Hey Luc, did you see my post on your other thread? I released my own market scanner yesterday, I'd love to get your feedback on it. It's a bit different to nervisrek's (great job btw!) but it gives you the ability to filter by a specific change threshold, so as to only show coins that have dropped 5%, 10% etc. in the given time period. In the near future I'll be adding the ability to filter out specified exchanges and markets as well.

im watching it now.. does it only refresh every 5 minutes? it says updating every 5 minutes.. our other scanner alerts seconds after a move happens, and often thats even too slow to react.. every second counts with daytrading..

Hey Luc, there are some other refresh periods in one of the two dropdown boxes at the top of the page. The way it works at the moment is that whatever lookback period you select, it will refresh after that period of time and then look back that many minutes to check for changes. So for example if you choose a lookback period of 10 minutes, it will look at the last 10 minutes of data for each symbol, compare that against the change threshold field, and display each symbol that has changed more than that amount in the last 10 minutes, then wait 10 minutes and do that again.

The shortest refresh period at the moment is 1 minute - I can definitely make that shorter but the question is how far back should it look for data? If it refreshes every 5 seconds but only looks at the last 5 seconds of data, it's unlikely that any symbols will have changed more than 5% in 5 seconds. Perhaps we should have two fields, one for the refresh interval and one for the lookback period. What are your thoughts on that?

I'm still new to this, but I'm guessing Luc will tell us that the refresh can always stay around 1sec (or as short as practical), and shouldn't be related to lookback period. Maybe I'm missing something though. Is there a reason you linked them together?

Noticed the alert noise and "mark as seen" have been added. Thanks very much!

Side note- your scanner just alerted me of 2 huge loads dumped so far at BTRX XLM/ETH just now. I made a trade on the 2nd one, hoping for a 3rd dump. Worth keeping an eye on

I'm glad to hear the site's helping you find good trades! Originally I had the lookback period and refresh interval separate but I combined them for the sake of getting the site up asap. The problem arises when a duplicate entry is formed, ie. when a symbol is displayed and then on the next refresh it is also displayed again. What should happen in this case? I'm thinking that it should replace the original entry if it has dropped by MORE than was shown in the the original entry, otherwise the original entry should remain. But then at what point should it not be shown anymore? When the user marks it as seen? After a certain period of time?

Once I know what's preferred I can get started on implementing it :)

Hi Luc. About Nervisrek Scanner. Awesome and thank you for sharing. Please, I have a question. When there is a considerable drop of one of the altcoins, would you place instantly a limit order slightly above the dropped price reached? So when it bounces back or pullbacks, you would buy almost buy to the lowest price? Thank you very much!!!! Or what would you do?

JUST A HEADS UP GUYS!

I don't know if anyone has mentioned this yet, and I'm sure a lot of the experienced guys are aware, but for all the newbies out there!

The scanner is picking up a lot of price drops that are dropping from pump and dump groups! Be very careful of these because after a pump and dump group has pumped up a low volume coin 50-100% (you will notice its just one huge green candle coming out of nowhere!) The scanner will notify us after it drops down a bit. The thing is if this is from a pump and dump group, that price is not going back up. The only reason it went up is because a group of people got together and bought the price way up and are waiting for people to buy in so they can dump the price right back down onto the unsuspecting people not in the group. a lot of the time they are actually dumping the price on people inside their own group who are trying to get in late as well.

just keep this in mind when using the scanner!

Happy Trading.

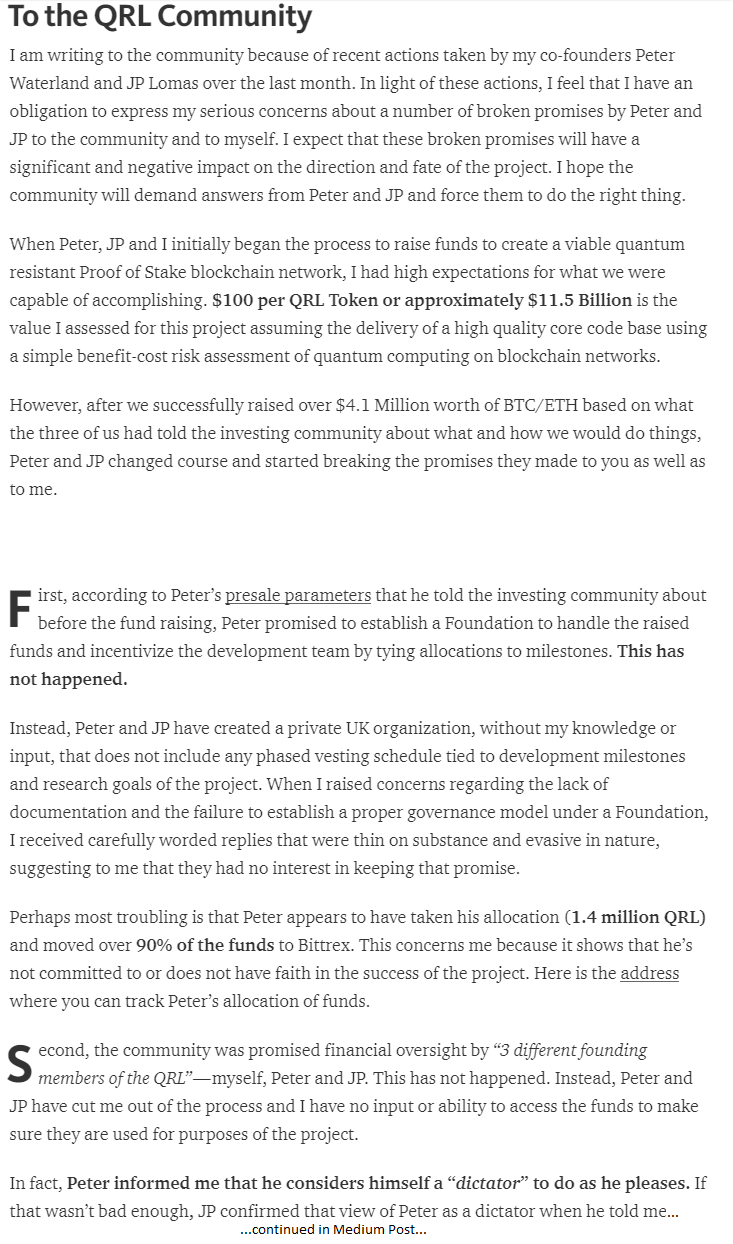

I WOULD ADVISE AGAINST BUYING QRL! The scanners are reporting a big drop in QRL but this could be owners dumping their coins. There is some rift within the project that someone within posted. Right now I'm trying to break even on my position,

I concur. Always read the social media on a coin before buying into a panic, thge extra 30 seconds it takes to catch the headlines may save you from being stuck in a position.

I created a blog about this and what I did to get out of the trade and minimize loss. Credit goes to Luc for his teachings (it would be nice if he can review for me :) ) and credit goes to nervisrek for the scanner tool. Let me know what you think in the blog. This is more of a learning experience for me. https://steemit.com/trading/@oneluckyflip/beware-trading-qrl-how-i-minimized-loss-on-a-trade-gone-bad

Hi Luc! Thank you and @nervisrek for this amazing tool. By the way, I am making a bot that can buy the coin with certain conditions. If I was to use the scanner, what conditions should I put the bot so it will automatically make a buy order? One is a 10% 5min drop or more, maybe if its below 24hr low too? I know the idea is to take the scanner alert and got to the chart, but I want to try this bot. Thanks!

What will be a good % volumen change to mix it with the 5min price change, like comparing the last 5min candlestick volume with the 24 hour volume. What will be a good % change? I was thinking a 5% spike in volumen compared to the 24 hr volume. Any ideas?

I think a useful tool for non-fulltime traders would be that if your buy order gets filled it would automatically sell at a predetermined price, that way you wouldn't have to worry about missing the sale if you're away and it would work with Luc's technique perfectly.

Yes. I have a bot in poloniex, detects when a coin goes down more than 10% in 5 min. But the thing here is, where to put the buy order? Right in the 10%? What if it goes lower? At the moment, I am buying just at 10%, or where the variation is. Then, after it successfully buys the coin, it puts a sell order at 5% margin (just to be safe, and not to put it in a 10% gain, better to have profit, that not at all!

