a LOT that I don't understand still. Don't be afraid to ask :)

Awesome, I really appreciate all of the research you have done on this topic, many of us are relatively new to the Crypto-Universe and it's a huge help to get information and advice on some of these up and coming currencies - i think EOS is a well thought out Crypto currency and definitely looks very promising! Thanks again, upvoted & Following.

Thanks for reading, glad I could help!

This was the best well-written post I've read around here. Please, keep writing!

Thanks for reading, I appreciate the compliment!

Thanks for putting in the time to clear things up, this breakdown is great !

Kept it simple and clear, keep up the good work man !

Thanks, glad I could help!

Amazing and very detailed post. Thank your for sharing. Up voted.

Thanks for reading!

Really good information thanks

Thanks for reading!

Great post!! Keep it up :)

By the way, I'm following you now

Cheers

EOS has great potential, but we have to wait 1 to 2 years to see the outcome.

Thanks for reading, and I appreciate the follow!

Thanks for the breakdown! I have a better understanding now!

Thanks for reading, glad I could help!

Wow, this is all new to me, thanks! Upvoted and followed to learn more :D

Thanks for reading! I appreciate it!

Absolutely amazing article again!

Thanks for reading!

I know you mentioned to not consider anything of this post to be investment advice, but might I say that is some THOROUGH work done on the research. You've got me keen on EOS and it only took one post. Tell you one thing is for sure here, you're FOLLOWED! Cheers!

Thanks so much! Glad I could help.

Wow the level of detail in this article is amazing. I am just learning about EOS and this is a great introduction.

Thanks for reading! I'm glad I could help!

What a fantastic article thank you so much for writing this! much much needed at the moment. many thanks. Im still bullish on both platform, though. I think they'll both make each other better. Ethereum NEEDS the competition.

You're definitely right. I think the competition will benefit both platforms. Thanks for reading.

thanks for the healthy load of info! I intend to watch the EOS ICO unravel from the sidelines for a little while before making any moves

Thanks for reading! It's probably a good idea to watch things carefully before making a move.