So, what ideas do you have? What could be a general rule for the buy and sell order?

I am not a programmer, but I started learning from other bots on the web. I thank xcbtrader for teaching us and donating this bot on Poloniex. I customized it to my needs.

May be it's a good idea to put a sell order on 5% margin and make a trailing take profit: when the price goes up without a stop you won't sell, if it then goes down and reach some threshold, you'll sell.

For instance. You buy at $1 price , set a trailing stop at $1.05. The price goes to $1.08 and then goes to $1.06. You set a threshold of going down for 1% and sell at $1.07.

Even though the bot is way faster to get to this opportunities, check thoroughly if it is stable in the long run. You don't really need a bot for these kinds of trades as they don't happen that often and the scanner is already doing all the work. Sometimes accuracy can beat speed

Yeah I know, it's just that I want to make it automatically. Anyways, I will be on the computer most of the time, I just want to catch the drop, and the bot can be quicker. If you have any ideas, let me know!

Here's a question I was thinking about while I was watching your video. around 18 minutes you were explaining how when there's a spike upwards the safest place to buy is at around 50% of the spike (the pullback) because 1. if it goes up, then you get profit, and 2. if it dives, it will most likely return to around the 50% mark where you would buy costing you little to nothing.

My question is this. If the price keeps diving in scenario 2 , why not keep buying as it goes down if it will most likely either return to around the 50% point or higher? That way instead of merely getting out even in the second scenario, you would profit from the low price buys. Is it too risky? Here. I'll try to include an image to clarify my question.

Uau! @nervisrek, Thank you very much! I'm sure as we all start growing money, we will all make donations! This is a true trading community! Not these other communities where the owners are only interested in making money and take advantage on other people lack of knowledge!

Thank you Luc for helping all of us!

Let's upvote all Luc's posts and comments, guys and girls!

Very excited about the scanner, thank you to @nervisrek for this!

but when you were talking about the 3rd type of trade would you buy on the first rebound only when it has a a drop of around 50% or would a 20 or 10% rebound be just as safe?

Suggestion would be 24 hour volume minimum of 5 BTC and 50 ETH, otherwise you are going to get these miniscule buys/sells that will intentionally drive the pricing. Or maybe logic using the last volume values, tho that would be a little bit more challenging.

yes, there is a filter for minimum 24hr vol there atm that luc mentioned when building it, but it is very small. We will need to find a suitable value for everyone, there may be an average min volume everyone would be happy with?

yes, id say AT LEAST 5 BTC 24hr minimum and 50 ETH. Or maybe we can have two seperate channels, one for the lower volume more volatile trades, and another for the larger coins for big trades. Is there a way that the scanner can notice the longer 2-4 hour panic drops on the bigger coins?

Thanks for the video -The marker scanner is a game changer . Special thanks to @nervisrek for making this tool.

I have some questions for you which I think will benefit a lot of people with small accounts (less than $400) which are just getting started

Using the market scanner to focus on what you call "account building" trades -is there any criteria which we should look for in order to decide if a trade will be an "account building" one or not ?

With or without the market scanner do you think it is possible to double an account value in one month by trading JUST ETH (since it always bounces back). So if I have let`s say $300 in my account and i decide to trade just Ethereum how likely it is to have $600 at the end of the month?

This was probably asked a lot already -What if after I draw my "bases" I see that the coin didnt break the base ? It seems to happen quite often..... Should we wait till the base will break or we should see if there was another base formed and hope to have a break on the new one ? Or better asked how long we should wait for a base to break before deciding if we should see if there`s another base formed and move on?

When you say "position trading" (not day trading) do you mean holding and selling a coin after a few days/weeks or what timeframe do you think it`s a good one for position trading ?

This is more of a statement -please correct me if needed : We can use the market scanner to build a small account and then move onto position trading where a single trade (which can take days to happen) could easily mean thousands or tens of thousands of dollars depending on the investment and how high the value of that coin will go. (i`m thinking here about ETH price drop to $136 or so which happend recently and then a big bounce back to $240)

One last thing -when you say to go small for those day trades how small we should be ? Put $10 on a trade $50, $100 or?

I appologize in advance for the long set of questions but I strongly think everyone which is new to trading and has a low account like myself would benefit a lot from your answers

Thanks everyone for helping answer questions like this. I am having a hard time keeping up.. I think the answers below are great.. I can get maybe 30-50 position trades per month.. But i usually take 20ish.. and daytrades happen several times a day... So you can absolutely build a small account on position trades alone, without the need to take the added risk of daytrading or small account building type trades.. You can just swing those slower base type trades and still do good.. But with the Account building trades and other types of daytrades you can double your small account in a week or less sometimes.. so those are the options..

Let me take 2 seconds to show you a chart, that I just traded and please respond what think about it...

Notice that for the past two weeks you can buy 11s or 12s and sell 14s 15s and 16s even sometimes.. imagine the effect that has on a small account if you were only trading this one coin only.. and there are even better ones out there, im just using this one because i just just sold some right now..

These rises and falls comes in spurts throughout the day, likely from either a pump and dump action or some whale buying or selling huge. That's why you'll see no activity in the transaction history for a couple of hours sometimes. Lurk the chat on HITB and you may be able to catch a pump and dump

@quickfingersluc I've been trying to do the account builder trades. I've noticed a lot of the time I get "stuck" waiting for movement between " bid walls". There seems to be a lot of attempts at pump and dumps/manipulation down in the low volume alts.

the volume of trades on this chart scares me, there was no activity for 40 minutes this morning - should we not be concerned with that? On the bright side the lvl1 data shows some significantly sized orders ready to take place, but what if that was not that case - for example LGD/ETH [BTRX]?

The chart seems nice, and more lively than few others I've tried. It seems its common for ETH pairs to move in nice channels, and maybe even less common pairs like altcoin/XMR, but in BTC I didn't find any pairs with similar movement that would give me at least 10% reliably. To me it seems that in altcoin/BTC pairs it's better to trade pumps, coins with volatility like XST and UNB that have huge movement.

EXACTLY. The limitation trading these coins is how much one can put in an order. Typically you may only get a couple of ETH orders filled maybe 1k USD worth at the most, hence Luc's phrase of small account building trades

I did a few trades on something like SNM/ETH, I think this type of chart in essence is simpler(except liquidity problems when your orders don't get filled) to trade along with the base strategy. But I don't trust myself too much to trade btc pair pumps and daytrades, those seem much more complicated. Without using any TA I can read percentage of a pump, base, timescale, and how most of these coins seem to pump after a significant dip, but I don't feel that's reliable enough. And daytrading is a whole new level, along with considering the order book & news & etc(except getting in time for flash wicks down, these seem pretty safe to not lose out on). Maybe I should just get some ETH and move on to these range/channel types of charts for now.

Man, you seem smart enough to be making a killing off of these coins. Honestly, there is no TA other than your own analysis so trust your own judgement. Look at patterns, understand what is going on with the trading environment, and come up with a good strategy then go for it. This sounds pretty basic and sometimes it works out, sometimes it'll go against you.....just have a backup plan. More than often I think you'll win since its fuckin crypto, as long as you understand and read the chart correctly.

Also make sure to know which coin you are trading. Coins like UET you just dont want to touch.

Hey man, thanks for all your help and the great videos!!.. i've been drawing my bases , and ive noticed something.. i can see the bases a lot clearer with heikin ashi sticks instead of the candles.. i assume there is nothing wrong with that right?..

...and you go back 1-2 months into the history to confirm that there the chart follows the pattern of base creation, base crack, panic, base creation, base crack, panic, base creation?

I have looked through many charts that seem to follow no particular pattern, and many more that don't follow the pattern that Luc is advocating that we look for... at least they don't follow it with any degree of consistency that we can count on.

I guess I was asking if anyone has identified charts that are in the ball park of reliability as ETH/USDT?

Once again, ALL charts have this reliability eventually - just be paitent and read the charts daily, eventually you will find the opportunities. Some charts I see prime opportunities in the past, but none currently - thats a fact of life while trading, its not free money, you still need to put in a little bit of work and be willing to take a risk.

With that said, here is an example of a chart which opened up to a great trading opportunity overnight. Once the price dips into the circle, your trade should be +EV if you sell upon the bounce back to the base.

Thank you for the reply and the chart share. I agree that I'll have to learn the story of the chart before being able to capitalize on oppurtunity, so I will keep trying to interpret them because apparently my thinking and pattern recognition is currently too rigid.

With the chart you shared, there is no way I would have recognized that base. There are a few instances of similar bounces working out, but it doesn't seem to follow much of a pattern to me. Especially since 12 hours later another bounce happened that was equal to the bounce you underlined, but we ignore that one. I also don't really understand your circle in reference to the underlined base, but I'll keep watching to see how it plays out.

I don't expect you to go back and forth holding my hand on this one, but I figured a response may help increase value for someone else that is struggling to understand this chart.

@quickfingersluc -This chart looks great. Thank you so much for sharing this with us. I will definitely keep an eye on it. Can you also recommend some other coins that I should keep in mind (since you said there are others even better than this) ? whatever you feel might be an "account building" type of chart... this would help me a lot. I do understand that its my responsability to do my due diligence before buying a coin but I would love to have a few of those charts set up so if Im not asking too much please feel free to share others like this.

I think he means common big swings on a coin, 20-30-40%. Coins with lower volume that can move in such ranges.

Probably possible but on ETH he mainly trades big swings, that could be one per month or few a month. To get to $600 u would have to trade off all the smallest bases most likely.

Personally I think previous bases are secondary, the newest one counts. U can look at the previous one if it's breaking it, or there's no new one forming. I don't wait for anything.

Position trading is trading off bases. The time varies, from a day-two to weeks.

Luc told me once to trade low volume coins till i make a few thousand, 3 or maybe 5 to make swing trading give significant returns. So maybe use mostly these daytrading methods he mentioned + trading pumps on low volume coins like mentioned before.

With position trading I believe he's talking about identifying a base and buying off the "panic sell" You hold onto to it until it reaches the base or comes near to it (study the chart's history to see how high the bounces in the past have reached, this will give you an idea of where you should sell).

Correct me if I'm wrong.

"One last thing -when you say to go small for those day trades how small we should be ? Put $10 on a trade $50, $100 or?"

A small trade is Relative to your account size.

So if you have total account of say $100, small would be $5

If your account is $1000, small would be $50

Trading in percentages of your total account makes sense, so you can

better diversify coins by having multiple trades going on

limit risk

leave room to add more to an ongoing trade.

3-10% of your total account makes sense for cryptos. Some professionals say no more than 5%, but do whatever you feel comfortable and within your goals. With smaller accounts, better to go higher to increase your chances of doubling your account.

A+++ @quickfingersluc and @nervisrek! I have a small request, perhaps the scanner could be split into two different telegram groups? It would be nice to see a dedicated group for BTC coin pairings and another for ETH coin pairings.

Hi there, yes something similiar has been mentioned for have exchanges in separate telegram groups, if people are only trading in certain exchange(s). Technically possible and if there is interest for this i will implement it. I mean we could keep the main telegram channel with all alerts and then separate ones for exchanges/coin pairings to keep everyone happy :)

Thanks @nervisrek! Some traders only trade one coin pairing or the other, therefore the extra content for the unused coin is just "background noise". For example I holding a large amount of ETH, waiting for the market to normalize before I convert back into USDT or BTC which is normally my primary trading coin. Until that occurs I am only trading ETH pairings, therefore for the next month (or less if I am lucky) I don't need to get any signals from Telegraph on BTC coin pairings .

BIG FAN of your work, this will only get better over time! As soon as I am more liquid I will send you over a donation as my way of saying thnx!

Looking forward to the time in the future when we can customize minimum volume requirements. In the meantime, I'm happy as a pig wallowing around in the mud ;-)

I got in on that same dump this morning. I put my sell at 9100 and was filled within a few hours. Looks like you could have made up to almost 9500 on that.

Hey luc, first off thank you so much for putting in the time to release these videos-- you seem like the only pragmatic and realistic crypto-currency trader who is putting out content and we are all super lucky to have your input.

I have a question about trading pairs--I have made some successful trades on Bittrex between ETH/USDT and BIT/USDT, but it looks like most of the trades showing up in the marketscanner do not have a USDT trading pair. My question is how should I turn my USDT into BTC/ETH to trade without losing money in the short-term with fluctuations in the BTC/USDT and ETH/USDT markets? Say I purchase 1 BTC at its current price (2573.175 USD) and am having success day trading BTC trading pairs, but the USDT market value of BTC drops below my original buy in price. I will be making my profits in BTC, but will ultimately be losing money because of BTC/USDT market fluctuations. I guess I am wondering if I should be patient and wait to buy BTC and ETH when they are low (following your position trading strategy of buying the dips) or should I just convert from USDT at anytime to capitalize on day trades?

Just picked up some CLOAK on Bittrex for .001 due to the scanner!!!! It was at .0013 / .0014 before someone started dumping it! :O

Granted I only had $11 worth of BTC in Bittrex when the signal hit, but money's money!!

Thank you @nervisrek for this awesome tool & @quickfingersluc for sharing it. Will def tip neverisk after I hit a big trade!

Oh, also wanted to say I just saw some weirdness on the signals for DTC, EDG & VIA vs BTC on Bittrex. Signal showed big drops, but Bittrex showed big gains. Then the Bittrex graph refreshed & showed the drops. The signals were faster than the exchange! How frigging cool is that!!!!

yes I had added Poloniex during the testing/building of the scanner but didnt get as many alerts. I'm working on some updates and I'll try to add Poloniex in aswell

cool... thanks for the effort..... another thing that i'ld like to ask is who are the people that you think that gives good TA and fundamentals over here and youtube? I'm building up my subscription list.....

Poloniex is now live :) we will see if there are much alerts there over the next couple of days. I'm thinking of using online straw polls for the community to vote on what exchanges people would like to add in the future. As for youtube links, i'm not the best person to ask but maybe someone else in the community could give some links. @quickfingersluc and price action is all you need to know :)

Great job, but won't this kinda defeat it's own purpose by having too many people fight for the same low volume coins? There are already hundreds of people in the channel, no way most coins can support that kind of volume.

i doubt most will have the patience to actually sit at the computer all day like I do and check each alert as it comes out.. Mainly because the real money is in the position trades.. these little daytrades are just extra bonus.. I like it but there are not enough traders on this blog to make much of a difference.. and most who try to daytrade will lose money and give up quick.. its not as easy to react fast as you might think.. thats why i suggest sticking with the easy position trading that I outline in my other videos.. But I share everything, so I had to explain daytrading also

In the swing of things, the number of people using it will be a drop in the bucket for the amount of people trading crypto. Most trade with little to no insight and purely on emotion and PR.

I tend to agree with you. I received an alert for MTL-ETH from the scanner. After about 20 mins I checked out the orders and there is now a swarm of low buy orders. If another spike down occurs, then the market will adjust to this low level. I'd caution using this tool on low volume pairs.

@nervisrek - Thank you so much for this scanner. Looking forward to using it.

Another good option, to filter some of the noise, would be the ability to choose only the exchanges I need to see. Since I only trade on Polo only seeing trades for Polo would be good. But when I want to move some money to Kraken then I would have that option available later.

Super excited about this scanner! Very grateful to @nervisrek and Luc for coordinating this whole thing, will be donating soon once I start getting some profits. Finally got my Kraken account funded and set some buys.....just waiting now, when BTC drops gonna buy some to send to Birttrex and get in on this fun with the scanner.

I see why you call yourself quickfingersluc now, I have seen multiple occasions now where you have to place that buy order super fast to take advantage of the drop!

I noticed Coinigy is slightly behind the scanner. When I pull up the page it will still be at the higher price before adjusting to the drop the scanner reported, would it be safe in situations like that to trust the scanner and put through the buy before seeing it on the chart?

Hey Luc, you have such a good way of teaching thanks for that! Could you also get more into the emotional rollercoaster. Patience is my weakest link and seeing the candles go up and down is killing. Take a look at this image for instance I bought into it at the lowest level. When you see the sell order list, I will be waiting a long time to get this chart back up. Would you stay around that long? I think that once we go past the whales the only is up for a long time. But my god how long do I have to wait haha https://postimg.org/image/40rmyobcr/

If you have a Bitcoin (BTC) balance on Bittrex during the BCC UAHF time on August 1st, 5:20am (12:20pm UTC), you will be additionally credited the equivalent amount of Bitcoin Cash (BCC) on a 1:1 basis. i.e. 1 BTC on Bittrex held during the on-exchange snapshot will get you 1 BCC. Full details below.

Luc, you are outdoing yourself. Your new set of videos are so good. I'm just watching occasionally as I don't do much day trading, but i find it fascinating and eventually my find my way into it.

No problem, I just trying to help everyone.. But I have to admit, it is getting distracting, so I might have to refocus my attention a little more to my trading.. Im taking less trades, due to answering questions... but helping everyone is addicting, because some of the followers are doing very well

Maybe you can start a discord channel (or other chat/discussion app) and more and more your followers can start helping each other with the frequently asked questions and things you've covered before. That should help take some of the workload of of you. We can also discuss trading opportunities with each other since we're all trying to do the same thing at the end of the day.

I think the scanner is not scanning very well at the moment. I just got a alert from coinigy from this FAIR coin. it dropped 30% within a few minutes but i didn't get any alert from the scanner telegram. Might have to check it out mate. But scanner still in Beta so fair game. Again, big thanks and i'd appreciate it. Would definitely donate once i make some good trade out of it.

Luc, @nervisrek... You do realize that you've just changed the game. You have me seriously considering a complete change of lifestyle. Thank you both so much for all your work getting the power of crypto independence into our hands!

I felt that way when I first started trading penny stocks.. like I just won the lottery.. and the best thing is, i have made money ever since.. 10+ years later, and I still feel the same.. Free Money?? wow, thanks market

Luc,

I'm sorry you're getting overwhelmed with questions. If you can't get to it, maybe others can chime in on my question. I've been following along and getting pretty good at finding bases. I'm not as good - yet- at knowing when to buy based on the bases. I usually buy too soon. Here's my question. When a base is cracked just a little bit and then it jumps back up, does that nullify that base? The little jump-up doesn't make a good new base, so do I go back to the original base or wait for a new base with a big jump to form. Here's a chart to illustrate what I'm thinking:

Thanks for sharing your knowledge!

I dont want to confuse anyone with all the Xs on this chart but lets talk about crowd mentality for a second. So 44s were resistance quite a few times, shown by the Xs and then when it finally broke threw it jumped up to 49s, then a sharp pullback to 44s again to see if that was going to hold as support, or in our language, was there a base forming at 44s.. then you get this huge spike to 60, and after all the craziness is over it starts to work its way back to the base and retest it a bunch of times.. bearly breaking it.. So the question is this: From July 22nd to the 27th is there lots of traders trapped above 44? Yes.. Will there be a panic when 44s finally break? Would all those trapped traders start to feel the pain and bail? .. You see, clearly there is good reason for a panic to develop here, and thats exactly what were looking for.. so I would be ready to buy up the 38s 37s 36s and so on, if we get some quick red bar movement down..

Drawing bases and safe circles are nice and easy, but simplistic if you dont understand the real reason for them.. You have to read the story of the chart and get why its acting the way it is. Once you have the story clear in your head of what everyone was thinking and how they could get hurt by a surprise, then you can take your trade with confidence when you see that panic develop.

That explanation makes sense. I would love to see more walk-throughs of chart narratives like that. It's really helpful in learning to see what's really going on behind the ups and downs. Thank you!!

YES! The story of the graph is very helpful when you're the chart doesn't match exactly what we see in the videos. I would love to see more of this kind of narrative walk through.

The first bounce after the crack of the base at 5050 was for only 7%. I'd set the new base at 4300, but I'd be on the watch for evidence that the next bounce will be stronger than 7% for me to take a trade.

That is essentially what I'm asking. I think the strong base was at 4500 (ish) and that was broken with only a 7% bounce. Can I look back to that 4500 base or do I have to wait for a new base to form (a stronger base because I agree that I don't want to buy on only a 7% bounce)

It was broken (maybe cracked is a better work here), but there was no "Panic Sell". That's what Luc identifies before his buying. Not if the base was broken, but was there "panic selling" afterward, thus causing the price to dramatically drop. Not trying to speak for Luc, but I've asked this same question before, and that's how he answered it for me.

I get that. I didn't buy for that reason. The question is, now that it's broken but with no panic, can I still use the 4500 base or do I have to wait for a new base to form?

Good question. If there was another crack, I tend to average both of the bases and get in between since the bounce wasn't as strong as your first base. In your case, drop it between 4300 to 4400. I don't do this all the time....only when the drop isn't that big.

And I agree, wait at least 10% drop from base to get in on a trade.

Dude you are a game-changer! Really big shoutout to @nervisrek So much appriciation! Enjoy your day off!

Just gave it a try (when the alert came on) on Bittrex - DGD, bought in at .023, looking for a 10% profit... am I following 'day-trading rules?

'https://www.coinigy.com/s/i/5978c64107580/

Right there where you put your line is a good place to buy. However I would only put a small amount first (a nibble) and now wait since only two things will happen and you can profit from both!

It goes up - sell ON THE BOUNCE. dont be greedy take your trade and never let those emotions take hold!

It goes down - buy some more when it hits its last base (looks like around .021) and wait for it to bounce back up. Sell BOTH trades and you will make your money back and some more because you bought when it dropped even more.

"Right there where you put your line is a good place to buy." <- I disagree. That is close to where he should set his base, but not where he should be buying. Based on the performance of prior bounces, he should wait till the price drops another 10% then start buying.

I agree with tizzle. Thats a base not a crack...Even though it looks to be bouncing off the base pretty good. I personally would only by under -10% or more of that line.

Whose "day trading rules"? I dont recall anyone discussing a different set of "rules" in Luc's posts. What you are doing seems like gambling to me, not trading.

I though with the account builder trades there were different rules? I probably get it all wrong.... so maybe you can help me out... On a chart like this, what is the 'right' procedure? Would you set a buy-order lower than where the candle ends? Thanks for your responses so far! https://www.coinigy.com/s/i/5979d11b1e1e6/

Thank you Luc, you are amazing. This blog is a goldmine. It's worth more than years of trying to learn trading scourging the web. The only way better than this is probably if someone is a trading genius and can devise his own successful trading style:> Before I thought that daytrading is more like going for 0.1-few % gains constantly trading the same coin without waiting for market situations.

And thanks @nervisrek

Big thanks to @nervisrek and @quickfingersluc !!!!!! I'm curious what happens when traders start using apps like these en masse? Will it force prices down? or create strong bounces? How did scanner like these change the stock day trading game?

Luc and @nervisrek; excellent job!! Really great work; above expectation with telegram integration. Really nice. You will get my donation. If we continue in this direction we will have a goldmine in few weeks :)

I actually started with pushover support but switched to telegram as people have to buy the pushover app on their phones whereas telegram is free - can i ask why you want pushover/what advantages it has?

Because I already own it (and use it a lot for many things and don't want tons of similar apps on phones), it's fairly popular, and it works really well. Very basic push over support can be added just by adding email support, users can enter their pushover email address and it will work. Although the API is really simple and it would take no time to add it.

What do you think about my trade in BTS/BTC? The first blue arrow is around 2.000$ and the second green is 500$. I am hoping for a rebound to the base(yellow line). Would it be wise to invest more or wait ?

as others have mentioned, i would look out at the bigger timeframe (2months) and you will not likely consider that yellow line to be a great base, but its not that bad.. you might be safe still .. i took this trade also, at .00005s and expected a timely bounce.. but now after a day has past and it seems to be weakning, without any real attempt at bounce, I decided to sell for 4% profit at .000052 .. thats like a break even trade for me.. and mainly im selling because it has not always respected the panics.,.. on 07/06 for instance, if you look back in the chart.. however with all that being said, your likely still safe, because it is still a very high odds trade you took, and the base is not that strong, but its not too bad.. and the chart is not perfect, but its pretty close

That's a strong base that was cracked, but before entering the trade it's best to look at a 1-2 month view of the past to see if bounces back to the base are common with this BTS/BTC pair...good luck!

+1 to @lingtriloquist, but I also want to add that you should have sold around 5330 if you bought around 5000 (NOTE: hours after I posted this I realized you bought at around 5220, this doesn't look like it will end well I'm afraid - we may never see a big enough bounce to be profitable) . The previous bounces were typically for under 7% prior to the crack, the 2 month + chart would show you that this is the case. This is a good chart to trade, but you should expect a relatively modest ROI if your trading off the base at 6040 - this is not a trade I would have taken, I would have waited for a better situation. You don't need to take every trade, wait for the more profitable situations. To illustrate my point, take a look at EOS/ETH - a killer chart at first glance, but the predicted ROI is too small to trade this chart over the past month.

I also invested in this pair....waiting for the rebound or maybe even higher in August. I have couple of sale orders above the cracked base. Good Luck!

I have the same situation and question, but I decided to sell. The main reason is that if you look at 2m chart I am not that sure anymore if this is the base or is it at 4700?

Hi Luc! many thanks for this, you're the man;) and thanks to the developers, the scanner looks great!

Btw I just found a good example of the last trading method you mentioned. as you can see, it bounces back to the 50% are of the first bounce: https://www.coinigy.com/s/i/5978cb1e5bd97/

@quickfingersluc - Is it also a safe trade to buy it again at the bottom of the bounce for the retracement back up to 50%?

In the chart above, since it didn't take off when we bought at 50% retracement (about 0.00019000) it then went back to the bottom. Would it be a good idea to buy again at the bottom (about 0.00006000) for the bounce back up to 50%?

Sorry but that is not the trade.. you start with 1hour candles to see whats normal trading then you go to 5min candles to execute daytrades... so your 50% first pullback would have been near .00004-.00006 and then it ran to 41.. 10x for a small risk... its not possible to see on your chart, because your looking at 1hour candles.. and this is daytrading

Hey Luc, thanks for all the great information! So many of us really appreciate the efforts to help others to an understanding. In case you didn't know, there's a fast way to undo less than perfectly drawn lines or circles without hitting delete. Hit Ctrl Z

It's a windows hotkey but seems to work pretty well in coinigy. Might be other useful hotkeys too. In any case, thank you thank you thank you for everything you do. I watch your videos every day, thanks for being a humble person and a great teacher.

hey guys, is there a reason why Hitbit isnt allowing me to trade?

I just added it as a exchange and added my api keys, everything on HitBit API is check off to give me full access.

on coinigy, it shows its Active, but the box that says " Trading " is blurred out and says, " Trading I not yet available for this exchange "

I have included links direct to the exchanges in alerts. In the case of HitBTC if you setup your browser and login first - then when you click on the exchange link in the alert, it will take you straight to the chart logged in and able to place a trade

Hey Luc ! How do you choose to store your coins for long term holds vs the ones you want to have ready for quick trading? Safe to have a couple BTC in Bittrex as long as I have 2FA?

Hey Luc, did you see my post on your other thread? I released my own market scanner yesterday, I'd love to get your feedback on it. It's a bit different to nervisrek's (great job btw!) but it gives you the ability to filter by a specific change threshold, so as to only show coins that have dropped 5%, 10% etc. in the given time period. In the near future I'll be adding the ability to filter out specified exchanges and markets as well.

You can find it at cryptodrop.net or read my full post at https://steemit.com/cryptocurrency/@bulk-coinz/cryptocurrency-market-scanner-now-live-cryptodrop-net :)

im watching it now.. does it only refresh every 5 minutes? it says updating every 5 minutes.. our other scanner alerts seconds after a move happens, and often thats even too slow to react.. every second counts with daytrading..

Hey Luc, there are some other refresh periods in one of the two dropdown boxes at the top of the page. The way it works at the moment is that whatever lookback period you select, it will refresh after that period of time and then look back that many minutes to check for changes. So for example if you choose a lookback period of 10 minutes, it will look at the last 10 minutes of data for each symbol, compare that against the change threshold field, and display each symbol that has changed more than that amount in the last 10 minutes, then wait 10 minutes and do that again.

The shortest refresh period at the moment is 1 minute - I can definitely make that shorter but the question is how far back should it look for data? If it refreshes every 5 seconds but only looks at the last 5 seconds of data, it's unlikely that any symbols will have changed more than 5% in 5 seconds. Perhaps we should have two fields, one for the refresh interval and one for the lookback period. What are your thoughts on that?

I'm still new to this, but I'm guessing Luc will tell us that the refresh can always stay around 1sec (or as short as practical), and shouldn't be related to lookback period. Maybe I'm missing something though. Is there a reason you linked them together?

Noticed the alert noise and "mark as seen" have been added. Thanks very much!

Side note- your scanner just alerted me of 2 huge loads dumped so far at BTRX XLM/ETH just now. I made a trade on the 2nd one, hoping for a 3rd dump. Worth keeping an eye on

I'm glad to hear the site's helping you find good trades! Originally I had the lookback period and refresh interval separate but I combined them for the sake of getting the site up asap. The problem arises when a duplicate entry is formed, ie. when a symbol is displayed and then on the next refresh it is also displayed again. What should happen in this case? I'm thinking that it should replace the original entry if it has dropped by MORE than was shown in the the original entry, otherwise the original entry should remain. But then at what point should it not be shown anymore? When the user marks it as seen? After a certain period of time?

Once I know what's preferred I can get started on implementing it :)

Hi Luc. About Nervisrek Scanner. Awesome and thank you for sharing. Please, I have a question. When there is a considerable drop of one of the altcoins, would you place instantly a limit order slightly above the dropped price reached? So when it bounces back or pullbacks, you would buy almost buy to the lowest price? Thank you very much!!!! Or what would you do?

Thank You!!! Best Regards Rodolfo

JUST A HEADS UP GUYS!

I don't know if anyone has mentioned this yet, and I'm sure a lot of the experienced guys are aware, but for all the newbies out there!

The scanner is picking up a lot of price drops that are dropping from pump and dump groups! Be very careful of these because after a pump and dump group has pumped up a low volume coin 50-100% (you will notice its just one huge green candle coming out of nowhere!) The scanner will notify us after it drops down a bit. The thing is if this is from a pump and dump group, that price is not going back up. The only reason it went up is because a group of people got together and bought the price way up and are waiting for people to buy in so they can dump the price right back down onto the unsuspecting people not in the group. a lot of the time they are actually dumping the price on people inside their own group who are trying to get in late as well.

just keep this in mind when using the scanner!

Happy Trading.

Congratulations @quickfingersluc! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPI WOULD ADVISE AGAINST BUYING QRL! The scanners are reporting a big drop in QRL but this could be owners dumping their coins. There is some rift within the project that someone within posted. Right now I'm trying to break even on my position,

https://bitcointalk.org/index.php?topic=1730273.460

I concur. Always read the social media on a coin before buying into a panic, thge extra 30 seconds it takes to catch the headlines may save you from being stuck in a position.

I bought allready too late but I WOULD ALSO ADVISE AGAINST BUYING QRL :D

I buy QRL too!, already exit with small profit.

https://www.coinigy.com/s/i/597bc2b0e9e9f/

Currently I have another disastrous purchase:

https://www.coinigy.com/s/i/597bc3410144d/

I created a blog about this and what I did to get out of the trade and minimize loss. Credit goes to Luc for his teachings (it would be nice if he can review for me :) ) and credit goes to nervisrek for the scanner tool. Let me know what you think in the blog. This is more of a learning experience for me.

https://steemit.com/trading/@oneluckyflip/beware-trading-qrl-how-i-minimized-loss-on-a-trade-gone-bad

Hi Luc! Thank you and @nervisrek for this amazing tool. By the way, I am making a bot that can buy the coin with certain conditions. If I was to use the scanner, what conditions should I put the bot so it will automatically make a buy order? One is a 10% 5min drop or more, maybe if its below 24hr low too? I know the idea is to take the scanner alert and got to the chart, but I want to try this bot. Thanks!

What will be a good % volumen change to mix it with the 5min price change, like comparing the last 5min candlestick volume with the 24 hour volume. What will be a good % change? I was thinking a 5% spike in volumen compared to the 24 hr volume. Any ideas?

I think a useful tool for non-fulltime traders would be that if your buy order gets filled it would automatically sell at a predetermined price, that way you wouldn't have to worry about missing the sale if you're away and it would work with Luc's technique perfectly.

Yes. I have a bot in poloniex, detects when a coin goes down more than 10% in 5 min. But the thing here is, where to put the buy order? Right in the 10%? What if it goes lower? At the moment, I am buying just at 10%, or where the variation is. Then, after it successfully buys the coin, it puts a sell order at 5% margin (just to be safe, and not to put it in a 10% gain, better to have profit, that not at all!

So, what ideas do you have? What could be a general rule for the buy and sell order?

I'd be interested in learning how to make a bot. Any good references on where to learn?

I am not a programmer, but I started learning from other bots on the web. I thank xcbtrader for teaching us and donating this bot on Poloniex. I customized it to my needs.

https://github.com/xcbtrader/pobot

Thanks!

May be it's a good idea to put a sell order on 5% margin and make a trailing take profit: when the price goes up without a stop you won't sell, if it then goes down and reach some threshold, you'll sell.

For instance. You buy at $1 price , set a trailing stop at $1.05. The price goes to $1.08 and then goes to $1.06. You set a threshold of going down for 1% and sell at $1.07.

I think that that is very possible to do manually

Wow, that sounds amazing! Let us know how it goes.

Even though the bot is way faster to get to this opportunities, check thoroughly if it is stable in the long run. You don't really need a bot for these kinds of trades as they don't happen that often and the scanner is already doing all the work. Sometimes accuracy can beat speed

Yeah I know, it's just that I want to make it automatically. Anyways, I will be on the computer most of the time, I just want to catch the drop, and the bot can be quicker. If you have any ideas, let me know!

Careful, the scanner also captures a pull back. So the price may have gone up and then notified us on the way back down

What will you suggest for that situation? I mean, the bot I want to make is not for every situation, but we can try to cover most of them.

Here's a question I was thinking about while I was watching your video. around 18 minutes you were explaining how when there's a spike upwards the safest place to buy is at around 50% of the spike (the pullback) because 1. if it goes up, then you get profit, and 2. if it dives, it will most likely return to around the 50% mark where you would buy costing you little to nothing.

My question is this. If the price keeps diving in scenario 2 , why not keep buying as it goes down if it will most likely either return to around the 50% point or higher? That way instead of merely getting out even in the second scenario, you would profit from the low price buys. Is it too risky? Here. I'll try to include an image to clarify my question.

Uau! @nervisrek, Thank you very much! I'm sure as we all start growing money, we will all make donations! This is a true trading community! Not these other communities where the owners are only interested in making money and take advantage on other people lack of knowledge!

Thank you Luc for helping all of us!

Let's upvote all Luc's posts and comments, guys and girls!

Very excited about the scanner, thank you to @nervisrek for this!

but when you were talking about the 3rd type of trade would you buy on the first rebound only when it has a a drop of around 50% or would a 20 or 10% rebound be just as safe?

SWEET!

Suggestion would be 24 hour volume minimum of 5 BTC and 50 ETH, otherwise you are going to get these miniscule buys/sells that will intentionally drive the pricing. Or maybe logic using the last volume values, tho that would be a little bit more challenging.

yes, there is a filter for minimum 24hr vol there atm that luc mentioned when building it, but it is very small. We will need to find a suitable value for everyone, there may be an average min volume everyone would be happy with?

yes, id say AT LEAST 5 BTC 24hr minimum and 50 ETH. Or maybe we can have two seperate channels, one for the lower volume more volatile trades, and another for the larger coins for big trades. Is there a way that the scanner can notice the longer 2-4 hour panic drops on the bigger coins?

Nice! and thx. I got something for you once I complete my first trade using your tool btw. For the volume value, probably best to defer to Luc.

Hey luke saw this on reddit about the liqu.io exchange I noticed you mention you use sometimes in your videos, be careful!

Hi Luc,

Thanks for the video -The marker scanner is a game changer . Special thanks to @nervisrek for making this tool.

I have some questions for you which I think will benefit a lot of people with small accounts (less than $400) which are just getting started

Using the market scanner to focus on what you call "account building" trades -is there any criteria which we should look for in order to decide if a trade will be an "account building" one or not ?

With or without the market scanner do you think it is possible to double an account value in one month by trading JUST ETH (since it always bounces back). So if I have let`s say $300 in my account and i decide to trade just Ethereum how likely it is to have $600 at the end of the month?

This was probably asked a lot already -What if after I draw my "bases" I see that the coin didnt break the base ? It seems to happen quite often..... Should we wait till the base will break or we should see if there was another base formed and hope to have a break on the new one ? Or better asked how long we should wait for a base to break before deciding if we should see if there`s another base formed and move on?

When you say "position trading" (not day trading) do you mean holding and selling a coin after a few days/weeks or what timeframe do you think it`s a good one for position trading ?

This is more of a statement -please correct me if needed : We can use the market scanner to build a small account and then move onto position trading where a single trade (which can take days to happen) could easily mean thousands or tens of thousands of dollars depending on the investment and how high the value of that coin will go. (i`m thinking here about ETH price drop to $136 or so which happend recently and then a big bounce back to $240)

One last thing -when you say to go small for those day trades how small we should be ? Put $10 on a trade $50, $100 or?

I appologize in advance for the long set of questions but I strongly think everyone which is new to trading and has a low account like myself would benefit a lot from your answers

Thanks everyone for helping answer questions like this. I am having a hard time keeping up.. I think the answers below are great.. I can get maybe 30-50 position trades per month.. But i usually take 20ish.. and daytrades happen several times a day... So you can absolutely build a small account on position trades alone, without the need to take the added risk of daytrading or small account building type trades.. You can just swing those slower base type trades and still do good.. But with the Account building trades and other types of daytrades you can double your small account in a week or less sometimes.. so those are the options..

Let me take 2 seconds to show you a chart, that I just traded and please respond what think about it...

Notice that for the past two weeks you can buy 11s or 12s and sell 14s 15s and 16s even sometimes.. imagine the effect that has on a small account if you were only trading this one coin only.. and there are even better ones out there, im just using this one because i just just sold some right now..

These rises and falls comes in spurts throughout the day, likely from either a pump and dump action or some whale buying or selling huge. That's why you'll see no activity in the transaction history for a couple of hours sometimes. Lurk the chat on HITB and you may be able to catch a pump and dump

@quickfingersluc I've been trying to do the account builder trades. I've noticed a lot of the time I get "stuck" waiting for movement between " bid walls". There seems to be a lot of attempts at pump and dumps/manipulation down in the low volume alts.

the volume of trades on this chart scares me, there was no activity for 40 minutes this morning - should we not be concerned with that? On the bright side the lvl1 data shows some significantly sized orders ready to take place, but what if that was not that case - for example LGD/ETH [BTRX]?

The chart seems nice, and more lively than few others I've tried. It seems its common for ETH pairs to move in nice channels, and maybe even less common pairs like altcoin/XMR, but in BTC I didn't find any pairs with similar movement that would give me at least 10% reliably. To me it seems that in altcoin/BTC pairs it's better to trade pumps, coins with volatility like XST and UNB that have huge movement.

EXACTLY. The limitation trading these coins is how much one can put in an order. Typically you may only get a couple of ETH orders filled maybe 1k USD worth at the most, hence Luc's phrase of small account building trades

I did a few trades on something like SNM/ETH, I think this type of chart in essence is simpler(except liquidity problems when your orders don't get filled) to trade along with the base strategy. But I don't trust myself too much to trade btc pair pumps and daytrades, those seem much more complicated. Without using any TA I can read percentage of a pump, base, timescale, and how most of these coins seem to pump after a significant dip, but I don't feel that's reliable enough. And daytrading is a whole new level, along with considering the order book & news & etc(except getting in time for flash wicks down, these seem pretty safe to not lose out on). Maybe I should just get some ETH and move on to these range/channel types of charts for now.

Man, you seem smart enough to be making a killing off of these coins. Honestly, there is no TA other than your own analysis so trust your own judgement. Look at patterns, understand what is going on with the trading environment, and come up with a good strategy then go for it. This sounds pretty basic and sometimes it works out, sometimes it'll go against you.....just have a backup plan. More than often I think you'll win since its fuckin crypto, as long as you understand and read the chart correctly.

Also make sure to know which coin you are trading. Coins like UET you just dont want to touch.

Hey man, thanks for all your help and the great videos!!.. i've been drawing my bases , and ive noticed something.. i can see the bases a lot clearer with heikin ashi sticks instead of the candles.. i assume there is nothing wrong with that right?..

thanks again!

What are the best charts to watch for position trades? I only really know of the ETH/USDT chart.

All of them. I review all of the charts daily,this gives you the greatest opportunity for success.

...and you go back 1-2 months into the history to confirm that there the chart follows the pattern of base creation, base crack, panic, base creation, base crack, panic, base creation?

I have looked through many charts that seem to follow no particular pattern, and many more that don't follow the pattern that Luc is advocating that we look for... at least they don't follow it with any degree of consistency that we can count on.

I guess I was asking if anyone has identified charts that are in the ball park of reliability as ETH/USDT?

Once again, ALL charts have this reliability eventually - just be paitent and read the charts daily, eventually you will find the opportunities. Some charts I see prime opportunities in the past, but none currently - thats a fact of life while trading, its not free money, you still need to put in a little bit of work and be willing to take a risk.

With that said, here is an example of a chart which opened up to a great trading opportunity overnight. Once the price dips into the circle, your trade should be +EV if you sell upon the bounce back to the base.

https://www.coinigy.com/s/i/597e0e27c99d3/

Thank you for the reply and the chart share. I agree that I'll have to learn the story of the chart before being able to capitalize on oppurtunity, so I will keep trying to interpret them because apparently my thinking and pattern recognition is currently too rigid.

With the chart you shared, there is no way I would have recognized that base. There are a few instances of similar bounces working out, but it doesn't seem to follow much of a pattern to me. Especially since 12 hours later another bounce happened that was equal to the bounce you underlined, but we ignore that one. I also don't really understand your circle in reference to the underlined base, but I'll keep watching to see how it plays out.

I don't expect you to go back and forth holding my hand on this one, but I figured a response may help increase value for someone else that is struggling to understand this chart.

Thanks again, and all the best!

https://www.coinigy.com/s/i/597e19804d2b9/

https://www.coinigy.com/s/i/597e1a4620dfa/

@quickfingersluc -This chart looks great. Thank you so much for sharing this with us. I will definitely keep an eye on it. Can you also recommend some other coins that I should keep in mind (since you said there are others even better than this) ? whatever you feel might be an "account building" type of chart... this would help me a lot. I do understand that it

s my responsability to do my due diligence before buying a coin but I would love to have a few of those charts set up so if Im not asking too much please feel free to share others like this.Once again thanks for your input

Hi octavyo... did you have any luck finding those small building account charts?

With position trading I believe he's talking about identifying a base and buying off the "panic sell" You hold onto to it until it reaches the base or comes near to it (study the chart's history to see how high the bounces in the past have reached, this will give you an idea of where you should sell).

Correct me if I'm wrong.

"One last thing -when you say to go small for those day trades how small we should be ? Put $10 on a trade $50, $100 or?"

A small trade is Relative to your account size.

So if you have total account of say $100, small would be $5

If your account is $1000, small would be $50

Trading in percentages of your total account makes sense, so you can

3-10% of your total account makes sense for cryptos. Some professionals say no more than 5%, but do whatever you feel comfortable and within your goals. With smaller accounts, better to go higher to increase your chances of doubling your account.

A+++ @quickfingersluc and @nervisrek! I have a small request, perhaps the scanner could be split into two different telegram groups? It would be nice to see a dedicated group for BTC coin pairings and another for ETH coin pairings.

Hi there, yes something similiar has been mentioned for have exchanges in separate telegram groups, if people are only trading in certain exchange(s). Technically possible and if there is interest for this i will implement it. I mean we could keep the main telegram channel with all alerts and then separate ones for exchanges/coin pairings to keep everyone happy :)

Thanks @nervisrek! Some traders only trade one coin pairing or the other, therefore the extra content for the unused coin is just "background noise". For example I holding a large amount of ETH, waiting for the market to normalize before I convert back into USDT or BTC which is normally my primary trading coin. Until that occurs I am only trading ETH pairings, therefore for the next month (or less if I am lucky) I don't need to get any signals from Telegraph on BTC coin pairings .

BIG FAN of your work, this will only get better over time! As soon as I am more liquid I will send you over a donation as my way of saying thnx!

ok , let me work on an ETH only telegram channel and probably introduce BTC and USDT channels aswell for others :)

Much LOVE!

Looking forward to the time in the future when we can customize minimum volume requirements. In the meantime, I'm happy as a pig wallowing around in the mud ;-)

I have setup an ETH only channel, here is the telegram link:

https://t.me/joinchat/AAAAAEQliyohm_u-unIZGA

if you could test this out, as its also running latest code that I will be releasing in next main update tomorrow/next day. Thanks :)

It works

Love your work @nervisrek! Thank you! Any news on the BTC and USDT only coinpairs channel? :)

Hi Luc, i joined because of you man. I'm starting this journey , like many others here and your videos have been a HUGE help. Thanks mate.

This is awesome, finally a market scanner that is already pretty decent. Really good job to @nervisrek

this is a good place to sale?, (blue line is where mi sell order is located).

https://www.coinigy.com/s/i/5979fbe219b7b/

I got in on that same dump this morning. I put my sell at 9100 and was filled within a few hours. Looks like you could have made up to almost 9500 on that.

Hey luc, first off thank you so much for putting in the time to release these videos-- you seem like the only pragmatic and realistic crypto-currency trader who is putting out content and we are all super lucky to have your input.

I have a question about trading pairs--I have made some successful trades on Bittrex between ETH/USDT and BIT/USDT, but it looks like most of the trades showing up in the marketscanner do not have a USDT trading pair. My question is how should I turn my USDT into BTC/ETH to trade without losing money in the short-term with fluctuations in the BTC/USDT and ETH/USDT markets? Say I purchase 1 BTC at its current price (2573.175 USD) and am having success day trading BTC trading pairs, but the USDT market value of BTC drops below my original buy in price. I will be making my profits in BTC, but will ultimately be losing money because of BTC/USDT market fluctuations. I guess I am wondering if I should be patient and wait to buy BTC and ETH when they are low (following your position trading strategy of buying the dips) or should I just convert from USDT at anytime to capitalize on day trades?

You da man!

Just picked up some CLOAK on Bittrex for .001 due to the scanner!!!! It was at .0013 / .0014 before someone started dumping it! :O

Granted I only had $11 worth of BTC in Bittrex when the signal hit, but money's money!!

Thank you @nervisrek for this awesome tool & @quickfingersluc for sharing it. Will def tip neverisk after I hit a big trade!

Oh, also wanted to say I just saw some weirdness on the signals for DTC, EDG & VIA vs BTC on Bittrex. Signal showed big drops, but Bittrex showed big gains. Then the Bittrex graph refreshed & showed the drops. The signals were faster than the exchange! How frigging cool is that!!!!

It'll be awesome when it gets scans for poloniex.... are you using this scaner for day trading?

yes I had added Poloniex during the testing/building of the scanner but didnt get as many alerts. I'm working on some updates and I'll try to add Poloniex in aswell

cool... thanks for the effort..... another thing that i'ld like to ask is who are the people that you think that gives good TA and fundamentals over here and youtube? I'm building up my subscription list.....

Poloniex is now live :) we will see if there are much alerts there over the next couple of days. I'm thinking of using online straw polls for the community to vote on what exchanges people would like to add in the future. As for youtube links, i'm not the best person to ask but maybe someone else in the community could give some links. @quickfingersluc and price action is all you need to know :)

@nervisrek Loving the scanner so far. Can you add kraken exchange as well?

Indeed! XD

kraken has been added aswell, please make sure to subscribe to @NEWS_cryptomarketscanner as I announce updates there:

invite link: https://t.me/joinchat/AAAAAEQUPCCuu3snF_F8EQ

Great job, but won't this kinda defeat it's own purpose by having too many people fight for the same low volume coins? There are already hundreds of people in the channel, no way most coins can support that kind of volume.

i doubt most will have the patience to actually sit at the computer all day like I do and check each alert as it comes out.. Mainly because the real money is in the position trades.. these little daytrades are just extra bonus.. I like it but there are not enough traders on this blog to make much of a difference.. and most who try to daytrade will lose money and give up quick.. its not as easy to react fast as you might think.. thats why i suggest sticking with the easy position trading that I outline in my other videos.. But I share everything, so I had to explain daytrading also

In the swing of things, the number of people using it will be a drop in the bucket for the amount of people trading crypto. Most trade with little to no insight and purely on emotion and PR.

I tend to agree with you. I received an alert for MTL-ETH from the scanner. After about 20 mins I checked out the orders and there is now a swarm of low buy orders. If another spike down occurs, then the market will adjust to this low level. I'd caution using this tool on low volume pairs.

@nervisrek - Thank you so much for this scanner. Looking forward to using it.

Another good option, to filter some of the noise, would be the ability to choose only the exchanges I need to see. Since I only trade on Polo only seeing trades for Polo would be good. But when I want to move some money to Kraken then I would have that option available later.

Super excited about this scanner! Very grateful to @nervisrek and Luc for coordinating this whole thing, will be donating soon once I start getting some profits. Finally got my Kraken account funded and set some buys.....just waiting now, when BTC drops gonna buy some to send to Birttrex and get in on this fun with the scanner.

I see why you call yourself quickfingersluc now, I have seen multiple occasions now where you have to place that buy order super fast to take advantage of the drop!

I noticed Coinigy is slightly behind the scanner. When I pull up the page it will still be at the higher price before adjusting to the drop the scanner reported, would it be safe in situations like that to trust the scanner and put through the buy before seeing it on the chart?

Hey Luc, you have such a good way of teaching thanks for that! Could you also get more into the emotional rollercoaster. Patience is my weakest link and seeing the candles go up and down is killing. Take a look at this image for instance I bought into it at the lowest level. When you see the sell order list, I will be waiting a long time to get this chart back up. Would you stay around that long? I think that once we go past the whales the only is up for a long time. But my god how long do I have to wait haha

https://postimg.org/image/40rmyobcr/

If you have a Bitcoin (BTC) balance on Bittrex during the BCC UAHF time on August 1st, 5:20am (12:20pm UTC), you will be additionally credited the equivalent amount of Bitcoin Cash (BCC) on a 1:1 basis. i.e. 1 BTC on Bittrex held during the on-exchange snapshot will get you 1 BCC. Full details below.

https://support.bittrex.com/hc/en-us/articles/115000808991-Statement-on-Bitcoin-Cash-BCC-

Luc, you are outdoing yourself. Your new set of videos are so good. I'm just watching occasionally as I don't do much day trading, but i find it fascinating and eventually my find my way into it.

Thanks so much!

No problem, I just trying to help everyone.. But I have to admit, it is getting distracting, so I might have to refocus my attention a little more to my trading.. Im taking less trades, due to answering questions... but helping everyone is addicting, because some of the followers are doing very well

Maybe you can start a discord channel (or other chat/discussion app) and more and more your followers can start helping each other with the frequently asked questions and things you've covered before. That should help take some of the workload of of you. We can also discuss trading opportunities with each other since we're all trying to do the same thing at the end of the day.

I like the idea on having a Discord or preferably a Slack channel.

@quickfingersluc I shared your Steemit page with the following Slack channel I’m part of (over 1k users):

https://cryptominded.slack.com

It will be good if we try to growth that community of cryto enthusiasts!

Regards,

Thank you @nervisrek for the scanner !!!

I think the scanner is not scanning very well at the moment. I just got a alert from coinigy from this FAIR coin. it dropped 30% within a few minutes but i didn't get any alert from the scanner telegram. Might have to check it out mate. But scanner still in Beta so fair game. Again, big thanks and i'd appreciate it. Would definitely donate once i make some good trade out of it.

Luc, @nervisrek... You do realize that you've just changed the game. You have me seriously considering a complete change of lifestyle. Thank you both so much for all your work getting the power of crypto independence into our hands!

I felt that way when I first started trading penny stocks.. like I just won the lottery.. and the best thing is, i have made money ever since.. 10+ years later, and I still feel the same.. Free Money?? wow, thanks market

Luc,

I'm sorry you're getting overwhelmed with questions. If you can't get to it, maybe others can chime in on my question. I've been following along and getting pretty good at finding bases. I'm not as good - yet- at knowing when to buy based on the bases. I usually buy too soon. Here's my question. When a base is cracked just a little bit and then it jumps back up, does that nullify that base? The little jump-up doesn't make a good new base, so do I go back to the original base or wait for a new base with a big jump to form. Here's a chart to illustrate what I'm thinking:

Thanks for sharing your knowledge!

I dont want to confuse anyone with all the Xs on this chart but lets talk about crowd mentality for a second. So 44s were resistance quite a few times, shown by the Xs and then when it finally broke threw it jumped up to 49s, then a sharp pullback to 44s again to see if that was going to hold as support, or in our language, was there a base forming at 44s.. then you get this huge spike to 60, and after all the craziness is over it starts to work its way back to the base and retest it a bunch of times.. bearly breaking it.. So the question is this: From July 22nd to the 27th is there lots of traders trapped above 44? Yes.. Will there be a panic when 44s finally break? Would all those trapped traders start to feel the pain and bail? .. You see, clearly there is good reason for a panic to develop here, and thats exactly what were looking for.. so I would be ready to buy up the 38s 37s 36s and so on, if we get some quick red bar movement down..

Drawing bases and safe circles are nice and easy, but simplistic if you dont understand the real reason for them.. You have to read the story of the chart and get why its acting the way it is. Once you have the story clear in your head of what everyone was thinking and how they could get hurt by a surprise, then you can take your trade with confidence when you see that panic develop.

That explanation makes sense. I would love to see more walk-throughs of chart narratives like that. It's really helpful in learning to see what's really going on behind the ups and downs. Thank you!!

that's a great answer, I'm really starting to get this whole "story of the graph" thing. Thanks

Your post is pure GOLD.

YES! The story of the graph is very helpful when you're the chart doesn't match exactly what we see in the videos. I would love to see more of this kind of narrative walk through.

This post just turned on the lightbulb! That is the "story of the chart". Thanks for all you do, Luc!

The first bounce after the crack of the base at 5050 was for only 7%. I'd set the new base at 4300, but I'd be on the watch for evidence that the next bounce will be stronger than 7% for me to take a trade.

That is essentially what I'm asking. I think the strong base was at 4500 (ish) and that was broken with only a 7% bounce. Can I look back to that 4500 base or do I have to wait for a new base to form (a stronger base because I agree that I don't want to buy on only a 7% bounce)

It was broken (maybe cracked is a better work here), but there was no "Panic Sell". That's what Luc identifies before his buying. Not if the base was broken, but was there "panic selling" afterward, thus causing the price to dramatically drop. Not trying to speak for Luc, but I've asked this same question before, and that's how he answered it for me.

I get that. I didn't buy for that reason. The question is, now that it's broken but with no panic, can I still use the 4500 base or do I have to wait for a new base to form?

It felt like I already answered that question in greater detail, but if u want the simple answer then the answer is no.

Good question. If there was another crack, I tend to average both of the bases and get in between since the bounce wasn't as strong as your first base. In your case, drop it between 4300 to 4400. I don't do this all the time....only when the drop isn't that big.

And I agree, wait at least 10% drop from base to get in on a trade.

cool been looking for a decent live chart thing for ages.. this does even more

Dude you are a game-changer! Really big shoutout to @nervisrek So much appriciation! Enjoy your day off!

Just gave it a try (when the alert came on) on Bittrex - DGD, bought in at .023, looking for a 10% profit... am I following 'day-trading rules?

'https://www.coinigy.com/s/i/5978c64107580/

Right there where you put your line is a good place to buy. However I would only put a small amount first (a nibble) and now wait since only two things will happen and you can profit from both!

"Right there where you put your line is a good place to buy." <- I disagree. That is close to where he should set his base, but not where he should be buying. Based on the performance of prior bounces, he should wait till the price drops another 10% then start buying.

I agree with tizzle. Thats a base not a crack...Even though it looks to be bouncing off the base pretty good. I personally would only by under -10% or more of that line.